I love it when a plan comes together. After many, many false starts and even falser head-fakes, we finally got the dip we've been playing for. No big deal so far, just a bit below our 2.5% lines and we'll see if they can be taken back this morning at:

- Dow - 15,250

- S&P – 1,667

- Nasdaq – 3,607

- NYSE – 9,450

- Russell – 1,033

As I noted in Member Chat this morning, the NYSE is keeping us from getting much more bearsih as it finished 39 points (1.1%) over the line and it's right on our -5% support so we're keeping the faith that this is just a minor pullback and not the start of a major correction, though we won't know for sure until next week as today is options expiration day and you can't trust anything that happens today.

We've been having fun with our oil trades and, this morning, we're back at $107.50, which is our new favorite shorting line (was $106.50 but we backed off this week) and we had a detailed discussion about Futures Trading Strategies in our Member Chat this morning – very good reading, along with our usual news rundown and market overview. Thanks to some very cheap (and even negative) rolling costs this week, the NYMEX crooks have already shifted most of their FAKE September orders to FAKE October orders:

Click for

Chart

Current Session

Prior Day

Opt's

Open High Low Last Time Set Chg Vol Set Op Int

Sep'13

107.18

107.57

107.03

107.43

07:04

Aug 16

-

Oct'13

107.01

107.37

106.80

107.19

07:04

Aug 16

-

-

Nov'13

105.98

106.25

105.73

106.06

07:04

Aug 16

-

Dec'13

104.57

104.86

104.29

104.66

07:04

Aug 16

-

Now there are 321,000,000 barrels "demanded" for October delivery but, if we take the WayBack Machine (copyright Mr. Peabody) to July 22nd, we had 387,000 open contracts for Sept, 131,000 in Oct, 83,000 in Nov and 204,000 in December for a total of 805,000,000 barrels worth of completely FAKE demand for oil (which forces you to pay REAL high prices) and now we have, drumroll please – 811,000,000 barrels of completely FAKE demand for oil. They just shuffle it around every month!

Back on July 22nd, the September contract was $107.87 and, over the course of the month, it traded down to $102.67, then back to $108.82, then back to $102.22 and now back to $107.50 – so it doesn't take a rocket scientist to see this is a good spot to short them. Not September, of course, that contract expires Tuesday – we've already moved on to the October contract (/CLV3), other than day trades, as we'd hate to get stuck actually having to deliver (because we're shorting) millions of barrels of oil to Cushing, OK next month.

Back on July 22nd, the September contract was $107.87 and, over the course of the month, it traded down to $102.67, then back to $108.82, then back to $102.22 and now back to $107.50 – so it doesn't take a rocket scientist to see this is a good spot to short them. Not September, of course, that contract expires Tuesday – we've already moved on to the October contract (/CLV3), other than day trades, as we'd hate to get stuck actually having to deliver (because we're shorting) millions of barrels of oil to Cushing, OK next month.

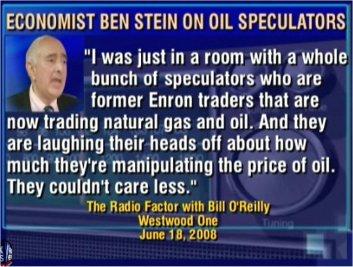

I don't know how I can make this more obvious – it's a complete and utter scam. The people trading oil contracts at the NYMEX have ABSOLUTELY NO INTEREST IN EVER BUYING ANY ACTUAL OIL – it is a complete and utter scam, run for the sole purpose of creating a false demand for the 2nd most plentiful liquid on the planet so they can gouge consumers and milk the American people (the World's 2nd largest producer of oil) out of hundreds of Billions of Dollars a year.

You can write your Congressman to complain. Just tell them to give me a call, I'll be happy to walk them through this charade – and I'll even teach them how to make money betting on it! Or we can put a stop to it. Of course, the oil markets aren't the only scam in the World. Back in June, I had a falling out with Seeking Alpha, in part over their questionable policy of promoting small cap stock over regular ones. This makes it possible (giving SA the benefit of the doubt that they don't do this intentionally for the kickback money) for some of their 7,000 authors to mislead readers with factless attacks or pumps of small companies with the sole aim of manipulating the stock price for their shadowy backers.

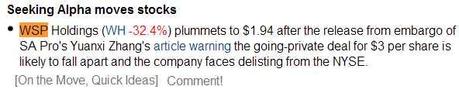

I felt this was a tremendous disservice to the readers, SA disagreed with me and revoked all my site privileges – I couldn't even comment and say goodbye to people who follow me there – I can't even reply to their Emails – I can't even comment on my own posts. What I can do, however, is help people to make money against these scam artists, as I did on Aug 8th, when we caught this bit of "news" featured in SA and read the article by Yuanxi Xang (and you MUST check out his "profile") and, despite the fact that it was speculative drivel – since the article was carried right on Yahoo Finance and other outlets as if it were legitimate, WH fell from $2.75 all the way down to $1.62 that day. At 1:50 pm, in our Member Chat, I said to Members:

I felt this was a tremendous disservice to the readers, SA disagreed with me and revoked all my site privileges – I couldn't even comment and say goodbye to people who follow me there – I can't even reply to their Emails – I can't even comment on my own posts. What I can do, however, is help people to make money against these scam artists, as I did on Aug 8th, when we caught this bit of "news" featured in SA and read the article by Yuanxi Xang (and you MUST check out his "profile") and, despite the fact that it was speculative drivel – since the article was carried right on Yahoo Finance and other outlets as if it were legitimate, WH fell from $2.75 all the way down to $1.62 that day. At 1:50 pm, in our Member Chat, I said to Members:

Let's add 1,000 shares of WH at $1.80 to the STP with a plan on doubling down and tossing it into the LTP if they fall below $1.20 on bad news. If no bad news, $1.50 is where they were trading pre-merger so, if they merger does fail – they'll probably end up there again over time.

Yesterday, WH bounced back to $2.50 and we cashed out with a $700 gain, up 38% in 7 days. All we did here is the same thing we do with oil – we accept the fact that the market is full of scam artists (cough, Icahn, cough, cough) who manipulate stocks through the media and physically (NYMEX), if they can. By being aware of what's going on behind the curtain, we can make some pretty spectacular profits and, sadly, these opportunities come up with great regularity.

Yesterday, WH bounced back to $2.50 and we cashed out with a $700 gain, up 38% in 7 days. All we did here is the same thing we do with oil – we accept the fact that the market is full of scam artists (cough, Icahn, cough, cough) who manipulate stocks through the media and physically (NYMEX), if they can. By being aware of what's going on behind the curtain, we can make some pretty spectacular profits and, sadly, these opportunities come up with great regularity.

IN PROGRESS