Welcome back my friends to the show that never ends We're so glad you could attend

Come inside! Come inside!

There behind a glass is a real blade of grass

Be careful as you pass.

Move along! Move along!

Come inside, the show's about to start

Guaranteed to blow your head apart

Rest assured you'll get your money's worth

The greatest show in Heaven, Hell or Earth. – ELP

What a long, strange week it's been in the markets.

I know we've been having fun. See that turn in the S&P at 2:35? My 2:46 comment to Members in Chat was:

$25KP/StJ – Keep in mind it's an aggressive portfolio BUT, in the $5KP, we're going to take $1.80 and run for the DIA $127 puts on the whole thing and 1/2 out in the $25KP.

That's two days in a row we nailed the turn almost to the minute (Wednesday it was USO) and those $127 puts cashed out with a 50% profit in 2 days (we picked them up on the 17th). I put it to you – are we simply amazingly good at picking tops and bottoms or is the market, in fact, a total scam and we just happen to be good at identifying criminal patterns of behavior?

That's two days in a row we nailed the turn almost to the minute (Wednesday it was USO) and those $127 puts cashed out with a 50% profit in 2 days (we picked them up on the 17th). I put it to you – are we simply amazingly good at picking tops and bottoms or is the market, in fact, a total scam and we just happen to be good at identifying criminal patterns of behavior?

Since our premise for making these calls is that the market is a scam and since I said just yesterday morning "Every morning we have a pump job to short into and every afternoon there is a BS stick-save to re-establish our shorts" – you have to at least consider the possibility that the markets are, in fact, fixed.

So it should come as no surprise that our ultra low-volume Futures are back up this morning with oil once again giving us an entry at our $103.50 shorting spot (see yesterday's post). We caught a $1,300 per contract ride down to $102.20 yesterday and then all we have to do is wait and let them pump it back up to $103.50 and we short it again and already we're back to $103.25 (7:30) for a quick $250 per contract gain and now we wait for the next run-up and see if we can short them again – maybe at $104 this time. If people are going to manipulate the Futures – that's fine with us – we just need to learn their limitations and pick our spots to step in.

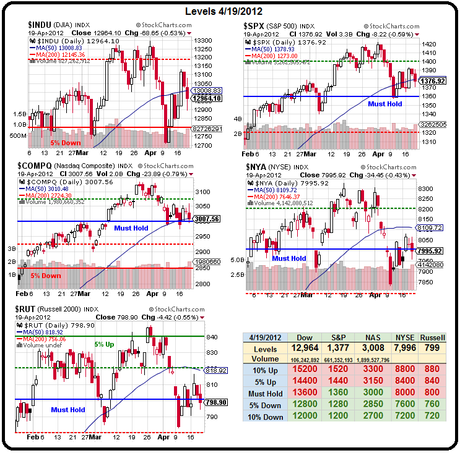

As you can see from our Big chart, we have blown 3 of our 5 Must Hold levels so, of course, we lean bearish but we've been leaning bearish all month and we're more concerned with a bounce here that forces us to take some profits off the table. I doubt anything can happen today to make us bullish into the weekend. The IMF is meeting and not much is coming from them but next week we get the Fed on Wednesday and, until 12:31, there will continue to be hope for more QE and, if not, we can expect a very, very large amount of selling in May.

As you can see from our Big chart, we have blown 3 of our 5 Must Hold levels so, of course, we lean bearish but we've been leaning bearish all month and we're more concerned with a bounce here that forces us to take some profits off the table. I doubt anything can happen today to make us bullish into the weekend. The IMF is meeting and not much is coming from them but next week we get the Fed on Wednesday and, until 12:31, there will continue to be hope for more QE and, if not, we can expect a very, very large amount of selling in May.

Do you see that MACD line on David Fry's VIX chart? Do you really need 10,000 hours of TA training to figure out what's likely to happen in the near future? Complacency is what's wrong with the markets – we are pricing companies to perfection and not discounting any kind of risk premium into our stock valuations. Something is bound to happen – all we need to do is choose the form of the Destructor.

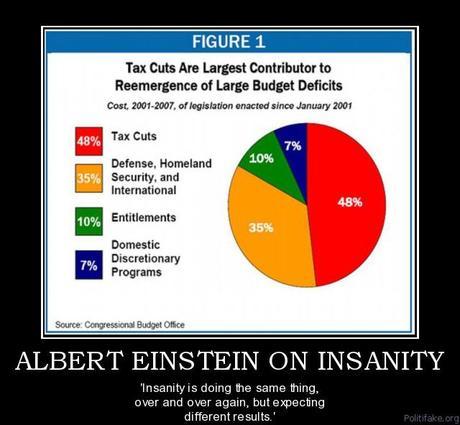

Which of our myriad of concerns will finally grow large enough to put fear back into the markets? Spain, France, China, Iran, India, Japan, Unemployment, Housing, Inflation, Deflation, our own Debts, Obamacare, lack of Obamacare? So many potential hazards and some of them even contradict each other and NONE of them matter in the markets as we are back to partying like the care-free days of 1999, or 2007 – when we didn't know from terrorism and we thought real estate only goes in one direction (like AAPL stock, right?) and we were sure that tax breaks would fix everything.

Thank goodness we're smarter than that now!

Thank goodness we're smarter than that now!

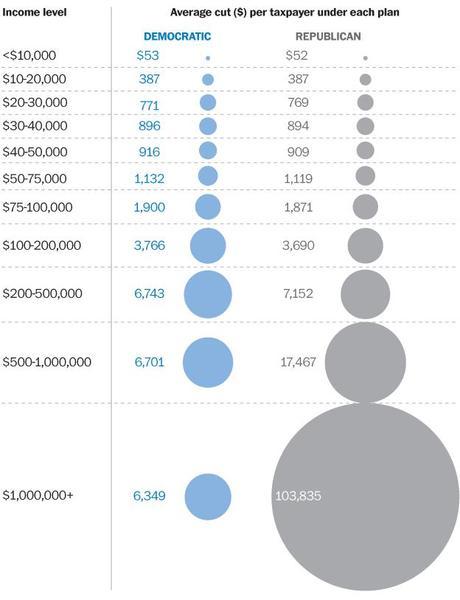

So smart that, fresh off defeating the Buffett Rule, which would have raised at least $49Bn a year by simply making sure multi-millionaires paid a 30% tax rate like everyone else in America, House Republicans rammed through a measure yesterday to provide another $46Bn a year tax cut to businesses in a blatant appeal to their donor base ahead of the elections.

This bill was so bad that 10 Republicans voted against it but, thanks to their overwhelming majority, they bill passed 235 to 173 anyway. "This is not about mom and pop," said Rep. Sander Levin, D-Mich. "It's about popping the cork for wealthy taxpayers." One estimate by the nonpartisan Tax Policy Center said 49 percent of its tax breaks would go to taxpayers with income exceeding $1 million.

Democrats tried taking advantage of the bill's broad sweep, trying to embarrass Republicans by forcing a vote on language that would have forbidden the tax breaks from going to businesses including pornographers, prostitution, golf clubs that discriminate by race or sex, and companies that send U.S. jobs overseas. GOP lawmakers held together and defeated the proposal. Democrats also tried unsuccessfully to replace the GOP tax cuts with breaks for companies that invest in their plants or equipment. It's NOT that the Dems won't vote for tax cuts – just not a BS bill like this one…

Democrats tried taking advantage of the bill's broad sweep, trying to embarrass Republicans by forcing a vote on language that would have forbidden the tax breaks from going to businesses including pornographers, prostitution, golf clubs that discriminate by race or sex, and companies that send U.S. jobs overseas. GOP lawmakers held together and defeated the proposal. Democrats also tried unsuccessfully to replace the GOP tax cuts with breaks for companies that invest in their plants or equipment. It's NOT that the Dems won't vote for tax cuts – just not a BS bill like this one…

Democrats said the House GOP bill would do virtually nothing to spark the economy, citing an analysis by the Joint Committee on Taxation that said the bill's economic impact would be "so small as to be incalculable." They also complained that it was not paid for, meaning its $46 billion, one-year cost would make enormous budget deficits even bigger. "They have run up deficits in this country recklessly, and in the name of a political campaign they're prepared to do it again," said Rep. Richard Neal, D-Mass.

Amazingly, having the Republicans vote to boost our deficit by $1Tn over the next 10 years seems to be a market-booster as the top 1% are licking their chops over the power they have to ram through legislation as well as the latest polls which show Bankster Romney with surprisingly strong numbers now that the Republicans are beginning to line up behind him. More tax breaks for the rich, more bailouts for the Banks, more military spending, less pollution controls, less Social Security, less Medicare, no Health Care, no Financial Reform – it's gonna be a Bankster's Paradise!

Of course, as top 1%'ers (or those aspiring to be) it's our job to invest in fiddles while Rome is burning and later we can sell lifeboat seats to those who can afford them when our ship of state finally takes on too much debt to stay afloat. I mentioned some of our recent long acquisitions in yesterday's pre-market post and, during Member Chat, we took advantage of the morning pop to get back into PCLN puts at $732 as well as that CMG spread from the morning post that's looking very good today.

We also added a long trade idea for FTR ($4.12) as well as CHK again ($18) FAS ($99.50) and TNA ($99) with the last 3 all at 1:15 as we called the turn a little early in Member Chat. Those should all be up nicely this morning and now it's 8:55 and oil is, in fact, testing $104, which is great for a re-load on our short positions if it holds up into the bell. The Dollar is at 79.40, keeping the Futures up 0.5% but the Euro is testing $1.32 and if you really think people would rather hold Euros than Dollars into the weekend – then you too have an exciting futures as one of the suckers we'll be selling premium to!

Have a great weekend,

- Phil