This is a companion post to the one published by DCG this morning on more California seniors are working full-time into their late 60s and early 70s.

The reason for that is very simple: Most “baby boomers” in America have not saved, which means they must work even when they reach the standard retirement age.

Baby boomers are people born between the years 1946 and 1964, during the demographic post–World War II baby boom. In 2015, if your age is between 50 and 69, you are a boomer.

Kate Davidson reports for the Wall Street Journal, Oct. 26, 2015, that a new survey from BlackRock, the New York-based multinational investment management corporation and the world’s largest asset manager, found that there is huge “retirement gap” — the gap between Americans’ retirement expectations and how much they actually have in savings.

Fewer than a quarter (less than 25%) of Americans regularly set aside money into long-term savings or investment plans—yet 74% said they feel financially secure and “prepared to pursue their dreams.”

Put bluntly, many Americans are deluding themselves about being able to retire comfortably, or to retire at all.

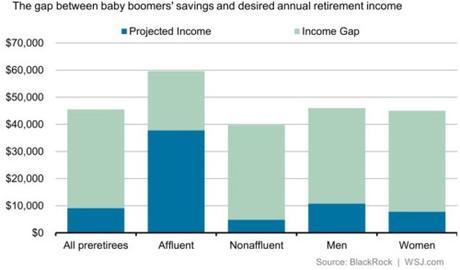

Baby boomers, in particular, who are retiring in droves, face a staggering shortfall. People ages 55 to 64 who responded to BlackRock’s online survey say they expect to have about $45,000 in annual income in retirement. But the amount they have actually saved would only provide an estimated $9,129—a potential $36,371 gap.

Here’s the breakdown of baby boomers into various groups:

- Even “affluent” boomer retirees—those earning more than $250,000 a year—had not set aside enough to generate the income they say they would need to meet their retirement expectations. The “affluent” expect an annual retirement income of $60,000, but their actual savings would provide an actual retirement income of about $38,000 a year, leaving a retirement gap of $22,000.

- “Nonaffluent” boomers — those earning less than $250,000 — are in a much worse strait. They expect an annual retirement income of almost $40,000, but their actual savings could provide an actual retirement income of $4,000 a year — a retirement gap of $36,000.

- Although women expect a little less in retirement income than men, women also have a bigger retirement gap than men: $37,000 vs. $36,000.

BlackRock’s global chief investment strategist Russ Koesterich warns us that “The amount of money you need to generate a certain level of income is a lot higher than it used to be” because interest rates are so low. As a result, even if an investor has saved diligently for decades, the amount that a nest egg can generate is much smaller, which has come as “a very unpleasant surprise” to retirees.

Interest rates are near zero because the Federal Reserve is keeping them low. As things are, much of the federal government’s spending goes to paying the interest on America’s astronomical and ever-expanding national debt. Higher interest rates will mean an even bigger national debt.

The BlackRock survey polled 4,213 Americans out of more than 30,000 people around the world.

Nearly four in 10 people surveyed said they want to make sure they have enough cash saved as a security blanket for an emergency before they save for retirement. And the vast majority said they find it difficult to keep up with bills and save for retirement at the same time.

That squares with other recent data from U.S. Financial Diaries, a project of the New York University Financial Access Initiative and Center for Financial Services Innovation, which found many households are saving regularly for small, short-term emergencies, such as an unexpected dip in income or a spike in expenses. But those emergencies happen so often it prevents them from building up larger amounts to put toward long-term goals.

In an environment where cash is paying nothing, and bond yields are well below where they were for the past 40 or 50 years, Koesterich argued younger workers will need to embrace the volatility of the stock market if they want to generate the returns they need to live comfortably for decades in retirement.

What Koesterich and Wall St. Journal left out is another reason why Americans are finding it difficult to save in the amounts they should:

Taxes

Under the Obama administration, the federal government is hauling in more money in taxes than ever before. Tax revenue is at an all-time high: Over $2.67 trillion has come in so far this fiscal year, according to the latest Treasury Department report. That’s a record — in dollar terms — for the first 10 months of the year (the government’s fiscal year ends in September). Expect 2015 to finish at an all-time high. (CNN Money)

Despite record tax revenue, the Obama administration keeps spending more and is accumulating ever more debt, which will have to be repaid by the baby boomers’ children, grandchildren, and great grandchildren.

~Eowyn