The warnings began several years ago, that Social Security Disability Insurance (SSDI) will go broke next year, in 2016 - an admission by none other than SSDI's administrators or trustees, who include the secretaries of the U.S. Treasury, Department of Labor, and Department of Health and Human Services.

See DCG's " Feds: Social Security Disability Fund Goes Broke Next Year "

Under the Obama administration, SSDI had become a new form of welfare, with an unprecedented number of Americans receiving disability benefits. (That is not to say that all SSDI recipients are undeserving.) In 2013, a record number of 11 million (10,962,532) Americans were on SSDI, which is 147,335 more people than the total population of the country Greece .

With news of the program's imminent insolvency, legitimate SSDI recipients who depend on the monthly checks are panicked. See, for example, .

You should know that those checks will keep coming, at least until Social Security itself goes broke 19 years from now, in 2034.

Congressman Xavier Becerra (D:Calif.) has introduced a bill, HR 3150: the One Social Security Act, that would avert a 19% cut to disability benefits in 2016 by merging the SSDI Trust Fund with the Social Security Trust Fund (Old-Age and Survivors Insurance or OASI).

Becerra says HR 3150 "does not add a penny to the deficit or the debt" and "does not change Social Security's overall financial condition" because the merge will pay all Social Security benefits "using trust fund reserves that current Social Security beneficiaries helped build up through their own contributions."

Those claims are, at once, deceptive and highly dubious.

Simon Black, founder of Sovereign Man, explains:

On January 31, 1940, the very first Social Security check ever delivered went to Ms. Ida May Fuller, a former legal secretary who had recently retired.

Ms. Fuller had spent just three years paying into the system, contributing a total of $24.75 to Social Security.

Yet her first check was for nearly that entire amount. Quite a return on investment.

She went on to live past 100, collecting a total of $22,888.92, over 900 times the amount she contributed to the program. Her story is quite the metaphor.

If you're not familiar, Social Security is comprised of two primary trust funds: Old-Age and Survivors Insurance (OASI) and Disability Insurance (DI).

Essentially, all of the taxes paid in to Social Security end up in one of these two trust funds.

The trust funds then 'manage' the money to generate a rate of return, and then pay out distributions to program recipients.

Now, the funds are overseen by a Board of Trustees which is obliged to submit an annual report on the fiscal condition of the program. It ain't pretty.

The Disability Insurance (DI) fund is particularly ugly. In fact, the trustees themselves wrote in the 2015 annual report that "[T]he DI Trust Fund fails the Trustee's short-range test of financial adequacy..." and, " The DI Trust Fund reserves are expected to deplete in the fourth quarter of 2016 ..."

In other words, one of the two Social Security trust funds is just months away from insolvency. [...]

The other trust fund, OAS, is projected to "become depleted and unable to pay scheduled benefits in full on a timely basis in 2034. "

Which means that if you're 47 or younger, you can kiss Social Security goodbye.

Bear in mind, these aren't my calculations. Nor are they any wild assertions. They're direct quotes from the trustees themselves. [...]

Late last week, several dozen members of Congress introduced the "One Social Security Act", HR 3150, to solve this problem.

And let me tell you, their solution is bold. Fearless. And brilliant. [Sarcasm Alert!]

HR 3150 attacks the looming insolvency of Disability Insurance by eliminating the fund altogether.So instead of having two separate funds for two distinct purposes of Social Security, the legislation aims to combine them into one unified fund.

That way, with just one fund, there won't be any separate reporting about DI's insolvency.

It's genius! They make the problem go away by eliminating the requirement to report it.

There's just one small issue. Legally, they have a word for this. It's called fraud.

You and I would go to prison if we commingled funds like this. But in the hallowed halls of Congress, this is what passes as a solution.

This is so typical- solving problems by pretending that they don't exist and destroying any element of transparency and accountability.

This pretty much tells you everything you need to know about government. [...] These people aren't the solution. They're the problem.

And don't think that 'voting the bums out' will affect anything. Elections merely change the players, not the game.

The only way forward is to invest in yourself, particularly in your business and financial education. Make plans based on the assumption that Social Security doesn't exist.

And if, by some miracle, it's still there by the time you retire, you won't be worse off for having built a larger nest egg thanks to the financial acumen you developed.

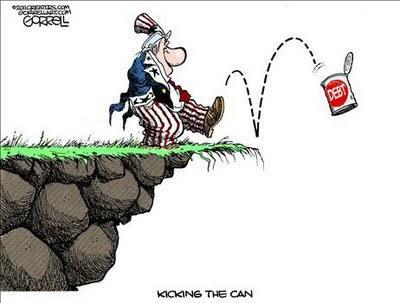

In other words, Congress fixed the SSDI-going-bankrupt problem by, once again, kicking the can down the road.

Of course, any informed person knows that the Social Security Trust Fund exists only on paper. That "trust fund," along with every other federal government program, is already insolvent because the Untied [sic] States of America has a national debt in excess of $18 trillion , which is 103% of America's GDP . That's the official figure; some economists estimate the debt to be much, much more.

The day of reckoning for that debt will come, when we run out of road to kick that can.

But hey, why worry? Be happy!

Let's just take, take, take our "fair share" while we can. We'll just leave the day of reckoning to our children and grandchildren!

See also: