#FinancialIndependence requires setting up multiple income streams to replace your income from your labor.

#FinancialIndependence requires setting up multiple income streams to replace your income from your labor.#Downshifting may mean that you still work but rely on a smaller income from some work and possibly some investments.

Today the focus is on dividend value stock investing to provide a passive income.

Buying shares in a company has several advantages

1. You have access to many companies in many different businesses

2. Companies can grow their earnings and dividends rapidly

3. Companies can be out of favour and cheap to buy

4. Companies are strictly regulated and lots of information is available about them

5. Companies can have a competitive advantage \ high barriers to entry

"One of the biggest mistakes investors makeTo help identify companies that are of interest to invest in I have been spending some time massively improving the stock screening tool to find some cheap #dividend stocks out there. Here is a look at the new screen (The UK all share list as of the 6th April is available towards the end of the post):

is to focus on stock picking for capital gains.

The reality is that if you're not looking at

dividends when you buy a company... you're

likely not going to make much AT ALL.

Did you know that without dividends, stocks

have actually UNDERPERFORMED bonds

for the last 113 years?

This is not hype, a study by the London Business

School found that without dividends, stocks return

a measly 1.9% per year... LESS than Treasuries!"

Gains, Pains and Capital

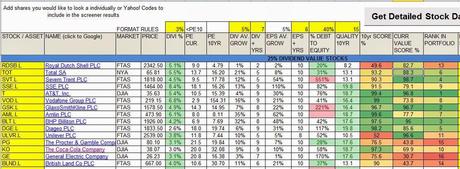

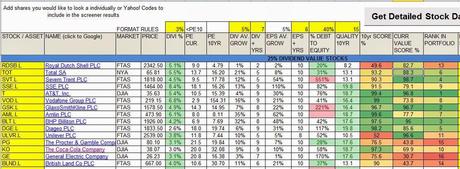

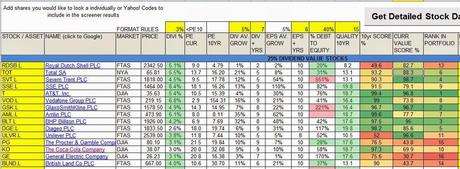

Sample from a stock screener created with 10 years worth of data

It has been made very visual with its colour coded formatting. 10 years worth of financial data is used for graphs and calculations. More of the major indices have been added. It has been made easier to use. Easy to personalise with your own portfolio of stocks. Backed by a large powerful data set and statistical data analysis.- Contains major market data (US, UK, EU)

- Current data can be evaluated on the fly for the Value Screener and Dividend Value Screener by clicking the magic button

- Stocks can be interrogated individually with 10 years worth of data in the graphical evaluation tool

- 10 years of financial performance is used to create the 10yr Value Dividend Screener to check the quality of the stock - has it made a regular growing profit and paid a regular increasing dividend?

- "My Portfolio" can be setup to show the screener results for your stocks

Markets no longer perform true market functions. In markets today, the dead hands of the academic and the rentier have replaced the invisible handWhy Look at History

of the merchant or the entrepreneur.

James Rickards

The Value Stock Screener and Dividend Value Stock Screener allow the user to click a magic button to download the latest data from the web. The tool then allows individual stock evaluation. The screen looks for undervalued stocks based on the methodology of "The Little Book That Beats the Market".

1. Stocks with a very high Return on Capital - are they a well run business?

2. Stocks with high earnings yield (i.e low PE) are they currently cheap

Why a spreadsheet - there are loads of options on the web? So why use this tool instead of one of the numerous screeners out there? Well in my opinion spreadsheets are more personal with the data, you can add your own comments and keep them for reference. Websites have flexibility in the type of graphs and how the data is shown on the screen.

This is great at looking at THE.PReSeNT but this is not the full picture. The stock may be cheap for a very good reason and can get cheaper.

In order to avoid this trap further research is required.

One part of the research is looking at THE.PaST and secondly can we be confident about THE.FuTuRe performance? How good is the stock really? Is the company solid, has solid earnings growth and good dividend cover? This needed to be added.

Introducing 10 Year Dividend Value Screening

Dividend champion investing is not new and numerous lists of stocks that have consistent dividend growth can be found across the web. What is more difficult to attain is weather you are paying too much for a champion share?

We need to gain in capital and dividends overtime. That way buying lowly valued stocks that become expensive can be sold and re-invested to gain MORE income.

The new screener has the ability to analyze 10 years worth of financial data for selected Markets (NASDAQ, NYSE, DJIA FTSE 100, FTSE 250, DAX, EURSTOX50).

Its purpose is to ask the following questions:

- Is the current PE ratio expensive for the share in comparison to its historical PE10 (10 year average PE

PE10 = 10 year average share price / 10 years average EPS - Is the company growing its EPS (Earnings per share) consistently?

What is the average EPS growth rate over 10 years?

How many years has the company made a profit? - Is the company growing its dividend?

What is the average dividend growth rate over 10 years?

How many years has a dividend been paid? - How much debt does the company currently have?

- What overall score is the company on Quality, Income and Value?

The screen can be looked at stand alone via Google spreadsheets however the excel spreadsheet has some distinct advantages

- Enter your portfolio and watch stocks to see what the screen results are. Here is a screen shot with some well known companies:

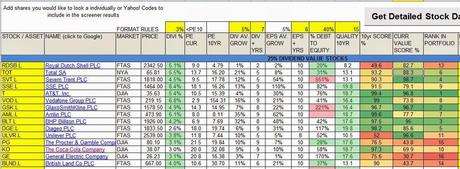

A manually entered portfolio showing 10YR data quality results and current value result

- Query the data by bringing up a graphical interface. Here is a screenshot of Proctor and Gamble:

- Record reasons for investing in the stock in the spreadsheet for future use

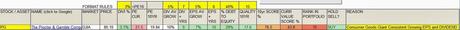

Here is an extended sample of data from a 10Yr data screen for this week

When to Buy

Buying a "safe" dividend growth stock does not mean it is at the right price. It may be growing its earnings and dividends consistently and it is calculated as a value stock in relation to other stocks.

What about in relation to the overall market though. Is the whole market overvalued - See the Schiller PE10 for the market.

When is the best time to actually make the purchase. Now? In a weeks time? Just before or after a dividend payment? On a Tuesday or whatever? Perhaps we can look at the Bollinger Bands for the stock and determine an entry point.

Work In Progress

Unfortunately the tool still requires some work to make it easy to update. It requires a huge data update at least twice a year for the 10Yr Historical data.

In the meantime here is a link to the original screener that looks for dividend value stocks based on current data (which can be updated by yourself with the magic button on the spreadsheet). If you are interested in the 10 year screener please leave a comment below,

A Bit of Perspective and THE.FuTuRe

Markets are cyclical based on bouts of greed and fear. Here we are in early 2014 after 5 years of a bull market! This "bull" run of 5 years usually means it is long in the tooth and time for a correction.

If fear and panic takes hold dividend stocks could correct sharply offering lifetime buying opportunities.

It could be deemed wise that you are not all in (the market) and have alternative investments / cash ready to buy the dip.

The common wisdom is to be diversified in stocks. This in turn indicates investments should be diversified with stocks forming part of the overall mix which may include property, arable land and cash equivalent investments.

Cash / precious metals for instance may not pay a dividend but they have been very good capital preservation tools in the example of a market crash.

Please see this excellent SeekingAlpha article for some perspective on when to buy dividend stocks:

http://seekingalpha.com/article/2115403-rising-risks-for-dividend-growth-investors?ifp=0

Looking to THE.FuTuRE

Dividends have been proven to be an effective way towards financial independence. Will dividend stocks continue to perform in line with history? If so they very attractive. They offer growth, capital appreciation, an inflation hedge and ultimately an inheritance.

References \ Sources of Note:

The Little Book of Value Investing (Little Books. Big Profits) Intelligent Investor: The Definitive Book on Value Investing - A Book of Practical Counsel

The Dividend Monk

The Death of Money: The Coming Collapse of the International Monetary System

BIG FAT DISCLOSURE

This is for entertainment purposes only. Investing is risky - do not invest which you are not willing to loose. Share prices go up and DOWN as do DIVIDENDS. As always do your own due diligence. I am NOT an investment adviser and do not have a background in finance. The information given on this website is given on good faith. Seek professional advice as required for investing. Please refer to the full disclosure clause on the right hand side of this website.

THE.FuTuRe is there to bite us on the butt - so THE.PaST does not necessarily represent THE.FuTuRe - be warned!!!!!

CoNTeNDeR

Welcome New Readers! Please take a look around.Click here to find out more about THE.TriBe and the blog is or perhaps browse the all posts list, Please feel free to play with the planning tools and checklists. You can also follow the blog in the following ways:

Do you like this post if so please spare a few seconds to share it >>