That could not possibly have gone better for us. We've been preparing for the bubble pop all week and we got a perfect 1.25% drop in the S&P with no bounce so far and, as all our 5% Rule™ insiders are well aware – that's is a good indicator of lower levels dead ahead.

As I have been saying for weeks – any idiot can make money in a relentlessly up market – the trick is making money in a down one – that's when you want to preserve your cash so you can bargain-hunt for stocks you will own for decades to come (our planted trees).

Yes, I called for cash a bit early but I'd rather be early than late any day – wouldn't you? While other people (over 90% of the sentiment was bearish) were freaking out in various market maven chat rooms, Scottmi summed up the mood at PSW saying: "Damn. Yesterday and today best two days for me in over a year!" I'm always in a good mood when Fundamentals reassert themselves as it suddenly makes all our picks turn "right" for a change. Having convictions can be very expensive in irrational markets but very rewarding in rational ones…

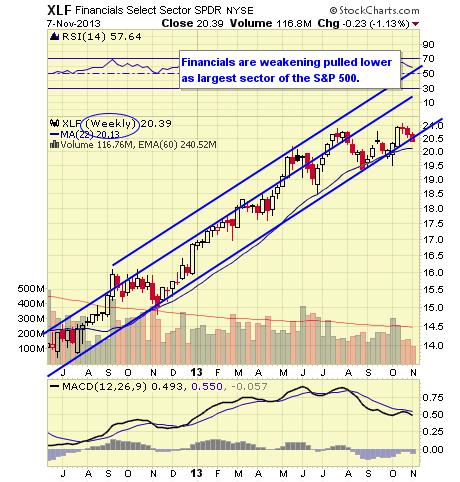

As you can see from Dave Fry's XLF chart, the Financials are now breaking below their long-held channel and, if that isn't taken back pretty quickly, it's going to be a huge drag on the indexes – especially the now more financially-weighted Dow Jones Industrial Average.

See, there's a point to all these boring macro discussions we have about the Dow components and how they affect the index and JPM's fines and everyone's earnings. It was the stupid, bullish reaction to early bank earnings that led us to go contrarian and short the Financials in the first place. This is how you can use FUNDAMENTALS to make really excellent short-term trades!

IN PROGRESS

You must login to see all of Phil's posts. To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.

To signup for a free trial membership, click here.