Happy New Year!

Happy New Year!

We've already posted our Trade of the Year for AAPL, rolling it out live on Money Talk back on the 19th and, before that, it was our Top Trade Idea for Dec 17th, along with our runner-up trade on BHI, which we also added to our Long-Term Portfolio (which we reviewed on Wednesday). On the 18th, Top Trades featured DBA, which became one of our "Secret Santa's Inflation Hedges" on the 21st. That should have you all caught up – in case you are just getting back from vacation.

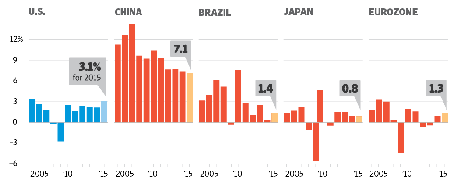

The big story of 2015 is going to be whether or not a strong US economy will be able to ignite what is an otherwise lackluster (almost recessionary) Global GDP. Just this morning we got TERRIBLE news on Euro-Zone Manufacturing PMI (50.6), which is barely over the 50 line that marks declines while CHINA only cleared the bar bay 0.1 on Saturday.

"Euro zone factory activity more or less stagnated again in December," says Markit. "The weakness of factory output, combined with the subdued service sector growth signaled by the flash PMI, suggests the eurozone economy grew by just 0.1% percent in the fourth quarter." That's 1/4 of the World's economy flatlining along with Japan and the BRICs (another 1/4) – not a good start:

Only China and the US are actually growing and China's growth is slowing and the US changed the way they measure their GDP and much of our "exciting" growth in GDP has been related not to actual growth, but to the new way we calculate the same old growth. Even our made-up numbers aren't that thrilling, with 3.1% expected for 2015 and that's WITH the Fed pumping in another $800Bn.

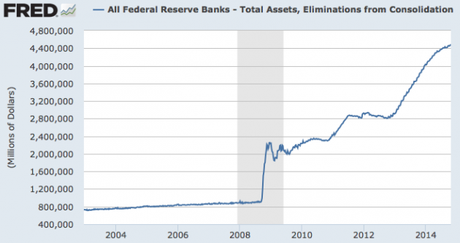

What? You thought the Fed stopped QE? Silly investor – the Fed didn't STOP QE, they just stopped increasing the amount of QE. They are STILL rolling over $800Bn worth of TBills as they mature each year and, in fact, as our need to borrow has been decreasing (thanks to that Socialist, Health-Care Providing, Job Creating, Anti-Business with the World's best-performing Economy Obama!), which makes the Fed and even BIGGER buyer of notes (by percentage) than they were in the past.

What? You thought the Fed stopped QE? Silly investor – the Fed didn't STOP QE, they just stopped increasing the amount of QE. They are STILL rolling over $800Bn worth of TBills as they mature each year and, in fact, as our need to borrow has been decreasing (thanks to that Socialist, Health-Care Providing, Job Creating, Anti-Business with the World's best-performing Economy Obama!), which makes the Fed and even BIGGER buyer of notes (by percentage) than they were in the past.

When the Fed REALLY stops QE and begins to sell back those $4Tn+ worth of notes they are holding, they will flood the market with debt paper and that means that rates will HAVE TO RISE in order to attract buyers – essentially exactly the opposite of the affect they had when they bought up the paper and created a scarcity that drove the rates lower (as was their intention).

To some extent, it may be possible for the Fed to let the notes die a natural death, and that may be possible if the US continues to DECREASE the amount of money it borrows.

To some extent, it may be possible for the Fed to let the notes die a natural death, and that may be possible if the US continues to DECREASE the amount of money it borrows.

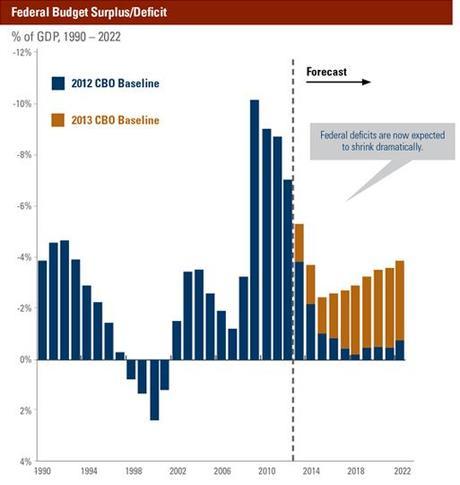

As you can see from the chart on the right, that evil, commie President Obama has dramatically decreased our deficit to the point where, like Clinton, he will almost be handing the next President a surplus. Of course, we know what happens when we project a surplus, don't we?

TAX CUTS FOR THE TOP 1%!!!

Remember the Bush logic of the 1999 election? That surplus was OUR money, why should we let our Government have it? Of course Al Gore argued that we had debts that needed to be paid off as well as long-term liablities that were unfunded and blah, blah, blah – who was really listening anyway? George Bush said we could have a party and we sure did, didn't we?

As we noted on Monday, the Global stimulus train is still going strong with China dropping another $800Bn last weekend and today it's Draghi's turn as Europe's top Central Bankster sent their currency to new decade lows this morning (below $1.20 per Euro) as he hinted about more QE from the ECB in 2015. That sent the Dollar flying to 91.2 – up 15% since July!

That drove oil back down to $52.03 and we just went long again on the Futures (/CL) in our Live Member Chat Room, where we'll be following it today. We expect the Dollar to pull back a bit (as Draghi says this crap all the time) and oil to bounce back a bit for a nice, quick trade to start the year.

That drove oil back down to $52.03 and we just went long again on the Futures (/CL) in our Live Member Chat Room, where we'll be following it today. We expect the Dollar to pull back a bit (as Draghi says this crap all the time) and oil to bounce back a bit for a nice, quick trade to start the year.

As you can see from Dave Fry's UUP chart (Dollar ETF), this move from 21.50 to 24 has already been 11.6%, which is 10% expected plus the overshoot, so we'll still be looking for a normal retrace (per our 5% Rule™) back to 23.65 (the 10% line) and then a weak retrace back to 23.25 and a strong retrace back 22.75 and you can see how those lines were contentious on the way up.

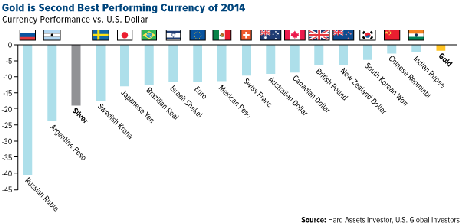

Speaking of currencies, I pointed out to our Members this weekend that GOLD was the 2nd best performing "currency" of 2014. This is why ABX is another one of our "Secret Santa's Inflation Hedges" because it's only in super-strong US Dollars that gold seems weak. To any other country on Earth, gold has been and exceptional hedge against the DEFLATION of their local currencies:

IN PROGRESS

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!