Recession in Europe – again?

Recession in Europe – again?

The eurozone economy has suffered a weak start to the year, with high coronavirus infection rates and government restrictions increasing the risk of a second recession since the pandemic first struck last year. Fresh Covid-19 outbreaks that authorities have struggled to contain are continuing to weigh on economic activity and have damped expectations for a strong global recovery in the first half, a reality that US Investors, so far, have refused to face.

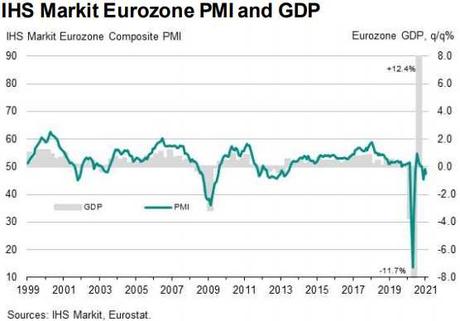

In the early months of the year, a number of large economies face the threat of declining output as restaurants, cinemas and a wider range of businesses that involve close physical proximity are closed or have had their activities severely curtailed. Data firm IHS Markit said its Composite Purchasing Managers Index, which measures activity in the manufacturing and services sectors, for the eurozone fell to 47.5 in January from 49.1 in December. A reading below 50 points to a decline in activity.

A similar survey for Japan pointed to a bigger contraction in the services sector, while figures for the U.S. to be released later Friday are expected to point to a slowdown in the services recovery.

We are still in the middle of a Global Catastrophe and it is NOT fixed. We haven't even seen the real repurcussions of the damage it's caused because we are filling all our economic holes with endless supplies of money and we're acting as if that has no long-term consequences. Now that Joe Biden is President, the GOP is worried about the debt again and is seeking to block his $1.9Tn spending program. Then where would we be?

…

You must login to see all of Phil's posts. To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.

To signup for a free trial membership, click here.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!