China gave the markets a big boost this morning by announcing an immediate $25Bn program for railway construction and another $50Bn a year for "more stuff." That sent the Nikkei flying to 15,150 but then Chinese Non-Manufacturing PMI fell to 54.5 for March and the Nikkei gave back 75 points while the Hang Seng closed just 0.2% over flat and the Shanghai fell 0.75%, back to 2,043, just 5% over the lows they've been testing all year at that critical 2,000 line.

Now to some extent we could say "what's the differrence where the money comes from, as long as they keep giving it to us?" and that would be the correct attitude, if we were 8 years-old and had no concept of consequences! As adults, we should wonder – WTF are all these Governments so afraid of that they can't even allow a small correction before jumping back in with "emergency measures"?

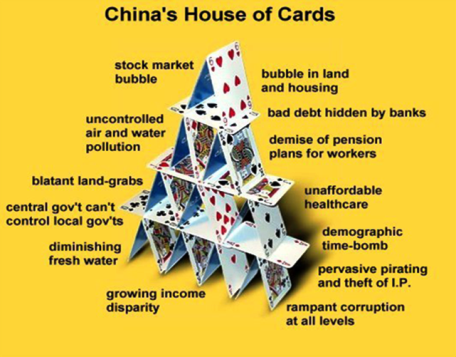

The simple answer is that IT'S A GIGANTIC CON, like the time they built a fake town in Blazing Saddles - it looked good, as long as you didn't look behind the facades. If you actually tried to touch it, it would fall over like a house of cards. That's what happens when you prop up an economy with stimulus – you haven't built a foundation – it's all a facade, so the Central Banks that built it are terrified to see it tested….

The simple answer is that IT'S A GIGANTIC CON, like the time they built a fake town in Blazing Saddles - it looked good, as long as you didn't look behind the facades. If you actually tried to touch it, it would fall over like a house of cards. That's what happens when you prop up an economy with stimulus – you haven't built a foundation – it's all a facade, so the Central Banks that built it are terrified to see it tested….

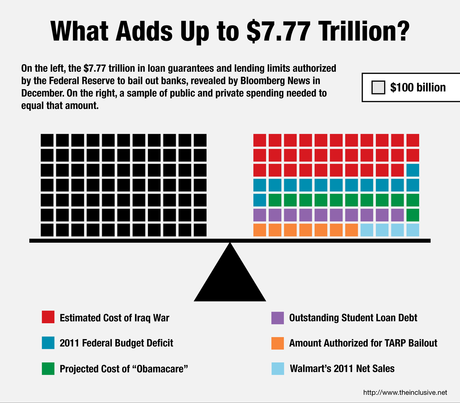

The con depends very much on people BELIEVING that the house of cards is a real house. Without a constant inflow of investment Dollars, the slightest breeze can knock the whole thing over and we'd be right back to the wreck we had before. And, of course, it's not just China that's built a house of cards. The US, Europe, Japan – pretty much all the Central Banksters are participating because, rather than let the banks fail in 2009, they preteneded everything was OK and went about trying to back-fill the $15Tn Global hole in their balance sheets by printing money and, not so subtly, handing it out to them.

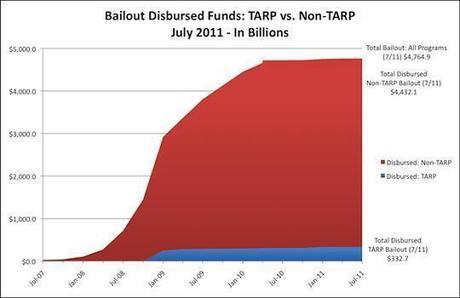

That's over $5Tn in debt (now, this chart was 3 years ago!) that we, the people, have taken on to bail out the Banksters. None of it stimulates the economy, they already lost that money. Of course you could argue that the money they lost was OUR savings deposits, which they were entrusted with and which they gambled away so, if we had let the banks go under – then we would have lost our deposits as well. That would not have been good. Still, the new debt is ours, not thiers and here they are – back to all of their old tricks again.

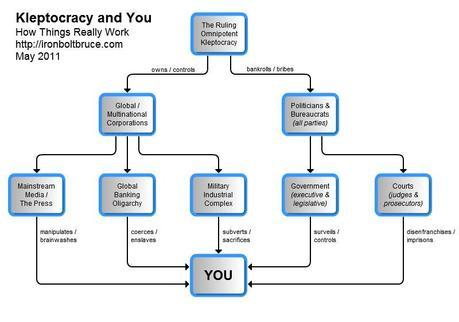

Face it, we are living in a Corporate Kleptocracy – a government of the Corporations, by the Corporations, for the Corporations and, not only are they now considered people by the Supreme Court, but they are people who can donate unlimited amounts of money to the cadidates (and judges) of their choice, people who live forever and pay no inheritance tax (nor do they pay taxes when they distribute unlimited money to their corporate children). They are "people" who can commit crimes but can never be put in jail and who can be shielded from all liablity by declaring bankruptcy, even if the exact same corporation is doing business the next day!

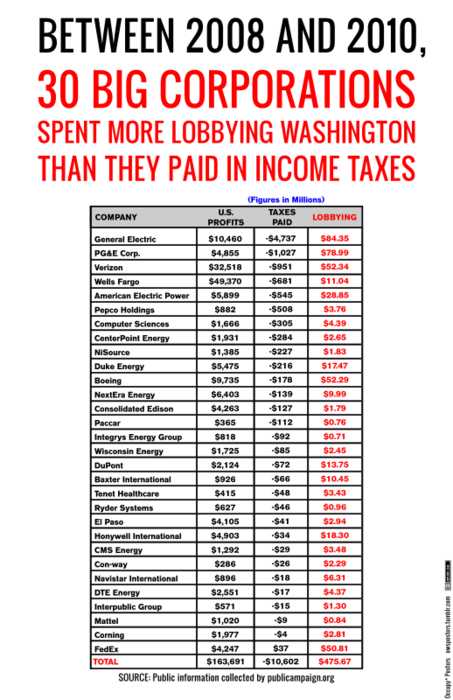

What entitles them to this special treatment? Well, they are so embedded in Government that they actively write the laws. We've discussed the evils of ALEC and the Kochs before but here's a chart that shows how just 30 of our Corporate Citizens spent $475M in a single mid-term election cycle and, aside from the sweetheart deals and contracts they got and the favorable rulings and legislation they paid for – they also got a tax CREDIT of $10.6Bn – that's a 2,230% return on their investment!

What entitles them to this special treatment? Well, they are so embedded in Government that they actively write the laws. We've discussed the evils of ALEC and the Kochs before but here's a chart that shows how just 30 of our Corporate Citizens spent $475M in a single mid-term election cycle and, aside from the sweetheart deals and contracts they got and the favorable rulings and legislation they paid for – they also got a tax CREDIT of $10.6Bn – that's a 2,230% return on their investment!

As an experiment, give a lobbyist 0.3% of your salary and see if they can not only remove your entire tax burden, but get the Government to give you a credit as well. If so, then the system is fair and we should all vote Republican.

$163Bn in profits and our Governement GAVE THEM another $10.6Bn! That's just 30 of the Fortune 500. Clearly none of these companies want anyone looking behind the facade, do they? Not only do they lobby but they donate to all the candidates that support their position and, most insidious of all, they offer high-paying jobs to the people who are supposed to be regulating them and blackball (as a group) any regulator who actually does his job.

Do you still think this is a Democracy? Our votes are no less a joke than the countries we laugh at where the party in charge wins by 98%. The great trick in America is that we have two parties, both bought and paid for by the top 1% so, no matter which party is in charge, they still win. One party may have slightly different moral standards than the other but, when it comes to perpetuating the Kleptocracy, both are equal partners.

OK, rant over (I can go on all day) – now, what does this have to do with the markets? Well, my point is that you need to consider who's really running things in order to understand the motives behind the actions.

OK, rant over (I can go on all day) – now, what does this have to do with the markets? Well, my point is that you need to consider who's really running things in order to understand the motives behind the actions.

China is no different than us except their power-brokers are a mix of politicians and businessmen – the way ours were about 40 years ago. Now, in the US, the politicians are nothing but puppets – China will get there in due course.

Check out Dave Fry's SPY chart from yesterday. We thought Tuesday's 96M volume was low, yesterday was just 77M. As I often point out to our Members, less volume going up than going down is not a good sign – it's an indication that the CROOKS who run the markets are manipulating the indexes higher to reel in the suckers so the crooks can dump their shares at higher prices. Then, once they are out, they pull the rug out and drop the market, so that they can buy the shares back again at lower prices.

For example, the S&P toped out at 1,881 on March 5th and flatlined through the 10th and the volumes on SPY were (in millions): 88, 82, 114 and 74. March 11th through the 14th, the S&P fell to 1,840 (2.25%) and the volumes were 99, 104, 155 and 153 – over 50% MORE VOLUME than on the way up.

For example, the S&P toped out at 1,881 on March 5th and flatlined through the 10th and the volumes on SPY were (in millions): 88, 82, 114 and 74. March 11th through the 14th, the S&P fell to 1,840 (2.25%) and the volumes were 99, 104, 155 and 153 – over 50% MORE VOLUME than on the way up.

March 17th (98) and 18th (101) were up days but most of those gains were erased on the 19th (176) and then it was choppy up and down until last Thursday (27th), when we bottomed back out at 1,843 on 142M shares traded on SPY and then we had 4 sensational up days on declining volume of 101, 99, 88 and 78 – hardly the enthusiasm you'd expect in a market breaking out to new highs.

I know you don't WANT to believe the markets are manipulated to this extent. If they are, then there must be something wrong with your Government as well and, therefore, your entire country, right? No one wants to believe that – especially when we have been conditioned, since birth, to believe that this is the greatest country in the World.

If not though, then what are the Central Banksters so afriad of that they can't even allow a normal correction in the market? Why did the Fed funnel $350Bn of reverse repo cash into the markets in just two days (Monday and Tuesday) this week and why is Mario Draghi, RIGHT NOW (8:50am) talkign about taking "extreme measures" to fix the economy?

The markets are at all-time highs while the Central Banks are taking "extreme measures" to rescue the economy? To some extent, this illustrates our complete faith in the Central Banksters and their ability to steer us towards prosperity. After all, when have they ever failed us?

The markets are at all-time highs while the Central Banks are taking "extreme measures" to rescue the economy? To some extent, this illustrates our complete faith in the Central Banksters and their ability to steer us towards prosperity. After all, when have they ever failed us?

We are ignoring all sorts of bad data and bad political situations and, frankly, I'm tired of talking about them and we are technically bullish in our portfolios because, technically, we're still above the lines that would make us flip bearish.

BUT, even as we were adding new bullish positions to our Income Portfolio in yesterday's Member Chat, my heart still wasn't in it – because it sure does look like a facade to me. Maybe I'm wrong – maybe there is a foundation here that we can build on and take the markets on to ever higher record highs on ever-increasing oceans of Corporate profits but, coming into earnings – I feel much better holding onto my cash until I see it in black and white.

Is that too much to ask?