Are we finally getting a little bit of reality this morning or will this dip too (down 0.3% in the Futures) be bought with abandon. Europe is down about 1% and we just got a revenue miss by JPM but earnings beat by .21 (15%) on the top line yet it's still not enough, so far, to justify that $50 line – as I had warned our Members on Monday. We're still waiting for WFC to give us more color but we've been playing XLF to top out at $18.50 and we were sweating bulllets yesterday but stuck to our guns into these reports.

As you can see from Dave Fry's XLF chart, we are in a serious uptrending channel that could go to $19 but I really think we need a little correction first and you can see the volume trailing off at these levels – we're really primed here for a volume sell-off if any of our early reporting banks trip up.

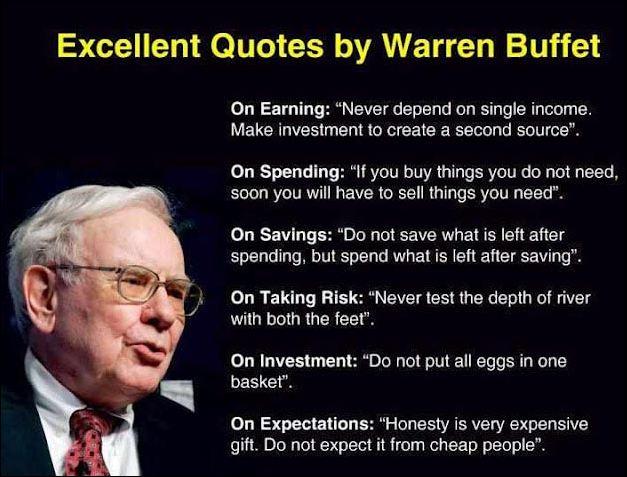

Actually, forget the banks, the XLF is all about BRK.A now, with Warren Buffett's conglomerate now making up 8.5% of the index at $159,935 a share. That's right – for most Americans, that is like trading houses but there are 1.65M of those shares outstanding for a $263Bn market cap with an average daily volume of 51,000 shares. That's 51,000 transactions at $159,000 a piece – now don't you feel silly trying to save an extra nickel when you bid on your little stocks?

There are people who have money and people who are rich. - Coco Chanel

The B shares of Berkshire are a more accessible $106.73 per share and we bought in last at $85 so we're thrilled and, in fact, our problem yesterday is we had only targeted $100 so they are well over our goal and we may have to roll our short calls but we're waiting until earnings because, of course, this is getting silly with a p/e of Berkshire of 18, which is 13% higher than the S&Ps p/e of 15 and what is Berkshire really but a proxy for the S&P?

The B shares of Berkshire are a more accessible $106.73 per share and we bought in last at $85 so we're thrilled and, in fact, our problem yesterday is we had only targeted $100 so they are well over our goal and we may have to roll our short calls but we're waiting until earnings because, of course, this is getting silly with a p/e of Berkshire of 18, which is 13% higher than the S&Ps p/e of 15 and what is Berkshire really but a proxy for the S&P?

Yes, they should be given a premium because Buffett is a better picker of stocks than Standard and Poors' but, historically, he's not 13% better so either the S&P should be 13% higher (1,800) or Berskhire should be 13%…

This article will become free after 48 hours (see below for free content). To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.