This is much more exciting than Christmas. So exciting that President Obama and Congress have cut short their winter vacations to give us hope – right before they snatch it away again. Will it be a bad plan or no plan? I can hardly wait to find out…

We have a bit of data today with the usual Jobless Claims, Bloomberg's Consumer (dis)Comfort Index, New Home Sales, Consumer (lack of) Confidence, Oil Inventories and even a look at the Fed's Balance Sheet and the Money Supply after the markets close. Tomorrow we get the Chicago PMI and Pending Home Sales but none of it matters compared to whatever rumor comes out of Washington over the next 48 hours.

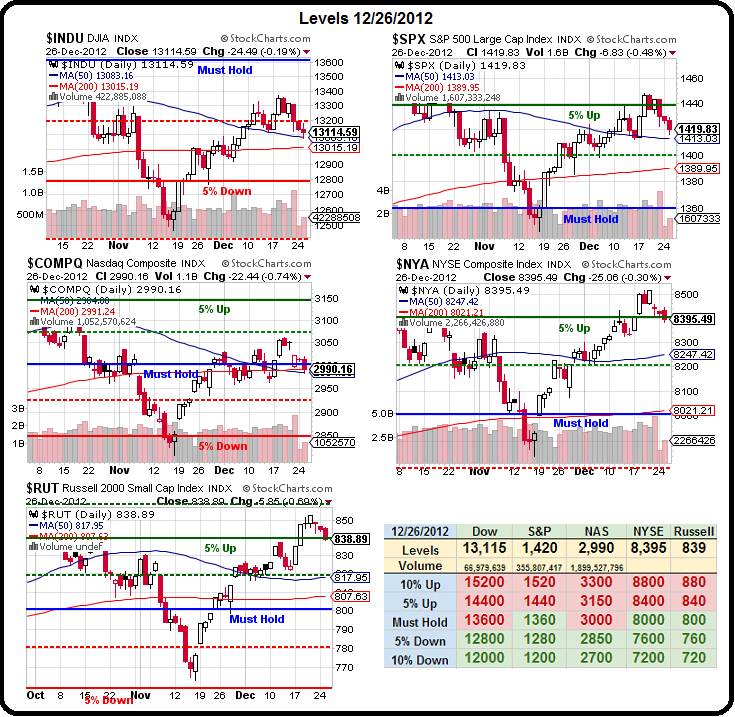

Meanwhile, we're focused on our technical levels and, as you can see from the Big Chart, we are right on the 50 dma of the Dow (13,083) and the Nasdaq (2,991) and not too far on the S&P (1,413) with the NYSE (8,400) and the Russell (840) testing (and failing, so far), their 5% lines.

Meanwhile, we're focused on our technical levels and, as you can see from the Big Chart, we are right on the 50 dma of the Dow (13,083) and the Nasdaq (2,991) and not too far on the S&P (1,413) with the NYSE (8,400) and the Russell (840) testing (and failing, so far), their 5% lines.

See my additional comments to Members in this morning's chat but, suffice to say, we need to watch these levels very carefully as well as the Dollar – which is right on the 79.50 line as the Euro attempts to get back over $1.33 and the Pound goes for $1.62 while the Yen remains extremely weak (and supportive of the Dollar) at 85.76 to the Dollar. As I said to Members:

Obama and Congress are back today. I don't expect an announcement this afternoon but, possibly, this evening or tomorrow if they are serious about not looking like they let the economy die. We also hit the mystical debt ceiling on Monday so much silliness over the next couple of days but, if there is a rumor of a solution – the markets could jump very sharply so be careful.

We also have an adjusted TZA spread that I suggested yesterday afternoon – just in case those levels don't hold up but we also found positive (but well-hedged) plays on SPWR, FTE and GDX yesterday and our HLF play from last week really kicked into gear as the stock has already jumped back from $25 to $27.50. That trade idea was from last Friday and made for a nice Christmas present as I said in Member Chat:…

We also have an adjusted TZA spread that I suggested yesterday afternoon – just in case those levels don't hold up but we also found positive (but well-hedged) plays on SPWR, FTE and GDX yesterday and our HLF play from last week really kicked into gear as the stock has already jumped back from $25 to $27.50. That trade idea was from last Friday and made for a nice Christmas present as I said in Member Chat:…

This article will become free after 48 hours (see below for free content). To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.