Wheee, what a ride!

Wheee, what a ride!

Tesla stock hit peak stupidity Tuesday at $550 per share in mid-day action but it finished the day at $530 and, this morning, we're down to $500 after I ranted about it in our Weekly Webinar (we are short TSLA). No, I don't think I caused it – I think Tesla, having kissed a $100Bn market cap, had a run-in with reality two weeks ahead of an earnings report that will theoretically show them making $150M for the Quarter (though I think they miss), which is still a run rate of $600M for 2020 or 1/166.6 of $100Bn.

See – I'm still ranting. These guys just annoy me!

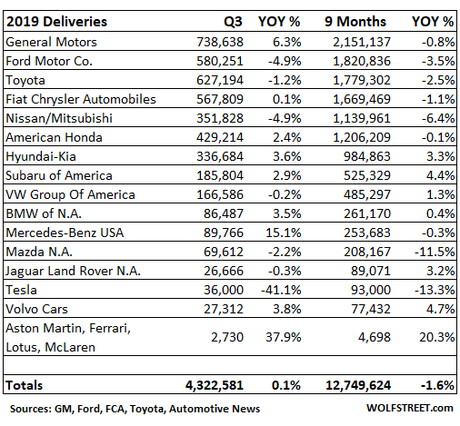

Yet TSLA is now valued twice as high as all of them, except Toyota (TM) at $200Bn, perhaps because they sell more than 50 TIMES more cars than TSLA in the US and 100 TIMES more cars than TSLA world-wide or maybe it's because TM MAKES $20Bn a year while TSLA loses $1Bn. JUST the Prius sold 500,00 units in 2019 – mostly to Uber drivers...

Nonetheless, TSLA is just our poster…

You must login to see all of Phil's posts. To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.

To signup for a free trial membership, click here.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!