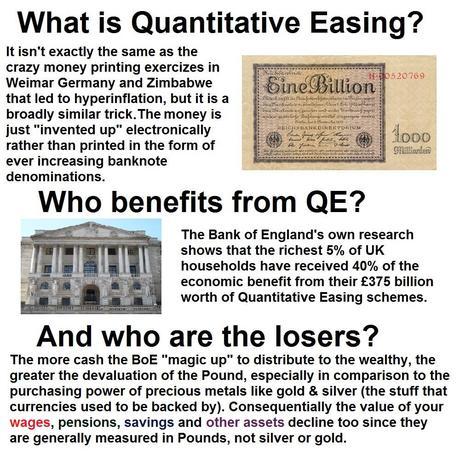

Oh boy was I wrong when I said Ben Bernanke wasn't crazy enough to ease into a bull market. Yesterday, he exercised the full power of the Federal Reserve to confiscate your wealth and hand it over to the bankers. That's right, by engaging in what many consider reckless money-printing practices and announcing there is no end in sight, Bernanke caused the Dollar to fall below 79, down from 84 (6%) before all this QE talk began.

That's like taking all $100Tn worth of US Assets – everything you worked for your entire life – and just devaluing them by 6%. Many of our Conservative friends decry the 1% tax on wealth imposed by the French – but at least they are honest about it. At least they debate it and vote on it. Not Bern Bernanke – the Federal Reserve Chairman simply decrees that you will contribute 6% of your dollar-denominated assets towards more bank bail-out and there's no cut-off if you are below the top 2% – this is a confiscation from every man, woman and child in America.

See how this scam works?

It is hard to see how another round of QE would help the economy. Long-term interest rates are already at historic lows. With rates this low, even if QE put effective downward pressure on rates — a dubious proposition — the economy would be unlikely to benefit. If a 3.5% mortgage rate is of little consequence, there is no reason to believe that a 3.4% or even 3.3% rate would suddenly produce results.

The real problem with QE — beyond increased near-term uncertainty — is that the Fed must at some point unload all these bonds it has bought. The Fed will buy bonds in soft markets and sell them when interest rates are already rising, pushing interest rates up further, faster. The problem, in short, is that the Fed will have failed to prop up the economy when it was weak only to risk killing the recovery once it really takes off.

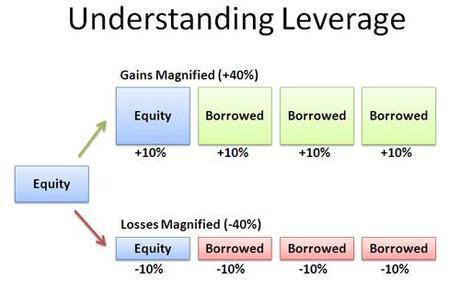

We discussed this and some other concerns I still have in Member Chat this morning. Meanwhile, we have to play the hand we're dealt and, for the moment, we've been dealt two aces and we MUST play our hand. Keep in mind we have to make 6% just to keep up with the devaluation of the Dollar the Fed is causing. For those of us who have real estate assets, metals and other commodities and, of course, stocks as the majority of our wealth – All is well as The Bernanke is working for us (top 1%'ers). I happen to be in Las Vegas this week, helping rich people get richer with Real Estate and then it's on to LA, where we look at ways to allocate some long-term investments in this market.

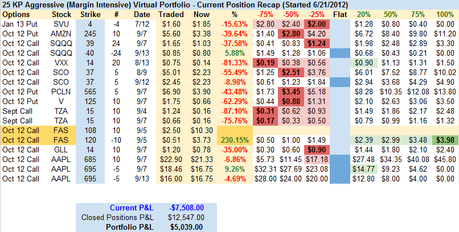

As you can see, we've made a lot of adjustments since last week but we haven't gone fully bullish yet, as we'd still like to see where we are next week before taking our losses on what's left of the short side. Not reflected here, of course, are our general bullish hedges like last Tuesday's 2 DIA Oct $135 calls at $1.23, selling 1 HPQ 2014 $15 put for $2.30 for net .16, now $2.05 for a quick 1,181% gain on cash – a very nice way to offset some losses on a few bearish plays. We have been picking aggressive offsets like this every Tuesday morning since the beginning of August and all 12 of them have exceeded their 300% return goals already.

So it pays to be patient and it pays to be cashy and cautious ahead of these events. Sure we may have missed some of the rally but now we can invest with a lot more confidence as we shift to a more bullish stance next week.

Have a great weekend,

- Phil