Here come those tears again

Just when I was getting over you

Just when I was going to make it through

Another night without missing youBaby here we stand again

Like we've been so many times before

S&P 2,120! Again…

It must be the 3rd week of the month because that's the week the S&P gets to 2,120. It's happened every month since February and the reason it happens is because it gives fund managers the chance to sell call options to suckers who bet the market will break out and go higher while they continue to lighten up on their holdings. For instance, the S&P ETF (SPY) is at $212 this morning and the July $212 calls can be sold for $2.75. Sell those calls to suckers 5 months in a row and you boost your returns by 5% even though the index itself goes nowhere!

The same goes for when the index is low in it's very tight channel. For instance, on Monday, when the S&P fell back to test 2,070 at the open, I said to our Members:

Let's lock in some gains by selling 100 SDS June $20.50 calls at 0.42 ($4,200) in the STP. We have the July $20 calls (and other long-term hedges) and we can always roll the short $20.50s to the July $22s (0.33).

I meant gains because we had gone into last weekend short so the move down in the morning was a win in our Short-Term Portfolio. We've already taken 1/2 off the table at 0.21 (up 50%) and today the rest will expire worthless for a 100% gain and net $3,150 gain for the week. We then use that money to press our longer SDS bet, so we'll be even more bearish going into this weekend than we were last weekend. This helps lock in the bullish gains in our Long-Term Portfolio without pulling money out of our own pockets.

As I mentioned yesterday, our bullish bet on the Gold ETF (GLD) will expire in the money today for the full 100% gain. We also mentioned yesterday, a bear play on China using the Ultra-Short ETF (CHAU) at $50.50 and this morning already the straight bet would be up 10% at $45 and our bear put spread was buying the Nov $65 puts, which filled at $21.17 and selling the Nov $53 puts, which filled at $12.19 for net $8.98 on the $12 spread that is now well in the money. We were also looking to mitigate the cost ($8,980) of 10 short spreads by selling 5 of the July $45 puts for $2.80 or better – I think we'll do much better this morning!

As I mentioned yesterday, our bullish bet on the Gold ETF (GLD) will expire in the money today for the full 100% gain. We also mentioned yesterday, a bear play on China using the Ultra-Short ETF (CHAU) at $50.50 and this morning already the straight bet would be up 10% at $45 and our bear put spread was buying the Nov $65 puts, which filled at $21.17 and selling the Nov $53 puts, which filled at $12.19 for net $8.98 on the $12 spread that is now well in the money. We were also looking to mitigate the cost ($8,980) of 10 short spreads by selling 5 of the July $45 puts for $2.80 or better – I think we'll do much better this morning!

Greece is still being fixed and that's driving all at the moment. They are all heading into a meeting and hopes are high that something will be accomplished (other than saying they will meet again Monday). Having dealt with M&A in the past, I can imagine the kind of arguing this is going on, page by page, on 100-page agreements…

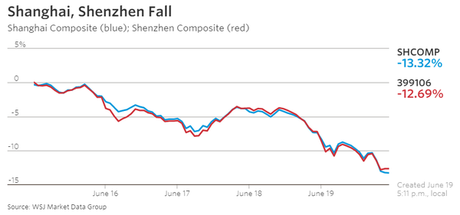

Meanwhile, don't tell anyone but the Shanghai fell another 6.4% this morning. Hong Kong followed it down into the close but ended flat and India and Japan ignored them for 1% gains so "mixed" is what we'll call Asia but just listen to the MSM ignore Shanghai yet again this morning! Don't forget, limit down is 10% so the whole market going down 6.4% means about half the stocks were halted at their 10% max loss for the day (if the other half were down 0, the avg loss would be only 5%, so statistically…)!

Meanwhile, don't tell anyone but the Shanghai fell another 6.4% this morning. Hong Kong followed it down into the close but ended flat and India and Japan ignored them for 1% gains so "mixed" is what we'll call Asia but just listen to the MSM ignore Shanghai yet again this morning! Don't forget, limit down is 10% so the whole market going down 6.4% means about half the stocks were halted at their 10% max loss for the day (if the other half were down 0, the avg loss would be only 5%, so statistically…)!

This puts China's mainland market officially in correction territory yet investors are distracted by (and bored by) Greece and have no time to look further East for another crisis they don't want to think about and then there's Japan… Have I mentioned how much I like CASH!!! lately?

Europe is up about 1%, pre-market, but generally following our lead from yesterday more so than any concrete progress from Greece. On the bright side for the EU, Russia just told Greece they can't help them (no one can) so Greece may feel the need to compromise today OR we'll see that they are actually planning to leave the EU or, more likely, leave the Euro while negotiating to stay in the EU, which is their most sensible option.

Think about Greece's current positions re. new loans: "Give us money we can never pay back so we can make the interest payments on the $360Bn that's ahead of your new loan." That's a tough sell – of course the only people you can borrow from are the people you already owe money to and those people have to find a way to justify putting more and more money into a black hole so they seek "promises" that Greece will mend their ways and magically cut spending (which has already been cut to the bone) and improve their economy (which has been destroyed by spending cuts) so they can balance their budget which, at the moment, solely exists to pay back creditors.

Why should Greece keep doing this? They EU (lenders) HAVE to do this, no banker wants to write off a loan. They will meet and meet and meet and meet in the hopes that they can gain further concessions that they can take back to their investors (in this case EU voters) to show they are doing their jobs. What they are saying now to Greece is "sign over your ports, give us your national utilities (so we can bill your people directly and threaten to cut their vital services if they don't pay) and give us a few islands and we'll forgive some of your debt." Greece is looking at this and this non-corrupt Government is thinking "this deal would suck for the people who elected us" so they are called "difficult" but the lender-controlled MSM.

Why should Greece keep doing this? They EU (lenders) HAVE to do this, no banker wants to write off a loan. They will meet and meet and meet and meet in the hopes that they can gain further concessions that they can take back to their investors (in this case EU voters) to show they are doing their jobs. What they are saying now to Greece is "sign over your ports, give us your national utilities (so we can bill your people directly and threaten to cut their vital services if they don't pay) and give us a few islands and we'll forgive some of your debt." Greece is looking at this and this non-corrupt Government is thinking "this deal would suck for the people who elected us" so they are called "difficult" but the lender-controlled MSM.

Athens is likely to leave the eurozone and the EU if it fails to reach an agreement to unlock a €7.2 billion bailout installment, said a statement from the Bank of Greece. Greek PM: “It (IMF) has been here (Greece) for five years and bears criminal responsibility for the situation in our country today.”

It's going to be a crazy day.

Happy Father's Day,

- Phil

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!