Granted there were about 120 companies reporting but 36 MISSED (30%) – that's NOT GOOD! What it's certainly not is what you expect to be seeing when the stock market is at an all-time high. Misses mean expectations were too high and companies (part of the indexes) are not doing as well as you thought and, therefore (and this is the logic people seem to have trouble with) the market is OVER-PRICED!

I know, it's a real logical stretch to connect those dots isn't it? It sure seems to be for our mainstream media (see yesterday's post), who remain in cheerleader mode. Another telling indicator is on the right of that earnings chart (link above) where you can see guidance and there we have 9 companies offering positive guidance and 13 lowering their guidance – 9 of the companies lowering guidance were ones that had earnings beats (CAJ, DHX, MSI, TUP, WLP, MLNX, MKSI, TER and VAR).

SQNM, who make diagnostic equipment, had 8 buys on them with 5 of them strong buys and the stock is down 33% on an earnings miss. CROX had 3 strong buys, 4 buys and a hold after running up from $12 in November to $17.50 (45%) and they missed by 23%, which is how much their stock dropped overnight ($13). It's not the company's fault that expectations were way too high and, in fact, they are now on our buy list if they drop any further (see early morning Member Chat).

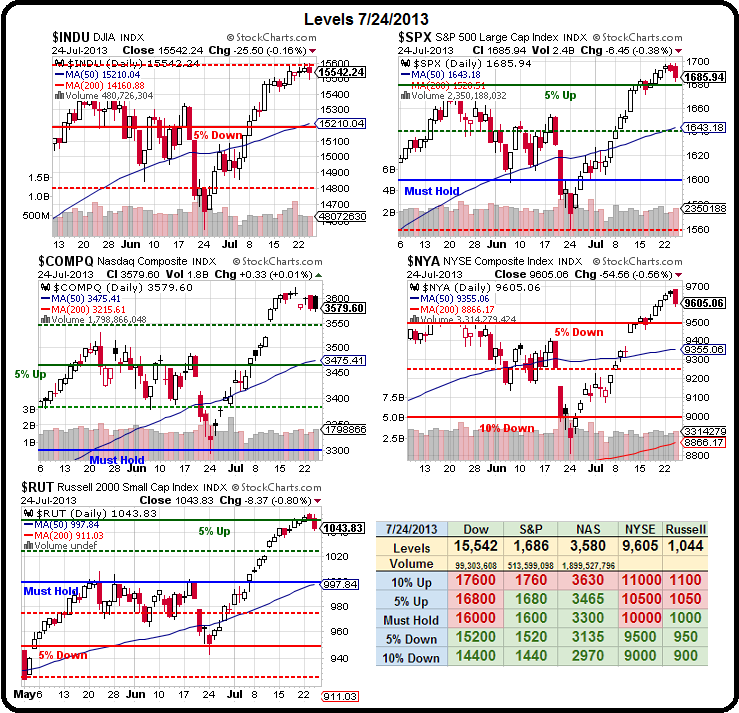

Ideally, we pull back no lower than 1,600 and prove that out as support and then we can consolidate for a proper break-out to 1,700 and above but, as I said last week – it's generally safer to bet your index WON'T break out of a…

You must login to see all of Phil's posts. To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.

To signup for a free trial membership, click here.