We haven't had a good V bounce-pattern in a while – one where the entire drop is entirely reversed on the other side – as if it were some mistake that's correcting itself as quickly as possible. According to ThePatternSite:

"Price at the bottom of the V will form a one-day reversal, island reversal, or tail, usually on heavy volume, perhaps gapping upward. Price trends up, usually at the mirror angle of the downtrend. If price dropped by 30 degrees, price will rise following a similar angle. The price trend tends to be a straight-line run with few or no pauses, often fitting inside a channel."

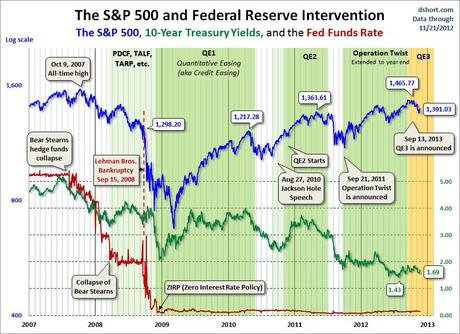

Of course, we don't have a V yet, we just have a bounce off a hard floor that we expected – it's the next 7 days that will be critical but so far, so good on our bottom call. The NYSE is already over our strong bounce line (8,100) and we wait for the rest of the indexes to confirm a recovery at Dow 12,950, S&P 1,400, Nasdaq 3,000 and Russell 805 with less than a 1% move between our indices and their goals – other than the Nasdaq, which needs 2.5% and has been dragging along.

IN PROGRESS

This article will become free after 48 hours (see below for free content). To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.