12 failures so far.

12 failures so far.

12 trading days since the S&P first hit 2,000 (Aug 25th) in which we have failed to hold 2,000 for a full day. Not one and, unless the Futures pop 10 points before we open, not today either. On 10 of those days, we've had a late-day run-up on low volume that popped us over 2,000 and on 7 of those days, 2,000 held at the close but EVERY SINGLE DAY – it also failed to hold.

Let's not forget that, during this time, we've had TRILLIONS of Dollars of additional stimulus pledged by Carney, Draghi, Kuroda and other minor Central Banksters and Yellen has certainly been as doveish as she could by (while still tapering our existing Trillion Dollar stimulus). This is how our market behaves WITH Trillions of Dollars of cash being pumped into the Global economy – I wonder what will happen when it stops?

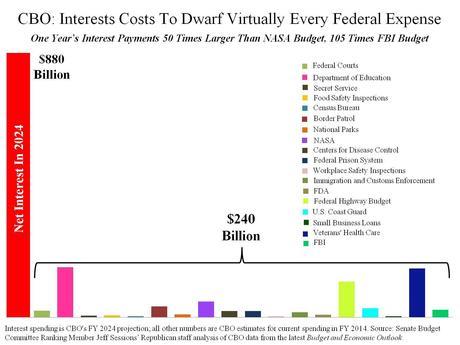

Of course, maybe it won't stop but, if it doesn't, this chart will look even uglier. This is a chart of our projected net annual interest payments on our debt in 10 years. That's $880 BILLION Dollars each year, just in interest payments, up $650Bn from the $233Bn we are spending now.

Of course, maybe it won't stop but, if it doesn't, this chart will look even uglier. This is a chart of our projected net annual interest payments on our debt in 10 years. That's $880 BILLION Dollars each year, just in interest payments, up $650Bn from the $233Bn we are spending now.

That's WITHOUT additional stimulus so I guess we can go for a bit more and make it an even Trillion, right? These are what we used to call CONSEQENCES – back when we used to care about such things. The US is not the leader in debt issuance, not by a long shot. Japan is 150% more in debt than we are and China has now doubled our debt to GDP ratio, after having been a creditor back in 2007 but now the undisputed king of stimulus spending.

Europe is also a mess. As I said to our Members in an early-morning Alert: Another thing the US Media is purposely ignoring is the 12.5% correction in Europe (example on Germany chart) since July that, so far, has bounced weakly (4-point drop on EWG has weak bounce at 28.8 and strong at 29.6) – failing exactly at the weak bounce line (the top blue line on Dave Fry's chart).

Europe is also a mess. As I said to our Members in an early-morning Alert: Another thing the US Media is purposely ignoring is the 12.5% correction in Europe (example on Germany chart) since July that, so far, has bounced weakly (4-point drop on EWG has weak bounce at 28.8 and strong at 29.6) – failing exactly at the weak bounce line (the top blue line on Dave Fry's chart).

I know the narrative from the MSM is to ignore the rest of the World and I hate to sound like a broken record but that's exactly what they told us while we were "rallying" in 2008 – just sayin'….

Of course, in 2008, we weren't almost at war with Russia and there wasn't a massive terrorist takeover of Iraq and Syria and Spain wasn't about to burst into civil war and Ireland wasn't breaking out of the UK and Italy wasn't teetering on Depression with the rest of Europe clearly in Recession and all with twice as much debt than they had at the time so yes, this time is different – it's MUCH WORSE!!!

Hopefully AAPL can save us today as the iPhone 6 begins taking pre-orders this morning and Apple's web site has already crashed once (back up now) as people begin the rush.

Hopefully AAPL can save us today as the iPhone 6 begins taking pre-orders this morning and Apple's web site has already crashed once (back up now) as people begin the rush.

It's Friday, so we're not going to take today's action too seriously and, as I mentioned in yesterday's post, we've doubled down on our DXD hedges into the weekend for protection.

The top 1% should be in a good mood as their GOP lackeys successfully filibustered an attempt at Campaign Finance Reform and that means it's going to be clear sailing into the November elections for our nation's Puppet Masters (see Brookings Brief) to tighten their grip on our once-great Democrocy/now Oilgarchy-Corporate Kleptocracy.

Have a great weekend,

- Phil.

Tags: AAPL, Apple, CBO, Economy, Europe, EWG, iPhone6Plus, kleptocracy, National Debt, SPY, top 1%

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!