We were bearish on Wednesday so you know it was time to flip bullish on Thursday and we did off that bad open where my morning Alert to Members added some aggressive positions:

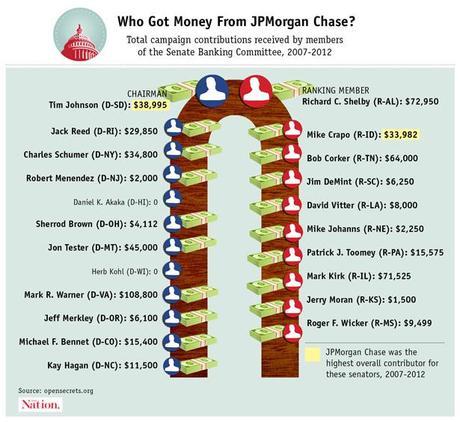

XLF/FAS is still my favorite bullish play to speculate with. FAS July $83/90 bull call spread is $2.60 and you can sell a JPM Jan $29 put for $2.30 to knock the net down to .30 and, if you stop the bull spread out at $1.30 (50% down), then you are in the short JPM Jan $29 puts for net $1 and your worst case is owning JPM for net $28, which is 18% below the current price.

Oil is also interesting (and I still like gasoline (/RB) over $2.65) at $82.50 and USO is down over 20% since May 1st so I like the USO Aug $35 calls for .53, selling the Aug $27 puts for .58 for a net .05 credit and your worst case is you are long on oil 13% below the current price or about $72 a barrel.

Needless to say they are all doing quite nicely and that Futures trade on gasoline is the same one I mentioned right in Wednesday morning's post, when we caught that big spike up to $2.69 for a $1,680 per contract gain so, of course, we were thrilled to get another crack at $2.65 yesterday morning and we got another run to $2.69, where we took our non-greedy exit again.

Needless to say they are all doing quite nicely and that Futures trade on gasoline is the same one I mentioned right in Wednesday morning's post, when we caught that big spike up to $2.69 for a $1,680 per contract gain so, of course, we were thrilled to get another crack at $2.65 yesterday morning and we got another run to $2.69, where we took our non-greedy exit again.

Oil futures ran up $1,500 to $84 and the USO spread shot up to .15 for a quick 200% on cash for the day and our FAS spread is looking very good with Sheila Bair paying JPM a backhanded compliment this morning, saying:

They made a big mistake. I think it proves my point these banks are too big and too complex to centrally manage. But at the end of the day it was not any kind of loss that would threaten the viability of the bank.

Believe me, that was harsh…

Believe me, that was harsh…