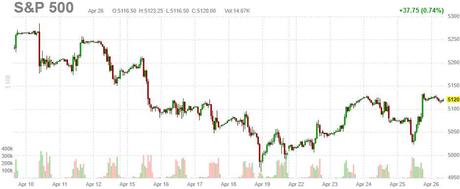

For no particular reason, the markets reversed after lunch and we finished the day not-so-bad but that quickly turned to GOOD after hours as the S&P jumped 40 points - back to just under 5,100 (5,120 on the /ES futures) as both MSFT and GOOG/L knocked it out of the park with earnings.

On the whole, the S&P 500 is still up 5.8% for the year, though still off the highs and the Nasdaq is up 3.8%, the Dow is up 1.1% and the Russell, which we are still worried about, it down 2.3% as we close out month 4 of 2024.

Adding to the fire of the recovery, GOOG/L (which is counted twice in the indexes) beat nicely with Cloud Revenues up 28.5% and they have so much money floating around that cloud that they are paying out an 0.20 dividend (on a $175 stock?) AND they are buying back $70Bn of their own shares at 25x earnings. To me, this indicates they can't think of anything better to do to grow the company and you know I hate buybacks but, whatever - the net effect is they are up 11.5% this morning.

MSFT also rocked it in the clouds with Azure Revenues up 31% and that sent that $3Tn stock up 4.5% and MSFT is now clearly the World's largest company again - and I don't think AAPL's earnings are going to change that. Unlike GOOG, MSFT has plenty of better things to do with money than give it back to their shareholders - I like that!

Other nice beats came from INTC (who dropped on guidance - as usual), TEAM, SAM, EXPO, GILD, KLAC, RMD, SKX and SNAP, who are up almost 30% with raised guidance and a 10% jump in Daily Active Users (DAU) to 431M people.

So the short story is companies like INTC and META (who we just added to our Long-Term Portfolio in yesterday's Live Member Chat Room), who spend money to build for the future are punished by companies like GOOG/L, who spend money buying back their own stock are rewarded. Clearly stock market incentives are completely F'd up but I guess we'll have to play the hands as they are dealt...

8:30 Update: Personal Income is up 0.5% and that was expected but Personal Spending is up a blazing 0.8% - 33% more than 0.6% expected so Consumers are still willing to go deeper and deeper into debt to keep up their lifestyles. Yay, I guess... PCE Prices are flat at 0.3% - same as February - so we made it through a 10% rise in oil and gasoline prices without fueling further inflation - that's a good thing!

As Steve on CNBC just said: " The stag is not there in the StagFlation " so there's not enough evidence in this data to be gloomy in our outlooks - though we're still waiting for Consumer Sentiment numbers at 10. Clearly there's still wage pressure but, if the employees are spending 33% more than you pay them - that's not a bad deal for our Corporate Masters, is it?

And this is why we hedge. Rather than gut-wrenching panic during the downturn, our Members were relaxed and looking for new opportunities - taking advantage of sell-offs like META that we disagreed with to ADD to our long positions, rather than liquidating them for no reason. Our Long-Term Portfolio made it through the week (so far) at $1,059,303 and that's UP $71,417 from our April 16th Review and up 111.9% from our start on May 16th last year as we took advantage of last week's dip and are now reaping the benefits of the bounce.

Have a great weekend,Would you like trade with us and get all of Phil's picks live? Just become a Member and join us inside!

You will gain access to our 6 Member Portfolios as well as Trade Ideas, Our Legendary Live Chat Room, Live Trading Webinars, Trading Education and other exclusive perks.

Find out why Forbes called Phil " The Most Influential Stock Market Professional on Twitter" (in 2016, before Elon ruined it!).Email Maddie - [email protected] - for a 7-day FREE trial at sign up.