Are 55% of the people in this country idiots?

Are 55% of the people in this country idiots?

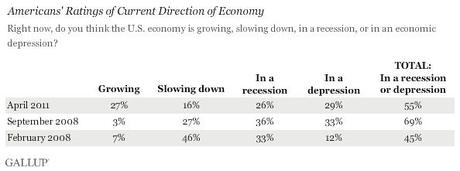

According to the MSM punditocracy, they must be because a whopping 29% of the people in the United States of America feel we are in an Economic Depressionwhile 26% of the people classify the economy as being in a Recession and 16% of the remaining 45% say the economy is slowing down leaving 27% of the people polled by Gallup (only 2% admitted they were not qualified to make a determination) who believe the economy is growing.

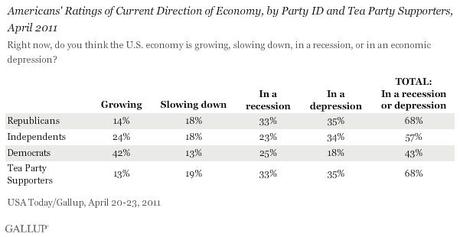

We already know how well the top 10% are doing so if we remove them from the "growing" side of the survey we see that, among the rest of the people, a full 83% aren’t buying into this "growth" BS. Living paycheck to paycheck does tend to put you a bit more in touch with the real economy than the average media pundit, Congressperson or Fed Chairman, I suppose. Now hear is the most interesting thing about the survey: The groups that sees the economy growing the least (14%) and who are most likely to feel we are in a Recession or Depression (68%) are Tea Partiers and Republicans. Democrats actually gave the economy the best scores, with 42% seeing growth in the economy and "just" 43% seeing the economy in a Recession or Depression with only 18% seeing Depression, 1/2 the number of Reps, Independends or Tea Party People.

Although economists announced that the recession ended in mid-2009, more than half of Americans still don’t agree. These ratings are consistent with Gallup’s mid-April findings that 47% of Americans rate the economy "poor" and 19.2% report being underemployed. According to Gallup:

It also seems likely that most Americans would not agree with the FOMC’s assessment of the current economic recovery. Nor does it seem likely that — given surging gas and food prices — most would agree with the Committee that "longer-term inflation expectations have remained stable and measures of underlying inflation are subdued."

Although the FOMC seems to perceive current economic conditions differently than most Americans, it does say it needs to "promote a stronger pace of economic recovery" by continuing its aggressive monetary policy, often referred to as "quantitative easing," through June. On the other hand, in the press conference after the FOMC’s April meeting — the first ever by a Fed chairman — Ben Bernanke said that, "the trade-offs are getting less attractive at this point," meaning it is getting harder to aggressively add liquidity to stimulate stronger economic growth while avoiding inflation.

In another possible disconnect with monetary policymakers, many Americans may not see the trade-off Bernanke suggests between promoting a stronger economy and experiencing higher inflation. Right now, prices are soaring, yet the latest Gallup Daily tracking data show that 67% of Americans say the economy is "getting worse."

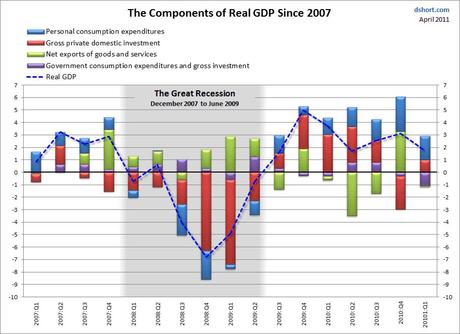

This is where our Government (average salary $160,000 + free health care), the FOMC (average salary $210,000 + free health care), Wall Street (average salary $340,000) and the MSM (average salary $230,000)just seem to not get it. Spending Trillions of Dollars to prop up banks and boosting the stock market does NOTHING to change the mood of the country. Last I heard, consumer spending was 70% of our GDP and the spending of the top 10% at TIF and COH etc. is back to it’s 2007 record levels so congrats on that but, unless you can get The Donald to start wearing two $3,000 jackets or 3 $20,000 watches or have an empty helicopter following his main helicopter just because he can – then at some point we need to do something to turn around the bottom 90% of the economy. Look where we’d be on GDP if we lose the consumers again (and they already pulled back 30% from Q4):

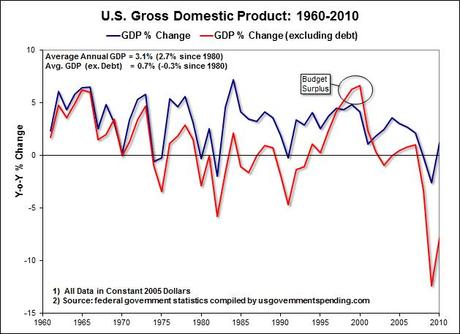

Let’s keep in mind that our "recovery" of the past two years came at a cost of $1.2Tn in Government Stimulus, $700Bn in TARP, $2.5Tn of "Quantitative Easing" and other increases to the Fed’s Balance Sheet and, of course $2.8Tn in deficit spending so that’s $7.2Tn in 24 months to get us back to where we were at the beginning of 2008. Of course the Government is still borrowing $140Bn a month and the Fed is still "easing" by handing their Bankster buddies another $120Bn a month so our run rate, at the moment, is still $3.1Tn a year to keep all these plates spinning.

We have Congress talking about reigning in the debt and spending (and look how Government Spending already flipped negative and dragged GDP down!) and the easy money has allowed speculators to run wild and jam up commodity prices to the point that we wiped out our entire export trade balance in a single quarter. When is the last time our GDP components had this blue, red, purple and no green profile on the chart above? That’s right, Q2 2007 – the top or our last rally (see Doug Short’s charts) …

We have Congress talking about reigning in the debt and spending (and look how Government Spending already flipped negative and dragged GDP down!) and the easy money has allowed speculators to run wild and jam up commodity prices to the point that we wiped out our entire export trade balance in a single quarter. When is the last time our GDP components had this blue, red, purple and no green profile on the chart above? That’s right, Q2 2007 – the top or our last rally (see Doug Short’s charts) …

I am trying to get more bullish, really I am – but to do so I end up reading and my reading leads to stuff like this that SHOULD NOT BE IGNORED. I’m not saying we shouldn’t participate in the madness of the markets – we are happy to do so, but we are not going to make the mistake of over-committing our assets to long positions that we may become trapped in later.

As Barry Ritholtz said yesterday on Kudlow– "There is a 25% correction coming, but we don’t see any evidence it is imminent." We had hit and held our 100% levels all week and that was our last line of resistance on the way to taking back the market highs. The Russell index is already there, popping over it’s all-time high of 855 and pegging 861 yesterday because – once you break the bounds of gravity – there’s no limit to how high you can float. The only index that ISN’T up 100% from the March ’09 lows is the poor Dow, but we expect that to change and we added DDM upside hedges in Tuesday’s Member Chat in a trade I noted yesterday was already up 75% and is now up almost 150% on yesterday’s fabulous move and we can leave it on over the weekend because we still have 200% more to gain if the Dow heads higher and that can cover our generally bearish short-term stance we’re taking into the weekend – just in case reality rears it’s ugly head.

As Barry Ritholtz said yesterday on Kudlow– "There is a 25% correction coming, but we don’t see any evidence it is imminent." We had hit and held our 100% levels all week and that was our last line of resistance on the way to taking back the market highs. The Russell index is already there, popping over it’s all-time high of 855 and pegging 861 yesterday because – once you break the bounds of gravity – there’s no limit to how high you can float. The only index that ISN’T up 100% from the March ’09 lows is the poor Dow, but we expect that to change and we added DDM upside hedges in Tuesday’s Member Chat in a trade I noted yesterday was already up 75% and is now up almost 150% on yesterday’s fabulous move and we can leave it on over the weekend because we still have 200% more to gain if the Dow heads higher and that can cover our generally bearish short-term stance we’re taking into the weekend – just in case reality rears it’s ugly head.

Of course there’s little danger of that in this Wonderland economy, where $13Bn rains down on the market every day ($260Bn a month from Government deficit spending and the Fed’s printing). Not only do we get that $13Bn a day, by the way, but we (the investor class) also got $1Tn PER MONTH ($50Bn a day) as our equity positions reinflated. Surely you people in the bottom 99% must have felt the warmth as we trickled some down on you?

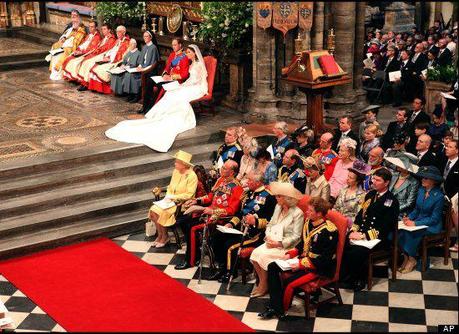

As Mel Brooks points out in that movie: "It’s good to be the king." It’s also good to be Prince William today and probably quite nice to be Kate Middleton as those two crazy kids got hitched this morning. Of course CNBC’s headiline is "How Rich are the British Royals" because that’s what it’s all about, right? Turns out, they are pretty darned rich though but nowhere near as rich as the top 50 of the Forbes 400 – mainly because they have a lot of their assets tied up in real estate. It’s fun to compare those slides to "The Homes of Donald Trump" – the man who would be President. Maybe we can hold royal weddings for his kids.

At least when you become the Queen or King of England you get to move into Buckingham palace, although word is that Liz prefers here estates in Windsor and Scotland to knocking around in here 830,000 square foot London playhouse. What’s poor Trump going to do if he becomes President? The White House is a huge step down for him in living quarters. I’m sure he’ll knock a few walls out and expand the place if he has to – maybe throw a little bling on the facade to jazz it up (and, of course, the Trump-brand logo on the roof). As Snoop Dogg pointed out at the Donald Trump roast – "This won’t be the first time Trump has pushed a black family out of their home."

At least when you become the Queen or King of England you get to move into Buckingham palace, although word is that Liz prefers here estates in Windsor and Scotland to knocking around in here 830,000 square foot London playhouse. What’s poor Trump going to do if he becomes President? The White House is a huge step down for him in living quarters. I’m sure he’ll knock a few walls out and expand the place if he has to – maybe throw a little bling on the facade to jazz it up (and, of course, the Trump-brand logo on the roof). As Snoop Dogg pointed out at the Donald Trump roast – "This won’t be the first time Trump has pushed a black family out of their home."

Back to the poor people: It looks like March Personal Income is up 0.5%, much higher than the 0.3% expected as wage pressure does begin to mount in the US. As is typical in America, spending was up 0.6% but that’s sharply down from 0.9% in February. Private wages went up $18Bn in March, slower than February’s $23.9Bn pace but business owners still bumped their own income by $4.4Bn in March – the top 1% taking 20% of the total gains in income.

Those in the top 1% who collect rents made an extra $8.7Bn in March as apartment prices are skyrocketing because people can’t afford homes anymore, so the owners have pricing power and are using it with a vengeance. Who is one of those owners? The Donald, of course. What better man to run our country than a man with Billions of Dollars in real estate income – you KNOW he’ll be looking out for the little guys, right?

Meanwhile, even The Donald should be concerned about the rapid drop in disposable income, despite the rising base incomes. This is a clear indication of the damage commodity prices is having on the average American. In inflation-adjusted dollars, Disposable Personal Income FELL by $9.3Bn despite the $18Bn rise in wages. That means it’s costing $27.3Bn a month for consumers just to stay even. Is corporate America prepared to hand out $327.6Bn in salary increases this year (actually it’s just $2,340 per worker) to keep up with inflation or are things just going to get worse?

Meanwhile, even The Donald should be concerned about the rapid drop in disposable income, despite the rising base incomes. This is a clear indication of the damage commodity prices is having on the average American. In inflation-adjusted dollars, Disposable Personal Income FELL by $9.3Bn despite the $18Bn rise in wages. That means it’s costing $27.3Bn a month for consumers just to stay even. Is corporate America prepared to hand out $327.6Bn in salary increases this year (actually it’s just $2,340 per worker) to keep up with inflation or are things just going to get worse?

We’ll see if the markets can stay up through the day but, more importantly, over the weekend. There has been nary a word from the G7 in reaction to Bernanke’s speech the other day so either they are stunned beyond words or they are preparing a measured response – I think we’ll have clarity on that over the weekend. As I mentioned, we’re short into the open, expecting this pre-market pump will fade but it’s the last day of the month and we do expect appearances to be maintained overall so our short play is really a bet for Monday, not today.

Have a great weekend,

- Phil