Omicron, Inflation, Fed Tightening, Debt Ceiling…

Omicron, Inflation, Fed Tightening, Debt Ceiling…

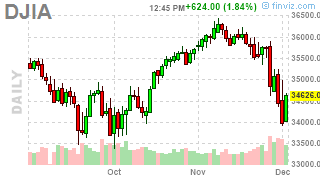

Take your pick, there's plenty to worry about and Omicron seems to be the straw that is breaking the market's back as the Dow and the Russell are bact to testing the September lows. It's bad enough now that we have to recalculate our bounce lines, using the fabulous 5% Rule™, which has been right on the money so far and is, at the moment, indicating we are only in the beginning of a correction.

- Dow 36,000 is the official line we fell from – the rest was just overhoot on the way up which we will ignore. 36,000 x 0.95 (a 5% drop) takes us to 34,200 and BINGO! – here we are at the -5% line. That means the bounce lines are 20% of the 1,800-point drops each so 34,560 will be the weak bounce and 34,920 would be the strong bounce.

The problem for the Dow (and S&P and Nasdaq) is, as I was saying in yesterday's Webinar, that AAPL is used to prop up the markets and mask the true weakness but AAPL rose 5% in the past two days so it too will pull back and make things worse today as it normalizes. Watch out for AAPL failing $160 – that would be bad…

- S&P 4,700 x 0.95 is 4,465 and we're not these yet but that doesn't stop us from calculating the bounce lines from our expected 235-point fall so 47 points to 4,512 (weak) and 4,559 (strong).

-

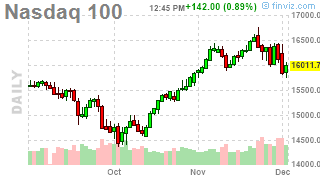

The Nasdaq moves in 5,000-point units over the long-haul so 15,000 was significant and 10% over that is 16,500. The Nas topped out at 16,700 but, again, overshoot that we will ignore so 16,500 x 0.95 = 15,675 and we're well above it but we'll see how support works out on the way down which would be 20% of 825 (165) off 15,675 is 15,840 (weak) and 16,005 (stong). At the moment, the Nas is 15,812 so already failed the weak bounce line and likely to test 15,675 by tomorrow.

- The Russell topped out at 2,450 but 2,400 is the big picture top as Russell moves in 800-point chunks so 1,600, 2,400… You

…

You must login to see all of Phil's posts. To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.

To signup for a free trial membership, click here.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!