China is the reason so many companies tell you how great their prospects are. TSLA is going to China, YUM and MCD sell so much fast food in China that now Chinese people are getting fat and having heart attacks – just like we do! Casinos make their money in China, luxury goods manufacturers do significant portions of their sales there and, of course, it's the raison d'etre for the commodities industry.

But what if China is a fairy tale and, rather than a decade of growth ahead, we have a decade of stagnation or, even worse, contraction on the other side of the World? As you can see from Dave Fry's FXI chart, the Chinese market has gone nowhere this whole decade – DESPITE the S&P starting 2010 at 1,100 and gaining 68% since then.

- Part 1: Banks Feel Strains After Credit Binge

- Part 2: Banks, Bonds Joined at the Hip

- Part 3: Banks Work Around Lending Limits

- Part 4: The Rock Star of Chinese Debt Analysis

- Part 5: Debt Drags on Growth

- Part 6:In China, a Big Bet on Smaller Borrowers

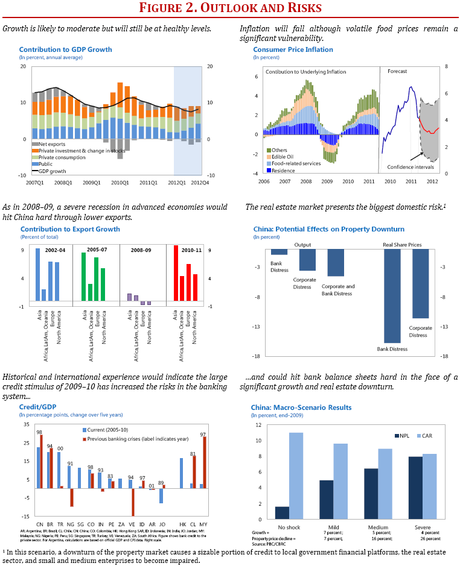

- Part 7:China's Credit Levels Echo U.S. Crisis

This morning we got data out of China showing Industrial Production growth slowed to 8.6% from 9.7% measured just a month earlier and no, it wasn't the weather. Retail Sales fell to 11.8% from 13.6% and Fixed Investments fell to 17.9% from 19.6% and none of those are BAD numbers (still growth, just slower) but, as I pointed out in Monday's post, bank loans and the bond market there are in no way, shape or form priced for slower growth.

If the rest of the World is going up 3.5% instead of 2.5%, then we can easily shake off a 2.5% pullback in China – but we have to be VERY SURE we have a good balance going forward. More importantly, we have to be more realistic about the prospects of our corporations and think about whether their sky-high valuations are likely to be realized in a market where growth prospects in China are no longer infinite.

With an $8Tn economy holding $4Tn of US debt, China needs to be VERY concerned about our stability, the same way we would be if we held $8.5Tn worth of Chinese debt. But there's the real problem – we don't hold $8.5Tn, or even $1Tn of the $100Tn worth of Chinese debt (see Monday's post for breakdowns) – that's owned by Asia and Europe and most of all by the Chinese people, who have been convinced to pour their savings into Chinese Corporate Bonds which never (until now) defaulted.

Of course your economy is going to grow 7.5% a year when you are paying 10% interest rates on bonds that "never" fail – how could it not? Maybe we should start doing that in the US. After all, what can possibly go wrong?

If you can think of a few things – then we need to be concerned about China…