This is one of the shortest holiday shopping seasons in recent memory. with only 27 days between Thanksgiving and Christmas ( 5 fewer than last year) but, unlike most horror films, this one might have a happy ending. Retailers faced what seemed like a perfect storm this year yet, rather than succumb to superstition, they've adapted with the survival instincts of the final girl in a slasher film - starting holiday promotions earlier than ever, some even before Halloween and consumers have responded, with 32% beginning their shopping sprees between July and October.

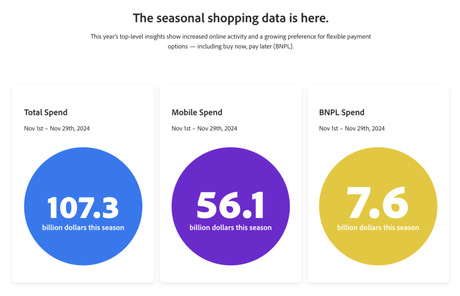

Despite (or perhaps because of) the compressed timeline, Black Friday through Cyber Monday delivered numbers that would make even Freddy Krueger's head spin:

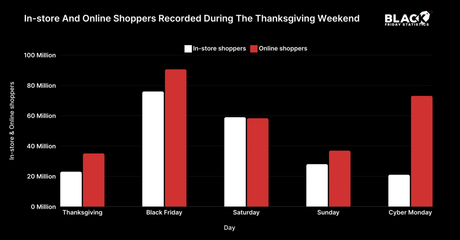

Like any good thriller, there's a transformation story here. Physical retail is experiencing its own metamorphosis with 81.7M people hitting the stores on Black Friday - although that was actually a drop in overall in-store traffic of 8.2% from last year. This year it was Mobile Shopping that dominated on Cyber Monday with 57% of sales ($7.6 billion) and over three-quarters of consumers planning to do MORE THAN HALF their overall shopping online.

For investors, this holiday season isn't about avoiding black cats and broken mirrors - it's about recognizing fundamental shifts in consumer behavior:

- E-commerce Dominance: The continued shift to online shopping benefits not just Amazon but also traditional retailers with strong digital presence

- Consumer Strength: Despite macro concerns, consumers are spending - focus on premium brands and luxury retail

- Mobile First: Companies optimized for mobile commerce should outperform

-

Deep Discounts: Watch margins in sectors offering the biggest sales:

- General apparel (39% off) AND spent 14% more on advertising.

- Health and beauty (34% off)

- Active apparel and footwear (23% off) and also spent 14.1% more on advertising.

As smart investors, we should also be getting ready for next year's sequel once we get the final numbers in January.

We'll see how the numbers come in but it looks like our Best Buy (BBY) positions ( the only stock that is in our Long-Term Portfolio AND our Short-Term Portfolio) are a good choice with 2/3 of the people going with electronics this year (should be good for AMZN as well).