"Inflation has eased considerably. It's time to recalibrate. We're returning rates from their high level to a more normal level over time. We're not saying, 'mission accomplished,' but we're encouraged by the progress we've made. "

Trump's response yesterday was a fairly reserved (for him): " I guess it shows the economy is very bad to cut it by that much-assuming they're not just playing politics. The economy would be very bad or they're playing politics, one or the other." It is a bit of a trap for candidate Trump to rail against the very rate cuts the people find to be such a relief. It also really damages the " Inflation is out of Control " narrative that is the center of his campaign.

For their part, the Fed's Economic Projections show PCE Inflation at 2.3% in 2024 with Core Inflation at 2.6% but next year, they expect 2.2%, just 10% over the Fed's 2% target and it's 2025 in 3 months so.... Unfortunately, GDP growth will also be 2% - just barely keeping up with inflation but here's my issue - as I noted yesterday, the Atlanta Fed's GDP Now Forecast was JUST raised to 3% - that is not 2% and will that not be inflationary and will not a 0.5% rate cut be MORE inflationary?

The Fed's Eleventh District head, Lorie Logan spoke on Tuesday morning but she stayed miles away from mentioning Fed Policy at a banking conference and tomorrow we'll hear from Patrick Harker at 2pm. This morning we'll get the Philly Fed (8:30), Home Sales & Leading Economic Indicators (10) as now our focus shifts to whether or not the data supports additional rate cuts but, judging from the pre-market rally - another cut will be very hard to justify at the Nov 7th Meeting (day after the election) and the last meeting this year is Dec 18th.

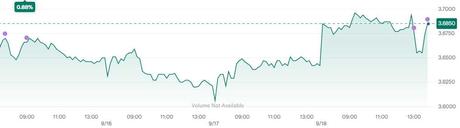

In fact, after yesterday's HUGE Rate Cut, long-term interest rates ROSE as the downward trajectory of the rate cuts, per the " dot plot " is less steep now than it was last quarter going into 2025 and those long-term rates are used to set the price on auto loans, mortgages, etc and they were were climbing off the year's lows, which we tested earlier in the week. The 10-year note is at 3.75% this morning, up sharply from 3.6% before the Fed decision.

Still, the markets are happy, with the Nasdaq back over 20,000 in the futures with a 426-point (2.2%) gain in pre-market trading and that's going to be FANTASTIC for the portfolios we just reviewed so let's sit back and enjoy the ride for now.