Well, well, well….it is good to know that there are others in the scientific arena who believed that YMI Bioscience's data (cough – Gilead) is a better drug than Incyte's Jakafi. Now, the definitive data are still unknown, but there was enough evidence from a Phase 2 trial to take a small risk for a huge reward. So, let's forget about Apple (AAPL), and do nothing but biotechs from now until Congress passes universal health care coverage for prescriptions….and drive the prices down so that research and development is no longer feasible to conduct in the US. Sheesh, even our old stalwart Seattle Genetics (SGEN) has been on a tear as of late, and we expect more from them in the future. Their future may be short lived though, as it is my premise that they will be bought out for their technology, and their pipeline. When, it remains unclear, but at PSW we continue to sell premium against a position. We have been doing this for many months, especially against a basket of biotechs that we have been buying and holding for a while (CRIS, PLX, EXEL, and others).

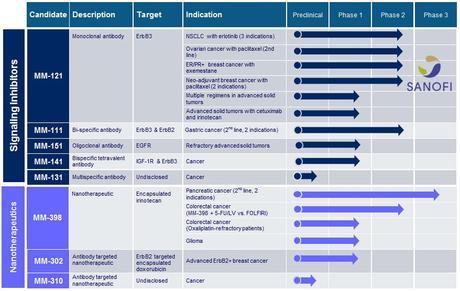

Now it is time to take a look at a few other companies pipelines, and dissect them to see if they are worthy of our funds.

Merrimack Pharmaceuticals (MACK) – the company was founded in 2000 and went IPO at the end of March 2012 for $7. The IPO, in which all outstanding shares of Merrimack's convertible preferred stock were converted into 66,255,529 shares of common stock and in which Merrimack issued 15,042,459 new shares of common stock, yields a market cap of $591M. Cash and equivalents on hand were about $80M, and a loan guarantee they note should get them into 2014, but raising money is something that Biotechs do on a regular basis. So, we will not hold our breath. In the last six months, insider ownership has increased by 2.8%, while institutional ownership has increased by a staggering 34% (here).

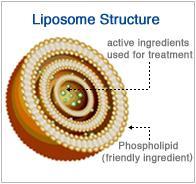

The company's lead drug is MM-398, which is a nanoliposomal encapsulation of the conventional chemotherapy Camptostar (irinotecan; Pfizer).

This article will become free after 48 hours (see below for free content). To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.