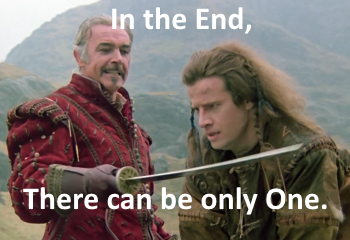

You might remember Highlander—an A.D. 1986 film that starred Christopher Lambert and Sean Connery. The film described an ages-old battle between “immortal” warriors. Its tagline, “There can be only one”, meant that all of the various “immortals” were destined to fight and kill each other until only one “immortal” survived.

You might remember Highlander—an A.D. 1986 film that starred Christopher Lambert and Sean Connery. The film described an ages-old battle between “immortal” warriors. Its tagline, “There can be only one”, meant that all of the various “immortals” were destined to fight and kill each other until only one “immortal” survived.

In this article, I’m exploring the hypothesis that our two institutional “immortals” (the Federal Reserve and U.S. government) are destined (like Highlander’s “immortals”) to fight each other until only one remains.

Conventional wisdom tells us that the Federal Reserve and U.S. government work hand-in-glove and without fundamental conflict. However, when you stop to think about it, it appears that the current relationship between these two institutions should be so fundamentally adversarial that, in the end, only one can survive.

Debtors love inflation since it allows them to repay their debts with “cheaper” dollars. Almost every American who’s bought a new home since WWII has been encouraged to take out a 20- or 30-year mortgage by the promise of being able to repay their debt with “cheaper” dollars. Inflation is the force that renders dollars “cheaper” and thereby encourages us to borrow and spend.

For example, if I were to borrow $100,000 over a period of time when there was 10% inflation, I’d repay the nominal sum of “$100,000” but that “$100,000” would have only $90,000 in value (purchasing power) as compared to the $100,000 I initially borrowed. I’d repay my debt with “cheaper” dollars. That would be good for me, but bad for the creditor that loaned me the $100,000. Because of inflation, after lending me $100,000 in purchasing power, my creditor would receive only $90,000 in purchasing power as repayment for the loan.

Inflation favors debtors (borrowers) and robs creditors (lenders). That’s why inflation encourages most people to borrow, go deeper into debt, in order to spend more currency and thereby “stimulate” the economy.

You might suppose that you’re not a creditor, but if you’ve contributed currency to So-So Security and you’re waiting on your retirement, you’re a creditor. If you’ve invested some of your wealth in a pension fund that purchased U.S. bonds, you’re a creditor. Stocks? Bank accounts? You’re a creditor.

Inflation steals your savings, every day.

.

• More, inflation destroys fiat dollars.

We see evidence of that destruction in the fact that, since the dollar became a pure fiat currency circa A.D. 1971, as compared to gold, the fiat dollar has lost over 95% of its purchasing power. That’s evidence of a 45-year long monetary policy that’s unlikely to revert to deflation on more than a temporary basis.

Inevitably, if the pro-inflation policy continues, after having lost 95% of it’s purchasing power, the fiat dollar will lose 96%, then 98% and finally 100%. Reduced by 100%, the dollar’s purchasing power will be zero and the fiat dollar will be useless and will therefore die.

Since the Federal Reserve’s primary (only?) product is fiat currency, it follows that if the fiat dollar dies, the Fed will become useless and therefore also die. Therefore, I’m going to postulate that the Fed doesn’t want its fiat dollars to be destroyed.

In fact, the Fed should have a powerful vested interest in preserving the fiat dollar.

Thus, the Fed should be opposed to the inflation that will ultimately render its fiat dollars worthless and the Fed useless.

.

• Deflation destroys debtors.

Deflation is the opposite of inflation since deflation increases the value/purchasing-power of the fiat dollar. That increase can bankrupt debtors since they’re forced to repay their debts with fiat dollars that are increasingly more valuable.

For example, imagine a man who could just barely afford to borrow $100,000 to invest in his business during a time of 10% deflation. He’d be forced to repay the equivalent of $110,000 in purchasing power. If he couldn’t afford to pay that extra 10% in purchasing power, he’d be pushed into bankruptcy—by deflation.

The U.S. government is the world’s largest debtor. As such, the U.S. government may be the single institution most vulnerable to bankruptcy and destruction caused by deflation.

Therefore, the U.S. government has a vested, vital interest in avoiding deflation.

Conversely, the overly-indebted U.S. government has a vital interest in causing inflation since inflation allows debtors (including government) to repay their debts with “cheaper” dollars.

Again, imagine that I borrowed $100,000 during a period of 10% inflation. When I repaid that $100,000 principal it would only have $90,000 in purchasing power as compared to its purchasing power when I first negotiated the loan. Inflation is great for debtors but terrible for creditors. As a borrower/debtor, I’d profit from inflation. However, because of inflation, my lender/creditor would suffer a loss of purchasing power.

Like all debtors, the U.S. government should want inflation.

Like all creditors, the Federal Reserve should want deflation.

.

• No one intentionally destroys anything that’s growing more valuable.

Deflation causes fiat dollars to become more valuable and thereby increases the fiat dollar’s life expectancy. Given that the Federal Reserve’s only product is fiat dollars, the Fed should have a vested interest in causing deflation.

Similarly, as the world’s biggest debtor, the U.S. government has a vested interest in inflation (which reduces the real value of the National Debt). Therefore, the Federal Reserve and U.S. government have diametrically-opposed interests and are adversaries rather than co-conspirators.

.

• In the past few months, the Federal Reserve has said repeatedly that the solution to current economic problems must be fiscal (government-based) rather than monetary (Federal-Reserve-based). The Fed has repeatedly said or implied that there’s nothing more they can do to heal the economy. According to the Fed, it’s now all up to government to devise a “fiscal” remedy (adjust tax rates and/or increase government spending) for our economic malaise.

Other than implement some crazy idea like negative interest rates, the Fed’s monetary policies has had only two mechanisms for stimulating the economy: 1) lower interest rates; and 2) increase the currency supply. When the Fed declares that there’s nothing else that it can do, are they expressing a matter of mathematics, or a matter of conflicting special interests?

If inflation “stimulates” the economy but also ultimately destroys the fiat dollar by reducing its value/purchasing power to zero—and if the fiat dollar is the Fed’s only product—it follows that the Fed has a vested interest in preserving the fiat dollar, avoiding inflation, and presumably causing deflation.

Yes, since at least A.D. 1971, the Fed has acted against its own interests by causing inflation. But the fiat dollar has lost 95% of its purchasing power. There remains, at most, only 5% of the dollar’s original value to lose to inflation. That’s not much of a margin for error. If the remaining 5% in purchasing power is destroyed by inflation, the dollar dies. This slim “margin for error” implies that the Federal Reserve can no longer participate in causing inflation and may explain why the Fed has repeatedly said that there’s nothing else it can do to “stimulate” the economy. The Fed can’t participate in causing much more inflation without destroying the fiat dollar and the Fed, itself.

.

• Given that inflation allows debtors (including the U.S. government) to repay their debts with cheaper dollars, the U.S. government has a vested interest in causing inflation (perhaps even hyperinflation) which will repudiate part of the government’s debt.

Again, if inflation ultimately destroys the fiat dollar and, thus, the Federal Reserve, while simultaneously reducing the U.S. government’s debt and thereby preserving that government from overt bankruptcy—isn’t it obvious that the relationship between the Federal Reserve and U.S. government must be adversarial? The government needs inflation to survive. The Federal Reserve must avoid inflation (and, ideally, cause deflation) to prosper and even survive.

More inflation (to supposedly stimulate the economy) will destroy the fiat dollar and, ultimately, the Federal Reserve. However, that same inflation will allow the U.S. government to rob its creditors, repudiate its debt, avoid bankruptcy and thereby survive.

Government needs more inflation.

The Fed needs more deflation.

“In the end, can there be only one”?—the government or the Federal Reserve?

I think the answer must be Yes.

.

• Through most of the past century, the Fed should’ve represented its own interests (as a major creditor) as well as the general interests of all creditors.

Throughout most of the past century, the U.S. government (world’s biggest debtor) should’ve represented its own interests as well as those of the nation’s debtors. During much of that time, the Fed-vs-government struggle maintained a rough “balance” between the competing interests of creditors and debtors. Neither side profited so excessively that it destroyed the other.

However, in the last two or three decades, we became a “consumer” (debtor) economy and government became the world’s biggest debtor. During that time, whatever “balance of power” may have previously existed between the Fed/creditors and the government/debtors has shifted to favor government/consumers/debtors so excessively that American creditors are in danger of being destroyed. This is particularly true during the last seven years of the Obama administration when the National Debt doubled in order to “stimulate” the economy.

As evidence, consider the likely result of our monstrous National Debt. It’s too big to be repaid in full. That means it won’t be repaid in full. That means the debtor-government that borrowed all of those funds must cancel most or all of the National Debt by open repudiation or by inflation—or suffer a national bankruptcy. In either case, most of the government’s debt will be repudiated, canceled and rendered void.

It also means that creditors who loaned the wealth to the government in return for a gen-u-ine U.S.-issued, paper debt-instrument (U.S. bond) are going to lose their assets. These creditors include banks, the Federal Reserve, institutions like pension funds and private individuals who are “safely” invested in U.S. bonds.

Those creditors will be robbed by insolvent debtors in general and the U.S. government in particular.

Over the past several years, many American creditors wishing to escape financial destruction and preserve their capital from low interest rates and inflation have tended to invest their funds in foreign economies.

.

• Given that most Americans believe themselves to be debtors (consumers) rather than creditors (producers), most people might cheer if the National Debt were repudiated. However, what will all those cheering debtor-consumers do when they learn that when the debt was repudiated, their creditors were destroyed (or at least moved their capital from the U.S. to foreign economies) and there’s no longer any paper capital left to borrow?

Once the creditors are wiped out by inflation and government can no longer borrow to feed its dependent consumers, those dependents will start to starve. How long will the poor welfare-recipients and wealthy subsidy-recipients have to go hungry before they realize their only means of survival will be by violence or by hard work at depression-era wages?

Even if the debtor-consumers resort to violence to steal whatever the remaining producer-creditors have of value, how long before even the debtor-consumers realize that, without producer-creditors, they will also soon starve?

I.e., figuratively speaking, if the debtor-consumers rob farmers of their crops this year and even steal his seed for next year, there’ll be no crops next year and both the farmer-producers and the debtor-consumers will starve.

The only escape from our debt-based debacle and from government’s pro-inflation policies that excessively favor debtor-consumers, is for each of us to start working again. Working hard. Working for little profit—at least initially. Becoming, once again, a nation of producers, then savers, and finally creditors—rather than a nations of consumer-debtors.

If we don’t return to productivity, our standard of living will continue to fall, our life expectancy will shrink, and we’ll simply die and leave a void for the next wave of immigrants to fill who are able to produce more than they consume.

.

• In the meantime, the Federal Reserve claims that its “monetary policy” (altering the currency supply and the rates of inflation or deflation) can do no more (can’t safely cause any more inflation) to “stimulate” the economy. In doing so, the Fed has arguably refused to participate further in the death-by-inflation of the fiat dollar, in the destruction of American creditor-producers and in the destruction of the Fed, itself.

Government, on the other hand, insists that it must have more inflation to “stimulate” the economy—but also to stealthily repudiate some of the value of the National Debt.

Implication: We’re watching the fundamentally adversarial relationship between the Federal Reserve and the U.S. government devolve into a “civil war” between the nation’s consumer-debtors and the nation’s producer-creditors.

.

• One last point: during the last seven years of the Obama administration, the National Debt has doubled. That doubling is evidence of the lost balance between the government and Federal Reserve. It’s also evidence that the Federal Reserve has been very nearly destroyed (sacrificed, if you prefer) by the U.S. government.

This implies that: 1) the Fed’s role and powers are inferior and subordinate to those of the U.S. government; and, 2) the much-maligned Federal Reserve may be more of a victim of government than a co-conspirator. .

In the end, there can be only one—either the inflation-dependent U.S. government or the deflation-dependent Federal Reserve. Either too much inflation will destroy the dollar and the Federal Reserve, or too much deflation will bankrupt and destroy the U.S. government.

Neither institution is truly “immortal”. Both will eventually perish.

But, which will perish first?

Although the battle between the Federal Reserve and U.S. government could go either way, it appears to me that the fiat dollar and Federal Reserve may be on the brink of being sacrificed and destroyed in order to temporarily save the U.S. government.