Mr Teddy Bear: "Time to review our family finances and consider where are we going. Let's get the facts and run the cold hard numbers."

Mr Teddy Bear: "Time to review our family finances and consider where are we going. Let's get the facts and run the cold hard numbers."Mummy Bear: "Oh daddy bear you are so cuddly when you talk tough"

Baby Bear: "I want a games station, mobile computer, princess bike and trust fund...Now!"

This post is about a few hypothetical scenarios entered into the NEWLY UPDATED financial time line planner.

The financial time line planner has received a little bit of tender and loving care in the last week. The following has been changed / added:

- Mortgage calculations

- Debt repayments

- Improved graphics

- Financial scenarios

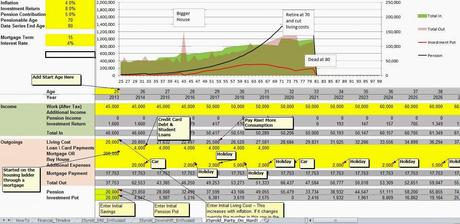

- A fun loving/carpe diem 25-year old on a professional career who loves #selfies

- A 35-year old looking to #downshift as fast a possible

- A clued up 25-year old who is going for #ExtremeEarlyRetirement

Our first example is the one THE.CoNTeNDeR started out in life believing would make him happy... This was soon dashed by the property boom in the UK effectively resigning him to having to rent for teh rest of his life. This caused a huge shift in THE.CoNTeNDeR's financial mindset.

So here is a representation of an ambitious life and fun loving 25 year old looking to climb the corporate ladder. He is going to enjoy the high life and all the consumer goods on offer. The result shows the need for an ever increasing income to pay for the increasingly high life living costs. Although cash flow rich and materially wealthy on the outside he needs to keep the hamster wheel turning to avoid a nasty shock.

CLICK ON PICTURE !

I want to chill out and enjoy everything life has to offer

OK so the first scenario was not working out for THE.CoNTeNDeR and he was getting fed up of the rungs on the corporate ladder disappearing whilst putting in long hours in work. After reading a book on downshifting he started wondering what alternative life he could be leading.

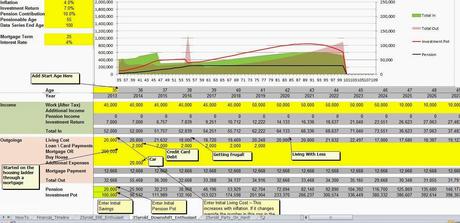

Below is our hypothetical example of a 35-year old wanting to downshift. He has worked hard, saved a bit but still has some credit card debt. He has purchased a house which has a 25 year mortgage to pay off and needs a new car to get to and from work.

He sets a plan in place to reduce his spending as much as possible to save in his late 30's and 40's followed by a reduction in hours in his late 40's:

CLICK ON PICTURE!

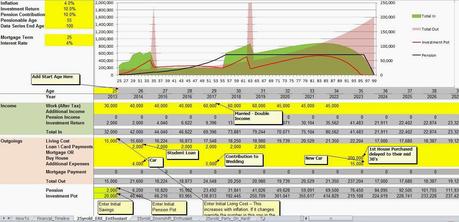

I want to do what I want to doThis is the final scenario. Here is what a 25-year old CoNTeNDeR would have considered to reach #financialindependence as soon as possible (10 years in this example). He delays a house purchase. Learns about investing and has his investments structured in low cost funds that return around 10% per year. He manages to save 10% of his salary into a pension (which is actually quite low considering the tax cost benefits). Is this what a financial independence plan can look like?

CLICK ON PICTURE!

Peace, prosperity and happiness

THE.CONTENDER

Welcome New CONTENDER Readers! Please take a look around.

* This tool is for a bit of fun playing around with a few financial planning numbers so that you can run your own life scenario if you'd like. The calculations can be carried out in different ways. Different taxation needs to be taken into consideration in different countries. No one knows THE.FuTuRe, especially investment returns and inflation numbers. Just a bit of fun!

Here you can find out about THE.CONTENDER and the purpose of the blog is or perhaps browse the all posts list, have a look at the pictures on the notice board. Please feel free to play with the planning tools and checklists.

Keep in Touch: RSS Feed, follow THE.CONTENDER on Twitter or Facebook or subscribe to posts by email: