Spanish bonds

Yo te quiero infinito

Yo te quiero, oh mi corazon

Spanish bonds

Yo te quiero infinito

Yo te quiero, oh mi corazon

Roughly translated, my two-letter altered Clash lyrics are: "Spanish Bonds, I want you forever, I want you oh my love."

If only that were true! NO ONE wants Spanish bonds (or expects the Inquisition), with net borrrowings from the ECB by Spanish banks jumping 50% in March, from $200Bn to $300Bn (227.6Bn Euros) using 29% of last month's LTRO facility already while the Spanish IBEX market crashes AND burns back below 50% of the 2008 highs. Someone better call Spain and tell them we're in a Global recovery before they go to zero!

"A consequence of the (LTRO) is that the correlation between sovereign risk and banking risk increased all over Europe."

That's not some EMU permabear speaking, that's Spain's Economy Minister, Luis de Guindos! The IBEX is down another 2.2% this morning and, as I have been pointing out for years now – we are only looking at the tip of the Spanish iceberg. 10-year Spanish Government debt is now back to 6% despite (or because of) the drastic austerity measures the country is undergoing. I won't go into it all again as we did this as recently as Wednesday but this is REALLY bad stuff people.

So, on to the title of the morning's post. As you can see from the chart on the right, neither David Fry nor I thought we could "recover" so quickly and David sums it up quite nicely this morning, saying:

So, on to the title of the morning's post. As you can see from the chart on the right, neither David Fry nor I thought we could "recover" so quickly and David sums it up quite nicely this morning, saying:

Let’s see, Jobless Claims were terrible by recent comparisons and recorded a large miss (380K vs 355K expect and prior revised higher as usual to 367K). Some analysts blamed Easter for the rise which seems odd frankly. Plenty of rumors were planted that China’s GDP growth (released Friday) would be better than expected and yields in the eurozone were lower on talk of more ECB buying. None of that is real news yet. Frankly the Chinese can make-up any number they want in their autocracy. Does anyone really believe otherwise?

The real news came from Fed Vice-Chair Janet Yellen who assured QE and ZIRP addicted bulls that ZIRP was here to stay, and by implication, more QE when and as if needed. This comment was echoed by NY Fed governor Dudley who said the Fed is analyzing recent poor employment data to determine if the recovery is losing momentum and more stimulus (Fed speak for more QE) is needed.

This is what this bull market has feasted on the last two years—QE and ZIRP. The Fed has bought 85% of all Treasury debt > 10 year maturities since Operation Twist began in November 2011. So the Treasury sells debt to pay its bills while the Fed prints money to fund it. It’s like a government façade fronted by an ATM behind which is a large printing press. A consumer could drain their credit card but there are limits, the Fed has none beyond ink and paper.

I already put out a lengthy 3:13 Alert to our Members and we even offered it to Seeking Alpha as there were not any Trade Ideas in it this morning but, so far, they haven't published it or I'd simply point you to the free version, which summarized the current situation complete with "27 8×10 color glossy pictures with circles and arrows and a paragraph on the back of each one explaining what each one was." In a later note to our Members, I did decide that JPM and GOOG were not going to save us this morning and our Futures plays were going to be shorting the Russell (/TF) below the 805 line and shorting oil (now $103.50 at 7:45) as long as the Dollar holds the 79.60 line (now 79.62) because the only reason the Euro isn't crashing and burning with the Spanish economy is that the SNB, like our Fed – hasn't run out of paper yet.

The BOJ, however, needs that Dollar stronger and they have already threatened to go nuclear with the money printing and isn't this all getting just a little bit silly as we have this insane global race to print more and more currency to offset the currency printing of the other countries so we can all keep our fiat money as weak as possible? It's like the Cold War arms race but the only thing we get to blow up is an entire generation's retirement accounts – and you know how that ends!

As George C. Scott puts it, we have to choose between two admittedly regrettable but nevertheless distinguishable post-war environments – one where you have 20M people killed and the other where you have 150M people killed or, in this case impoverished by monetary policy. Aren't we lucky today to have leaders who have chosen to impoverish 150M people (the bottom 50%) for the sake of preserving the wealth of the 20M bondholders (the top 10%)?

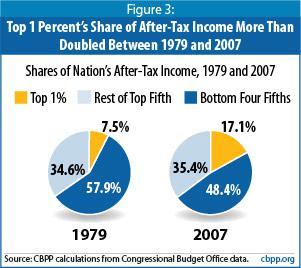

Very much like Dr. Strangelove, our Government and the top 1% have all sorts of ways to justify horrific abuses of the lower classes and that plan is ALREADY IN MOTION – as you can see from the chart on the right where 16% of our National Income has been ripped out of the pockets of the bottom 80% in order for the top 1% to increase their share by 128% in the past 3 decades.

Very much like Dr. Strangelove, our Government and the top 1% have all sorts of ways to justify horrific abuses of the lower classes and that plan is ALREADY IN MOTION – as you can see from the chart on the right where 16% of our National Income has been ripped out of the pockets of the bottom 80% in order for the top 1% to increase their share by 128% in the past 3 decades.

We are NOT going to have any sort of long-term economic recovery until and unless we begin to claw back some of those earnings from the top 1%. Is this class war? Of course it is – but it's a class war that the bottom 80% have already been losing for 33 years!

The problem in this country is that the top 10% is as separated from the bottom 80% as any noble class ever was from the peasants. Sure we watch them on TV and we even hire a few of them but, in general, they are "Les Miserables," which I highly recommend re-reading or at least watching the movie or seeing the play as that's the reality this global economy is hurtling towards.

As Victor Hugo said in the forward of the book in 1862:

As Victor Hugo said in the forward of the book in 1862:

So long as there shall exist, by reason of law and custom, a social condemnation, which, in the face of civilisation, artificially creates hells on earth, and complicates a destiny that is divine, with human fatality; so long as the three problems of the age — the degradation of man by poverty, the ruin of woman by starvation, and the dwarfing of childhood by physical and spiritual night — are not solved; so long as, in certain regions, social asphyxia shall be possible; in other words, and from a yet more extended point of view, so long as ignorance and misery remain on earth, books like this cannot be useless.

I hope the same can be said for blogs like this as I am simply trying to make you aware of the bigger picture. While it's all well and good to profit from the economic circumstances, what good does it do if we are allowing our Nation, along with the rest of the World, to follow a path that historically has led to misery, poverty despair and, eventually, revolution?

Speaking of elitist bastards who are destroying the World, Ben Bernanke speaks at the Princeton Club in New York City this afternoon at 1pm and, if he doesn't serve up a strong dose of quantitative easing either in his speech, entitled "Rethinking Finance" or in the Q&A session that follows – we can expect a poor finish to the week.

I'll be on Financial Impact Factor Radio this morning (9am) so you can get my up to the minute thoughts there but, at the moment – they are dark.

Have a great weekend,