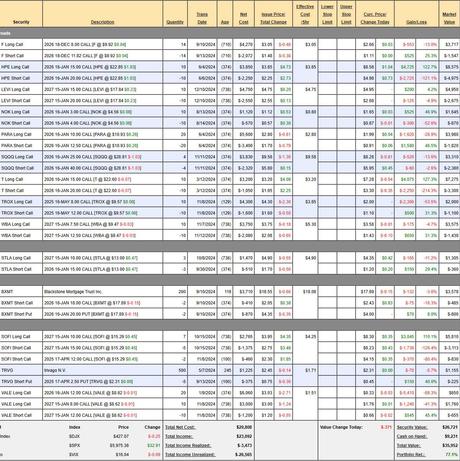

We took a big $2,429 hit since our last Dec 10th Review as the Russell dropped 4.7% (we have mostly small caps) and the VIX rose 20%, giving us unfavorable LOOKING relationships on the premiums we sold.

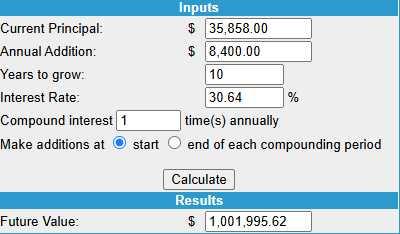

Not every month is going to be a winner and the key is how we make adjustments along the way - so we'll be looking at each position very carefully this month. Our $700 Portfolio follows a very simple concept of investing $700 every month (10% of the average family's income) and then finding the optimal mix of positions to give us good long-term return that will grow our nest egg. It's a conservative, low-touch portfolio but we are using option strategies to improve our leverage and that has rocketed our gains.

This pullback was not unexpected. As I said in the Dec 10th review:

We are over the "Top of Range" our 5% Rule predicted for 2024 - so we're simply at our goal and now we need to consider what our target is for 2025. We have not seen, so far, a rise in earnings that would dictate raising our targets - especially when we consider that, without the Magnificent 7, 2024 earnings for the S&P 493 have been essentially flat. Last month, I was looking to play it cautiously but, in reviewing our positions, we felt safe enough playing it more aggressively but I'm not sure I will feel the same ways playing over the holidays - especially with the S&P OVER the top of our range. HOWEVER, I did say last month that, if we popped over 6,000, we could get more aggressive - so we'll play it by ear, I suppose.

- T - Well in the money but only net $3,975 on the $5,000 spread so we have $1,025 (25.7%) left to gain over the next 12 months.

- TROX - As the longs are down 53.5%, I no longer want to wait for earnings so let's roll our 10 May $8 calls at $2 ($2,000) to 20 Dec $8 calls at $2.90 ($5,800) and sell 10 Dec $12 calls for $1 ($1,000) so we are spending net $2,800 for another $4,000 spread while buying more time for our longs. Now it's an $8,000 spread at net $3,700 with $4,300 (116%) upside potential .

- SOFI - Over our goal already at net $1,167 on the $3,500+ (not fully covered) spread but let's call it just $1,633 (139%) upside potential.