Financial observers have been sounding the alarm on the U.S. banking system. But a recent letter from the Federal Reserve to JPMorgan Chase, the largest U.S. bank , should impress on skeptics the gravity of the situation.

In an April 12, 2016 letter to JPMorgan Chase's CEO and chairman James Dimon, the Federal Reserve expressed its unhappiness over "a deficiency" in JPMorgan's "wind-down plan".A bank's "wind-down plan" is also called its living will. "Wind-down" is a euphemism for bankruptcy, "wind-down plan" thus refers to a bank's plan in the event of bankruptcy.

The letter, which has passages blacked out or redacted, begins by saying that on July 1, 2015, the Board of Governors of the Federal Reserve System and the Federal Deposit Insurance Corporation (FDIC) - henceforth referred to as "the Agencies" - received from JPMorgan Chase & Co. (JPMC) its "annual resolution plan" (2015 Plan).

In reviewing JPMC's 2015 Plan, however, the Agencies determined that the bank's plan "is not credible or would not facilitate an orderly resolution under the U.S. Bankruptcy Code."

The Fed specifically identifies several deficiencies in JPMorgan's bankruptcy plan, including the problem of liquidity . As the letter puts it:

"JPMC does not have appropriate models and processes for estimating and maintaining sufficient liquidity at, or readily available to, material entities, or for estimating its liquidity needs to fund its material entities during the resolution period.... JPMC's liquidity profile is vulnerable to adverse actions by third parties."

The term "material entities" refers to JPMC's branches in the U.S. and abroad. Put in simple English, the Federal Reserve says it is skeptical about JPMC's ability to have the capital or cash on hand to maintain its branches during the "bankruptcy resolution" period. That, in turn, means that JPMC simply does not have the cash to pay all its customers should they demand to withdraw their deposits.

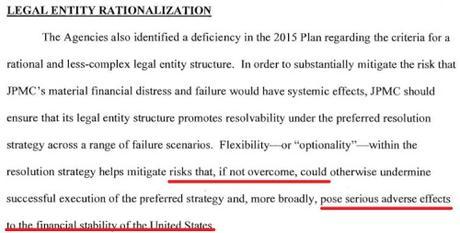

It is bad enough that, in the judgment of the Federal Reserve, JPMorgan does not have the needed liquid capital to pay its depositers. Ominously, on page 11 of the letter, the Fed states there could be "systemic effects" if JPMorgan does not properly address the "deficiency" in its "wind-down plan". JPMorgan's failure could "pose serious adverse effects to the financial stability of the United States."

Here's a screenshot I took of the relevant paragraph in page 11 of the letter:

And yet, none of this is being reported by the mainstream media. Writing for the blog Wall Street On Parade: A Citizen Guide to Wall Street, Pam and Russ Martens point out:

A rational observer of Wall Street's serial hubris might have expected some key segments of this letter to make it into the business press. A mere eight years ago the United States experienced a complete meltdown of its financial system, leading to the worst economic collapse since the Great Depression. President Obama and regulators have been assuring us over these intervening eight years that things are under control as a result of the Dodd-Frank financial reform legislation. But according to the letter the Fed and FDIC issued on April 12 to JPMorgan Chase, the country's largest bank with over $2 trillion in assets and $51 trillion in notional amounts of derivatives, things are decidedly not under control. [...]

The Federal regulators didn't say JPMorgan could pose a threat to its shareholders or Wall Street or the markets. It said the potential threat was to "the financial stability of the United States."[...] How could one bank, even one as big and global as JPMorgan Chase, bring down the whole financial stability of the United States? Because , as the U.S. Treasury's Office of Financial Research (OFR) has explained [...], five big banks in the U.S. have high contagion risk to each other. Which bank poses the highest contagion risk? JPMorgan Chase.

As explained by a by the U.S. Treasury's Office of Financial Research (OFR):

"... the default of a bank with a higher connectivity index would have a greater impact on the rest of the banking system because its shortfall would spill over onto other financial institutions, creating a cascade that could lead to further defaults. High leverage, measured as the ratio of total assets to Tier 1 capital, tends to be associated with high financial connectivity and many of the largest institutions are high on both dimensions... The larger the bank, the greater the potential spillover if it defaults; the higher its leverage, the more prone it is to default under stress; and the greater its connectivity index, the greater is the share of the default that cascades onto the banking system. The product of these three factors provides an overall measure of the contagion risk that the bank poses for the financial system."

Three of the five largest U.S. banks (JPMorgan Chase, Bank of America and Wells Fargo) have now had their wind-down plans rejected by the FDIC and the Federal Reserve. It is high time for America's major newspapers and TV networks to do their job - accurately reporting on the scale of today's banking problem.