Frank Hollenbeck, PhD, teaches at the International University of Geneva. He recently wrote an article entitled “Fear the Boom, Not the Bust” for Mises Daily.

Frank Hollenbeck, PhD, teaches at the International University of Geneva. He recently wrote an article entitled “Fear the Boom, Not the Bust” for Mises Daily.

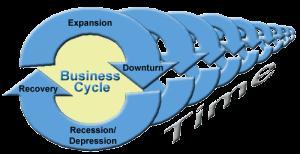

In that article, Mr. Hollenbeck described the modern “boom-and-bust” business cycle. Most people celebrate the “boom” when the economy is running hot and everyone seems to prosper. Most people fear the “bust” (recession or depression) when we’re almost all suffering from diminished incomes.

However, Dr. Hollenbeck argues that the irrational excesses of the booms cause the painful corrections in the busts. Thus, because the booms cause the busts, we should be more afraid of the booms and less afraid of the busts.

He argues that today’s QE ($85 billion per month) mixed with no “tapering” is an explosive combination. He supports his argument with references to the recession of A.D. 1937, saying

“If we do not learn from history we are bound to repeat it. We have been here before. The depression of 1920 and Roosevelt recession of 1937 show us what happens when excessive monetary printing is followed by tepid tapering.

“The 1937 Recession . . . was severe but short. Output fell by 11 percent and industrial production by 32 percent. Unemployment surged back up from 14 percent to 19 percent.

“The real cause of the 1937 recession occurred much sooner. The die was cast early in 1934 when the United States set the price of gold at an overvalued $35 an ounce. The ensuing gold inflows caused the money supply to explode, increasing 12 percent per year (M2) from 1934 to 1936. A boom ensued with real output growing 10 percent in 1934, 8.9 percent in 1935 and 1 percent in 1936. . . . the additional money masqueraded as real savings. Since no real resources had been liberated, a scramble for resources followed.

Dr. Hollenbeck does not specify the source of the “gold inflows”. But he apparently means that the American people who hadn’t voluntarily surrendered their gold to the government at $20/ounce in A.D. 1933, were eager to sell their gold in A.D. 1934 for $35/ounce. The net result was an “explosion” in the supply of paper dollars and the economy was seemingly “stimulated”.1

However, those paper dollars didn’t represent any newfound “real resources”. Therefore, people began using their paper dollars to compete to purchase real resources, causing monetary inflation and economic stimulation that was dramatic but illusory.

“Eventually, many of the investment projects [probably speculation based on the increased supply of paper dollars] that had been undertaken [during the 1934-1936 boom] turned out to be unprofitable and needed to be abandoned. The 1937 recession was necessary and desirable to free up resources from the malinvestments of the previous years. A recession is a realignment of resources closer to what society really wants to be produced. The central bank could have continued printing [more paper dollars], extending the illusion of prosperity, but this would have just delayed and amplified the final adjustment.”

That’s a brilliant argument. If it’s true that recessions and depressions are necessary and even beneficial, then government’s attempts to avoid recessions necessarily prevent a healthy “realignment of resources” in our economy. From this perspective, a recession (or even a depression) isn’t something to be feared and avoided, but welcomed as a medicine that’s particularly foul-tasting but nevertheless necessary to cure a persistent disease.

More, the fundamental idea of Keynesian economics is to smooth out the business cycle of booms followed by busts. That idea is evidence of central planning that’s virtually identical to that of the former Soviet Union. On the one hand, Keynesian central planners at the Fed would try to moderate or minimize the irrational booms in the business cycle. But, on the other hand, they’d also like to eliminate the “busts” (recessions and depressions) that may be best viewed as beneficial corrections rather than painful losses.

In a sense, economic booms are analogous to enjoying a big feast at Christmastime. Economic busts are analogous to the need to defecate a day or two later. If government claims that they’ll save us from stinking up the bathroom by preventing us from defecating, it may sound like a great idea. However, we’re going to get really sick and we’ll stay sick until we’re allowed to defecate.

The point Dr. Hollenbeck makes is that economic busts are natural, necessary and even healthy. Trying to prevent recessions and depressions is ultimately detrimental to real economic health.

“By late 1936, The Fed started to get worried [about the excess money supply], and in March 1937 the chairman of the Fed, Martin Eccles, said ‘[r]ecovery is now under way, but if it were permitted to become a runaway boom it would be followed by another disastrous crash.’

“[In fact,] the 1937 bust was written in the cards. It could not be avoided, just postponed. It is not the bust, but the boom that should be feared. The bust was of short duration, and could have been much worse if the Fed had not pulled the punch bowl then and there.”

The Fed “pulled the punch bowl” by restricting the money supply (“tapering”). If they hadn’t “tapered” the bust would’ve been worse.

An economic imbalance or “disease” had been spawned by artificially increasing the supply of paper currency between 1934 and 1936 causing a boom. That disease wouldn’t be cured until we “took our medicine” in the form of a small dose of recession. If we wouldn’t quickly take our medicine (recession), our economic disease would grow until the only medicine that could cure it would be a big dose of depression.

Why should we fear the boom? Because, as you’ll read, much of that boom is not merely irrational but also often criminal.

“We currently fear Fed tapering, as we should. Yet, we should be even more fearful that it doesn’t taper. Today, we really have a dreaded choice of losing an arm now or two arms and a leg tomorrow.

“Because the price distortions have been massive, the adjustment will be horrendous. Government policy makers and government economists simply do not understand the critical role of prices in helping discovery and coordination.”

Dr. Hollenbeck’s use of the term “price distortions” sounds agreeably “economic,” mathematical and morally sterile.

But what do “price distortions” really mean?

First, “price distortions” mean that some people, corporations, or industries are being paid far more than they’ve earned—and other people, corporations or industries are being paid far less. Some products are hugely over-priced; others are ruinously under-priced.

Thus, “price distortions” are morally wrong.

Second, “price distortions” are caused and even mandated by central planners.

Once we see that “price distortions” mean “significant, unearned profits” (at least for some), we can also see that those who benefit most from price distortions have a vested interest in maintaining and even causing those price distortions as a means to gain unearned wealth.

Thus, “price distortions” aren’t morally sterile or merely mathematical.

In fact, when sustained by plutocratic clout or political influence, price distortions are evidence of criminal acts perpetrated the government’s central planners for the purpose of defrauding and robbing the majority in order to enrich and empower a few.

“Price distortions” are code for crony capitalism and rigged markets. “Price distortions” are code for fraud and criminal conspiracy committed by the rich and politically powerful.

• Government policy makers claim to know better than the private, free markets as to what the majority of people want and what they need.

But (assuming government is really working for the best interests of the majority rather than working to enrich the elite few who bribe our legislators) the public’s wants and needs are constantly changing in both nature and magnitude. When the central planners in Congress and the Federal Reserve adopt a fixed system of values, those values can’t be changed except by congressional mandate. That means the fixed system of value can’t change fast enough to suit the free market and people’s fast-changing needs and wants. Thus, the central planners’ fixed values cause disruptions in the economy that are so irrational that they ultimately cause the economy to collapse.

The economy is as moody as a woman. One day she wants chocolates. Next day, she wants diamonds. The day after that, she wants furs. If the law mandates that you can only give her chocolates (no diamonds or furs) and that you can’t give her something different on other days, “she” is going to be very unhappy. Odds are, “she” will also make you very unhappy. That’s true for women and it’s true for the economy.

The most rational economic system is one based on the seemingly irrational, free markets that are free to change every day—rather than the seemingly rational central planning conducted by a bunch of smooth-talking economists and politicians who deny us the right to daily changes.

Governments that would rule and economists that would control have masses of data, statistics, formulae, and reasonable arguments. But every time governments engage in central planning, they precipitate the same fraud, exploitation and then economic collapse seen in the former Soviet Union.

● Freedom includes the right to play the fool and act like an idiot. But freedom also includes the obligation of being held personally liable for your foolishness and idiocy.

Government control and central planning claims that it will protect us from the consequences of our own foolishness and idiocy. But, by allegedly protecting us from the responsibility and pain of our own errors, government deprives us of a chance to learn from our mistakes.

If we invest in a stock market that’s rigged to go up, up and up, we may seemingly make some pretty large profits—but we won’t really learn how to invest in private corporations that are truly productive.

Instead, we’ll learn how to invest (indirectly) in the government that rigs the stock market and favors some stocks or industries over others. We’ll learn how to send lobbyists to Washington, how to bribe congressmen and senators, how get our own laws passed to favor our continued success in the markets. We’ll learn how to invest in politicians with political campaign contributions (bribes) rather than learn how to read a corporate balance sheet. We’ll learn to buy stocks based on government’s most recent regulations rather than a particular corporation’s ability to produce a particular product at a profit.

If we can’t learn from our mistakes—in fact, if we’re not forced to learn from our mistakes—then we become an ignorant and mistake-prone people. As we are dumbed down by our government’s central planning, we become increasingly vulnerable to, and even increasingly needful of, a catastrophic “bust” exactly as Dr. Hollenbeck explained.

● In the free market you might invest in a “sure thing” and lose $100,000 in the first week. That’s called a “learning experience”. But if you learned from your mistake on your first investment, you might do better with your second investment.

More, although your loss of $100,000 may be disastrous for you, for the markets and the economy that loss is merely a “micro-correction” that tells us all that at this particular time the particular stock you invested in was a bad idea. It may be that your stock pick was a winner six months earlier and it may be a winner again, six months from now. But, today, your $100,000 loss teaches all of us that your stock pick is, currently, a loser. We can all learn from your loss.

Relatively small, daily losses like yours don’t add up to an economic collapse. They’re merely “micro-corrections” that a free market economy can absorb, learn from and go on to profit from in future investments.

When you’re guaranteed to suffer little or no loss –as was the case with the housing market in the early 2,000s, and stock market (thanks to the Plunge Protection Team) since the Reagan administration–you play the fool. You buy one house; you buy a second; you buy a third. You buy stocks. You can’t miss because . . . well, . . . because “you can’t miss” because the game is rigged by the government’s central planners. But then there’s a housing collapse or a stock market plunge and you wind up losing all three of your homes and much of your paper wealth.

Central planning (manipulated markets) may work for a while, but they’ll inevitably implode under the weight of the “price distortions” (fraud) committed by the government, Fed and all “central planners”.

So, here’s the bright side: Recessions aren’t your enemy. Recessions are primarily the enemy of the gangsters who exploit their governmental powers to cause and profit from the “price distortions” during the boom years.

The longer we avoid our next recession (or even depression) the longer the crooks can profit—at your expense—from rigged markets.

The recessions/depressions tend to hurt everyone. But, if Dr. Hollenbeck’s argument is correct, those economic busts may be the only available means to hurt the gangsters, crooks and plutocrats who’ve seized control of government. A recession or depression might be viewed as “nature’s way” to stop, or at least slow, the rackets we call government and central banking.

If so, the correct reaction to recessions might be Hooray!—or, at least, Thank God.

1 Incidentally, Dr. Hollenbeck even offers a new spin into the “gold confiscation” attributed to the Franklin D. Roosevelt administration. The confiscation wasn’t simply achieved by the brute force of law in A.D. 1933 or even by the American people’s blind willingness to obey all laws. Instead, the confiscation was primarily achieved by raising the price of gold in A.D. 1934 from $20 to $35 per ounce and then purchasing the people’s gold with fiat dollars. Those who wouldn’t voluntarily surrender their gold in A.D. 1933, were delighted to sell it for $35/ounce in A.D. 1934.

Suppose government again wanted to confiscate the gold held by private Americans. Could we expect gov-co to send armed soldiers door-to-door to take our gold by force? Or could we expect government to suddenly offer to pay, say, $2,500 (in fiat currency) for gold that the markets had priced at just $1,500/ounce?

Could you resist the temptation to make a fast $1,000/ounce on your gold?

Back in A.D. 1934, the American people could not resist the temptation to make a fast $15 profit on every $20 ounce of gold. It’s hard to blame them for taking that deal, but in retrospect, they were fools, weren’t they?

If today’s government offered to overpay (in fiat dollars) for your gold, would you take the deal?