Here we are again!

Here we are again!

As we expected, the Fed cut rates another 0.25% yesterday after changing just 15 words from their last statement, essentially indicating that Business Spending has slowed down to justify the completely unneccessary cut. “We took this step to help keep the U.S. economy strong in the face of some notable developments and to provide insurance against ongoing risks,” Powell told reporters. So, apparently, we've gone from a "data-dependent" Fed to one that now uses psychic powers to react to trouble before it even happens?

Powell said “Weakness in global growth and trade policy have weighed on the economy” but does that mean he will RAISE rates if Trump makes a deal with China? Powell can't win so he shouldn't try to please Trump, who immediately tweeted about the Fed Chairman: “No ‘guts,’ no sense, no vision!” for not giving the President the negative rates he demanded just last week.

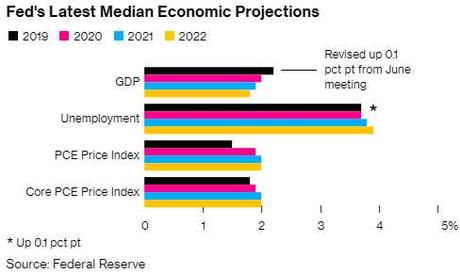

As you can see from the Fed's projections, we're wrapping up Trump's Presidency (hopefully!) with barely 2% GDP growth and an uptick in unemployment while the fiction of low inflation is being maintained and keep in mind that if inflation is 2% and the economy is growing 2% – then the economy isn't growing at all – things are just getting more expensive while we produce the same amount of stuff. To some extent, that's to be expected in a mature economy but we do have 1% population growth so really 3% growth with 2% inflation should be the minimum we shoot for.

I discussed the Fed and the overall economy with Kim Parlee on Money Talk last night, so here's that segment:

Given all those concerns, as we noted in…

You must login to see all of Phil's posts. To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.

To signup for a free trial membership, click here.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!