We're shorting the S&P (at 4,512 avg so far) ahead of the GDP Report next Thursday..

We're shorting the S&P (at 4,512 avg so far) ahead of the GDP Report next Thursday..

As noted yesterday, the Fed's estimates for Q3 GDP have come down from 6.25% in July to 0.5% as of last week yet the consensus among leading Economorons is still for a 3.75% gain and those are the guys who are yapping on TV and writing the articles you read in the MSM – you know, idiots…

Part of the discrepancy is, of course, laziness. 3.75% is the average of the Top 10 and Bottom 10 forecasts in the GDPNow Survey and a lot of people still in the Top 10 simply haven't revised their opinion since July, failing to follow the advice of John Maynard Keynes, who said: "When the Facts Change, I Change My Mind. What Do You Do, Sir?"

Facts have definitely changed in the past 3 months as inflation has spiked, Covid has resurged, shipping has backed up, disrupting supply chains, labor is in short supply and we're even flat out failing to deliver some commodities, causing spikes in Natural Gas, Gasoline, Copper, Uranium… In short – it's a mess!

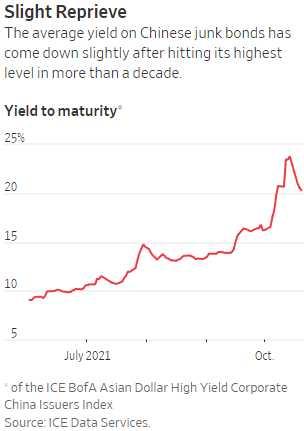

Since Evergrande and Fantasia defaulted on payments earlier this month, at least four other Chinese developers have either defaulted or asked investors to wait longer for repayment. A 30-day grace period for Evergrande to pay international bondholders, meanwhile, runs out this weekend, and investors are expecting the company to default on close to $20 billion in outstanding dollar debt.

That is just a drop in the bucket as Evergrande alone is over $300Bn in debt and, if they want to borrow more – 20% is the going rate. Does that sound sustainable to you? The extreme market dislocation raises the risk of a vicious cycle, in…

You must login to see all of Phil's posts. To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.

To signup for a free trial membership, click here.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!