Feng shui.

Feng shui. It's the Chinese system of laws considered to govern spatial arrangement and orientation in relation to the flow of energy (qi) using those energy forces to harmonize individuals with their surrounding environment. The term feng shui means, literally, "wind-water " (i.e., fluid) and the practice is all about balancing the basic elements of Earth, Metal, Water, Wood, and Fire to create a harmonious environment (Daoism).

Unfortunately, China has NOT been practicing Feng Shui with their own economic growth and their house is in severe disorder and, at the moment, it is the single biggest threat to global economic harmony.

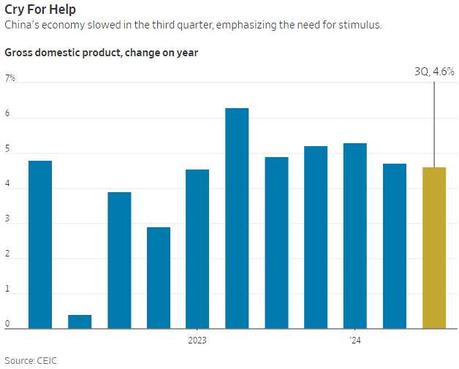

China's latest GDP numbers are certainly emphasizing the disharmony. The world's second-largest economy grew at a meager 4.6% in the third quarter compared to last year. That's a tick down from the 4.7% growth in Q2 and 8% below the Government's full-year target of " around 5%." If you're thinking, " Well, that's not too bad," remember that for China, this is a far, far cry from their pre-covid average of 7%.

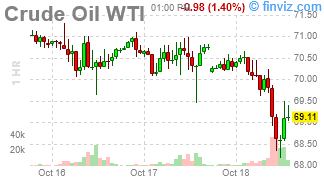

Why Should We Care? Well, China isn't just a big player; it's the elephant in the global economic room. When China sneezes, the rest of the world catches a Covid. Their slowdown has a domino effect, impacting everything from commodity prices to global supply chains.

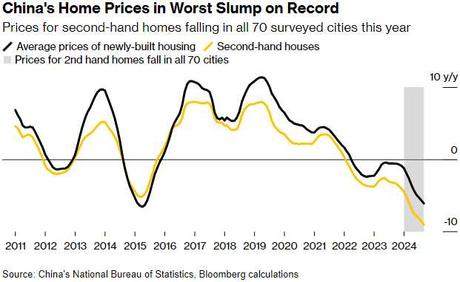

One of the main culprits dragging down China's growth is its still-spiraling property sector. New Home Prices have fallen for the 16th straight month, with prices in 68 out of 70 cities declining. Developers are struggling, projects are left unfinished, and consumer confidence in real estate is in the gutter.

Remember Evergrande? The poster child for corporate debt nightmares? Well, it's not just them. The entire sector is teetering, and Beijing's attempts to stabilize it have been a tragic series of half-measures as the situation gets worse and worse - spreading like a cancer through the Housing Sector.

Consumer spending is another sore spot. Retail sales did rise 3.2% in September, up from 2.1% in August, but let's not pop the champagne just yet. These numbers are propped up by government subsidies on things like home appliances and cars. Without Uncle Xi's wallet, those numbers would likely look a lot worse. China's Consumers were at 11.5Tn Yuan at the end of 2019 and Q3 just came in at 11.8Tn Yuan - not much growth for 5 years.

Investors initially cheered the stimulus announcements last month - ahead of their "Golden Week" holiday but that enthusiasm faded faster than a Chinese New Year's resolution. Without more concrete plans and some sort of transparency, it's hard to gauge how effective these measures will be. As one economist put it, " It is a better situation this month than last month. But does this change the central tendency of the economy? Probably not."

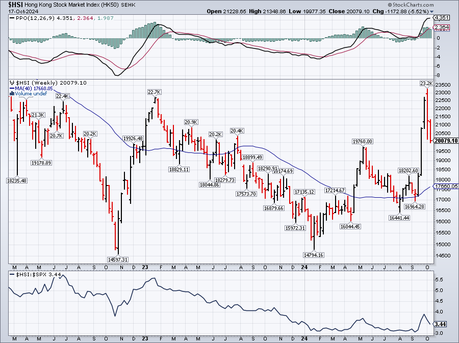

Chinese stocks have been on a wild ride. The benchmark CSI 300 Index surged more than 30% over six trading days through October 8th but then dropped around 8% from that peak. The Hang Seng Index followed a similar pattern.

Today's announcements did give markets a little pep. The CSI 300 jumped 3.6%, and the Shanghai Composite and Hang Seng showed strength as well (not updated on this chart). But let's not kid ourselves; without meaningful policy changes, this could be a dead-cat bounce.

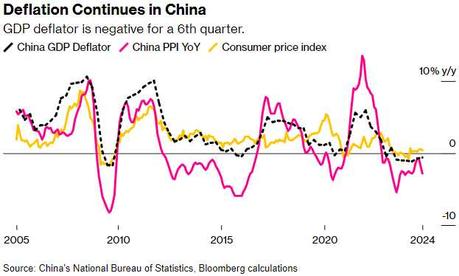

A sluggish Chinese economy could disrupt global supply chains even further. We've already seen how fragile these were during the pandemic and, if China devalues the Yuan to boost exports, we could see increased currency volatility - affecting everything from multinational earnings to Forex markets.

Inflation's "last mile" is proving to be a tough nut to crack. With higher long-term Inflation expectations and our other geopolitical tensions, the Fed is stuck between a rock and a hard landing.Back home, the Fed is watching all this with keen interest. Strong U.S. economic data, like the better-than-expected retail sales and lower jobless claims, suggest our economy is still humming along but global headwinds like China's slowdown might cause the Fed to think twice about the pace of future rate hikes or cuts - and we need those cuts the way China needs more stimulus to keep this ship afloat...

China's economic woes are a stark reminder that Global interconnectedness cuts both ways. While we've been focused on domestic issues, the ripples from Beijing could soon be reaching our economic shores. For now, keep a close eye on commodity prices, Multinational Earnings and any further policy announcements from China.

Have a great weekend,We raised more cash and and added more hedges in our Member Portfolios this week - just in case...