This post is by Market Shadows and does not represent the views of Sabrient Systems and Gradient Analytics

From Fun With Numbers: Glimpse into the Future (Market Shadows Newsletter, 10/7)

In Fun With Numbers: Events Horizons, we discuss the Non Farm Payroll numbers released last week, the Household survey vs. Establishment survey, Seasonally Adjusted (SA) numbers vs. NON Seasonally Adjusted (NonSA) numbers, good economy vs. bad economy, random fluky numbers vs. a conspiracy to reelect Obama.

The Wall Street Journal distanced itself from the conspiracy theory, but also acknowledged that the celebrated results are actually not so good, the economy is not healed: ”You don’t need a conspiracy to know the job market is still lousy.” Happy Days Are Not Here Again. For a detailed analysis of the employment numbers read Fun With Numbers, Jobs, Food Stamps, Conspiracies.

While exploring whether the report’s outlier numbers were the product of chance or conspiracy, we realized that the conspiracy theorists could have it all backwards. Perhaps, the plan was to make the economy seem worse than it really is, before September, thereby giving the Federal Reserve an excuse to launch QE-Infinity. Another gift to Wall Street.

This was Lee Adler of the Wall Street Examiner’s suspicion. With the QE-Infinity announcement out the way, could it be, stronger numbers are now coming out? Convenient for Obama, but maybe not the primary purpose of the plan?

And for the record, we are not conspiracy theorists. However, just because we are not conspiracy theorists, doesn’t mean there aren’t conspiracies.

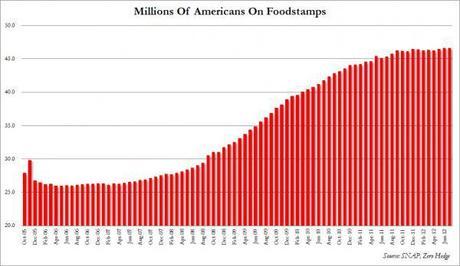

We also noted that other indicators besides jobs suggest that the economy is hardly improving. For example, trends in food stamps.

Zero Hedge reported, “While the perfectly unmanipulated and totally coincidental swing in the unemployment rate in an Obama favorable direction one month before the election came at a prime time moment for the market, one hour ahead of the open, setting the market mood for the rest of the day (which despite all best efforts still closed red), there was one other, far more important data point released by the government’s department of agriculture, sufficiently late after the market close to impact no risk assets. That data point of course was foodstamps (or the government’s Supplemental Nutrition Assistance Program, aka SNAP), and we are confident that no readers will be surprised to learn that foodstamp usage for both persons and households, has jumped to a new all time record…

“Finally, and putting it all into perspective, since December 2007, or the start of the Great Depression ver 2.0, the number of jobs lost is 4.5 million, while those added to food stamps and disability rolls, has increased by a unprecedented 21 million. Oh and about $7 or $8 trillion in debt. Who’s counting really.

“And this is the real and only key economic statistic of today that nobody wants to talk about, because it is equally the fault of both parties.

Total foodstamp recipient persons:

(US Foodstamp Usage Rises To New Record High, Zero Hedge)

GLIMPSE INTO THE FUTURE

For equities, two important countervailing forces are at odds heading into the future. As we stressed in the last two newsletters (9/23 and 9/30), fundamentals are not key to market performance. Liquidity has been master, and if it continues its reign, the stock market and commodities are in good shape moving forward.

Lee Adler of the Wall Street Examiner made this argument in This May Be The Most Important Treasury Market Update In Two Generations.

Arguing Hot, Hot, Hot, Lee writes:

“Major events may be about to unfold in the markets that will affect market trends in a huge way:

- Traders sold Treasuries at the end of the week, reversing yields from near their September lows. This was not a supply issue. Supply was very light, with only bills on tap this week at the auctions. Instead, this may have been an indication that buyers may be beginning to get cold feet from the signs that the economy may be growing at a little higher rate than widely ASSumed. (Our comment: recall, Lee Adler took the position that higher job numbers were suppressed prior to September, giving justification to the Fed’s launch of QE-Infinity. This is opposite the perspective of most “conspiracy theorists” who believe the lie was in the surge in jobs report by the Household Survey, for the purpose of beautifying Obama’s pre-election image.)

- The Treasury continues to have the good fortune of seeing very strong growth in tax collections through September and carrying over into October, with nominal year over year growth now at 7.4%, and real growth over 3%. There was a big surge in earnings inflation in September with average weekly earnings up over 4% y/y.

- The Treasury was able to pay off the $70 billion in expiring CMBs on September 17th and has built a huge cash hoard more than double the cash on hand last year at this time. That could enable it to sharply reduce borrowing in October

- The Fed’s purchases of around $80 billion this month in MBS and net Treasury purchases from Primary Dealers under Operation Twist will be enough to fund 100% of new Treasury supply.

- This period is beginning to look a great deal like the mid 1970s when small investors stampeded into bonds, only to see their holdings destroyed by inflation and rising bond yields through 1982.

- With signs of economic improvement, reduced Treasury supply will cause even greater excess liquidity. That, along with signs that the economy may be growing and inflation picking up, is likely to flow toward equities and commodities.

- Withholding taxes are now more than 3% ahead of the same period last year in real terms. This suggests that economic data is likely to continue to surprise to the upside. Additional QE will now add fuel to an economy that was already heating up, bullish for stocks and commodities, but bearish for Treasuries.

- While I expect to see Treasuries come under distribution in a topping process, there’s probably not much chance of a big selloff in Treasuries or stocks. Those who believe that a market cataclysm is likely under these conditions are probably engaging in wishful thinking. If Primary Dealers are flipping their Treasury inventory, it means that they will have plenty of cash to deploy elsewhere.”

[Get regular updates the machinations of the Fed, Treasury, Primary Dealers and foreign central banks. Click this link to try WSE's Professional Edition risk free for 30 days!]

Zero Hedge argues Not, Not, Not. Earnings will be disappointing, and earnings season is directly in front of us. From Five Fun ‘Pre-Earnings’ Facts For The “Buy-The-F$$$ing-Dreamers:

“With the S&P 500 once again testing multi-year highs, forward P/Es over 14 in a real-rate environment which suggests single-digit P/Es, abnormal micro-structure (mega-caps outperforming and high-beta fading in an up-tape), and a buy-the-f$$king-’dream’ mentality soaking in everywhere, we take a close-up view of the earnings season reality that is about to come crashing down on multiple-expansion hopes. Following on from the five most ridiculous charts in US equity markets, these five ‘facts’ will be assuaged by every long-only manager as ‘priced-in’ – we suspect otherwise.

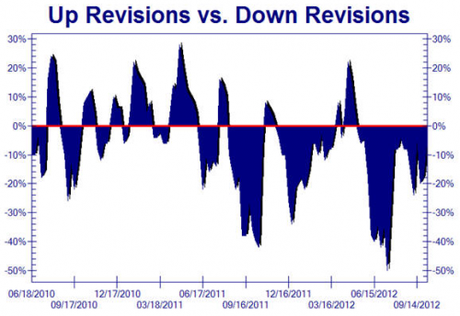

- Downward EPS revisions have outnumbered upward revisions for 22 weeks

- For the S&P 500 companies, there have been 91 negative pre-announcements versus 21 positive

- The 4.3x negative-to-positive pre-announcement ratio is the highest since 2001

- Of the S&P 500 companies that have reported thus far (25 total), only 52% have exceeded expectations (long-term average is 63% and last four quarters average 67%)

- Overall Q3 earnings are expected to fall 2.5%

(Five Fun ‘Pre-Earnings’ Facts For The “Buy-The-F$$$ing-Dreamers)

Will the pressure on earnings matter? We think not so much, but time will answer that question.

Examining the technical side, Springheel Jack and Chris Vermeulen give us charts and analysis and Pharmboy closes a few positions and adds one more.

Read: MarketShadows Newsletter: Fun With Numbers (10/7/12)