Previously, I made an article on my other website about the different ways to make money using cryptocurrencies, and one of the methods on that list was Staking. In this article, we are doing a deeper dive into the concept of staking and then, we’ll get to the different ways savings and staking can earn you money on the Binance.

What is Staking

If you have always heard about staking but always wondered what it actually is, well there is a simple explanation. It is the concept that allows cryptocurrencies to confirm transactions on their network. Staking is also one way you can let your cryptocurrencies work for you and earn passive income.

With staking, you allocate your cryptocurrency to supporting a blockchain network and in return, you get interest on the tokens that you have staked depending on how long you choose to stake them for. However, you should know that the interest that you get for staking your coins is completely up to the particular cryptocurrency that you are staking.

In the simplest terms, I can think proof-of-stake and proof-of-work are simply consensus systems that certain cryptocurrency tokens run on. A consensus system is simply a fault-tolerant mechanism used in blockchain systems to achieve the necessary agreement on a single data value is of the network among distributed or multi-agent systems like cryptocurrencies.

Bitcoin, for example, runs on the proof-of-work consensus system, which involves heavy computers and lots of energy to mine a coin. The proof-of-stake consensus system, on the other hand, is designed to be faster, more secure, and more efficient.

Now, the crypto token that you decide to hold or buy is an important part of staking, because staking can only be performed with cryptocurrencies that run on the proof-of-stake consensus. So, be sure to have all of these checked before you move on.

Now, that we are all caught up on the basics of Staking, let us get into an overview of how you can turn your crypto tokens into a passive income stream for you.

BINANCE EARN

Binance Earn is a feature on the Binance platform that offers a wide range of options and products that allows its users to make money by staking their coins. Depending on your risk tolerance and how long you are willing to wait, these options give you flexible terms that can fit almost anyone.

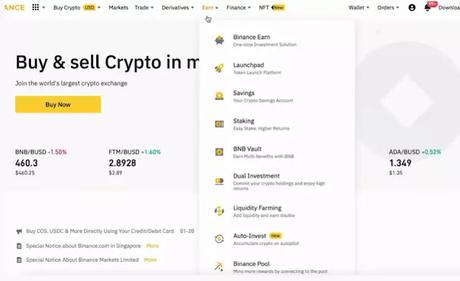

To access Binance Earn, log in to your Binance account for the web and click on the Earn tab on the menu bar at the top of your computer screen. On clicking this tab, a drop-down list will appear. You’ll then see a list of items or products related to Binance Earn, Staking, and others. Clicking on Binance Earn takes you to a new page.

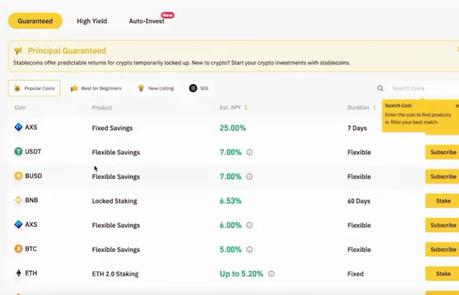

On the Binance earn page, you will find three options on display, Guaranteed, High Yield, and more recently Auto Invest. So, basically, you are allowed to either go for investments in stable coins that bring predictable returns, Guaranteed, or you can explore high-yield staking coins that come with much higher gains and risk to match.

The third option is more like a Dollar Cost Averaging strategy. You basically choose a cryptocurrency that you want to buy on a regular basis and this purchased crypto will be automatically deposited into your account so you can earn passive income.

For mobile though, the options are the same, except for the Auto Invest option, but you’ve got the Guaranteed and High Yield. Now, if you are a beginner at investing in crypto, then, the best place to start is, of course, the low-risk guaranteed section that has relatively stable yields. With guaranteed staking, you can also get back your principal after the locking period.

On the Binance Earn page, you also get a section for the coins available for staking. You can filter the coins you see by “Popular Coins” or “Best for Beginners” to see Binance’s suggestion for the best place to start. Right under the Binance Earn page header, you will find the drop-down menu for the filters to get suggestions from Binance, or just select a specific coin of your choice and hit search.

If you are completely new to investing in cryptocurrencies, then, it might be best to start off with the coins Binance suggests are best for beginners. But, that’s not all. Scrolling down the Guaranteed section of the Binance Earn page, you will find more products that Binance offers users to earn with their coins.

There are Savings, Locked Staking, Launchpool, BNB Vault, ETH 2.0 Staking, etc. Each of these is a unique staking option that offers varying levels of interest rates and returns. Clicking on their individual buttons below takes you to the dedicated page for each of these products. So, let us do a quick overview of what each of these products has to offer.

BINANCE SAVINGS

Starting out with Savings, this has two main options in the box. You can choose between flexible savings and Fixed or Locked Savings. This system is almost the same as what banks offer you. Simply, deposit crypto and gain interest on the deposits without having to do anything.

The major differences between Fixed and Flexible savings are withdrawal and interest rates. The option you go for will be dependent on how patient you can be with your investments. On the flexible side, you can withdraw your deposits whenever you want at whatever interest you have gotten on your principal.

With fixed savings, however, you will have to leave your deposit for a fixed period of time, pretty much like the fixed deposit account in regular banks. The upside with Fixed savings is that it offers way higher returns on investment than you would get with Flexible savings.

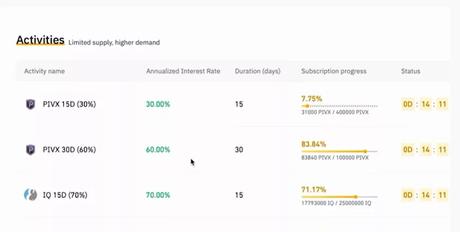

One thing to note with Fixed savings is that you actually get the freedom to withdraw your assets when you want before the fixed date. But, you will be forfeiting whatever interest that has been gained on your asset, should you choose to withdraw too soon. Now, on the Binance savings page, you will find another tab labeled Activities.

The Activities section contains staking opportunities that offer very high yields in return. These different “activities” are offered by both Binance and many other projects This section is a little tricky, and so I would recommend that you get familiar with the more basic areas and work your way up to the more complex sections like activities.

For those that are still interested in how it works. You can gain even higher returns if you decide to lock the coins into the platform. You can subscribe to any activity you want until it reaches its maximum limit.

LAUNCHPOOL

Well, that is all for Binance Savings, next on the list is Launchpool. To understand the usage and functionality of the Launchpool product on Binance, we first need to understand Yield Farming which involves lending or staking your cryptocurrency coins or tokens to get rewards in the form of transaction fees or interest.

This is somewhat similar to earning interest from a bank account whereby you are technically lending money to the bank. So, take, for example, you decide to stake your crypto in a Decentralized Finance project that involves adding liquidity or money to a liquidity pool, the stake is bound to come with a reward for your investment.

Now, when you decide to reinvest the rewards gotten from this stake, this is what Yield Farming is. Using the Launchpool product on Binance, you get easy access to new assets that you can farm and earn. As a reward for staking their coins, users also get newly launched tokens when they stake their crypto assets.

With Launchpool, rewards on investment get disbursed by the hour, and the icing on the cake here is that you are allowed to withdraw your assets whenever you want.

BNB VAULT

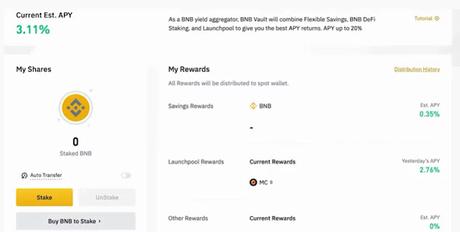

For those who may not know, BNB is the Binance Coin, a cryptocurrency owned by Binance itself. With that being said, you can probably already guess what this is about, and a sense of how it works. BNB Vault works as a capital-guaranteed product that is designed to help investors widen their potential income with the BNB token. It is quite simple.

When a BNB holder invests in the Vault, these holders are exposed to several centralized and decentralized products that they can invest in with one click of a button. The Vault also allows investors to increase their yields, and enjoy a truckload of opportunities that the Binance ecosystem offers.

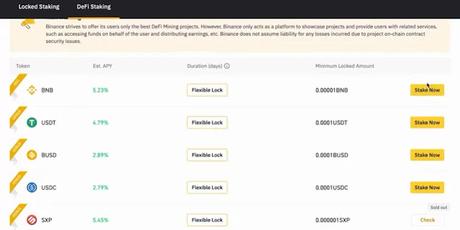

LOCKED STAKING

Next on the list is Locked Staking. This is somewhat similar to Fixed Savings we discussed earlier in the Savings section. However, to use the Locked Staking product on Binance, you have to stake crypto assets on the blockchain.

What this means is that you are allowed to withdraw your assets after your subscription to the product is successful. But, here is where the real difference is evident. There is an unlocking period attached to any asset that you decide to stake.

Each asset comes with its own locking period, and the locking period for that asset must be completed before you can take back what is yours.

ETH 2.0 STAKING

Ethereum recently launched an upgrade to its blockchain that moved it from a proof-of-work system to a proof-of-stake consensus system. With Binance’s ETH 2.0 staking, all Binance users now have quick access to staking the new Ethereum 2.0.

With just 0.1 ETH and a few clicks, Binance will handle all your validator operating expenses, and to top it all off, you don’t have to worry about on-chain penalties, as Binance also covers the risk.

Right now, Binance has a token for ETH called the BETH or Binance ETH and it is used to represent your staked ETH on a 1 to 1 basis so 1 ETH is 1 BETH, this is to help ease the complications of the ETH 2.0 staking. Well, that is all for the Guaranteed section of the Binance Earn page.

HIGH YIELD

Now, let us jump to the High Yield section. As for the High Yield section of the Binance Earn page, you have three other options to choose from. DeFi Staking, Dual Investment, and Binance Liquid Swap.

Before we jump in, please be reminded that the high yield nature of the investments in this section also comes with a relatively high risk. So, ensure to do proper research on whatever product you want to put your money into before you invest.

DEFI STAKING

Decentralized Finance is a tricky space that not a lot of people have fully understood, however, the benefits that it offers are as close as you can get to endless. So, what if you could access the benefits of Decentralized Finance without having to deal with the messy details?

Well, this is what Binance’s High Yield DeFi Staking offers you. DeFi Staking on Binance Earn allows you to access decentralized financial Services using smart contracts, but no private keys, rescue acquisition, trading, or any overly complicated tasks.

This is offering some of the highest possible returns on a silver platter without compromising the safety of your assets. Keep in mind, though, that DeFi products also have a locking period. If you decide to withdraw your assets before the locking period elapses, you are likely to miss out on some or all of your rewards.

All of the DeFi products come with different rules and details, so, please read all the terms for the products before you start putting in your money, so you don’t get stuck halfway.

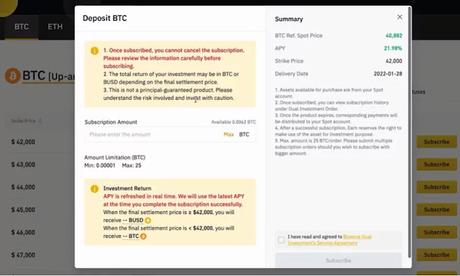

DUAL INVESTMENT

The concept of Dual Investment is both simple and complex if you try to think about it too hard. With Dual Investments, you are to deposit just one cryptocurrency, however, your earnings will be based on two different assets.

Using this product opens up the opportunity to commit your crypto assets, and have them stored in a savings yield. If the price of the committed assets goes up in the market, you earn even more money on your savings.

The returns you get on your savings and the currency you get paid in are dependent on how the price moves since your first investment in the Dual Investment system.

When you hit the subscribe button on any of the products, you will see a dialog box carrying all of the information that you will need concerning the product.

Please ensure that you go through all of the details as they will determine how you earn by the delivery date. Do note that Dual Investment does not permit you to withdraw your assets until the expiration date of the product and it is a non-principal protected structured saving product so, again, really high risk.

BINANCE LIQUID SWAP

Binance Liquid Swap runs on the simple rules of liquidity pools. It draws from the good sides of both the centralized and decentralized finance system to offer users high annual returns when they add liquidity to liquidity pools on Binance.

Users are also allowed to swap their cryptocurrencies in the liquidity pool. With this, they can enjoy low slippage and low handling fees.

However, this staking option is as risky as it gets. In fact, the first thing you see on the Liquid Swap page is a risk warning. You may take a good look at this warning and be sure you are up for the risk before diving in.