You know pot must be legal these days.

You know pot must be legal these days.

How else do you explain these non-stop, non-pause moves up in the market on no particular volume? Can everything really be that awesome and what, exactly is it that is awesome in the first place?

Yesterday we saw Avon (AVP) jump 20% after a FAKE takeover rumor on an SEC-maintained web site from a FAKE company calling itself PTG Capital Partners who filed a document stating they would pay $8Bn for AVP, which has generally been in free-fall for two years as their business model collapses.

Despite the TERRIBLE fundamentals of this company, within two minutes of this fake filing being posted by a fake company (11:34), the stock began climbing from $6.50, all the way up to $8 by 11:45 before the 23% gain triggered a halt in the system.

Despite the TERRIBLE fundamentals of this company, within two minutes of this fake filing being posted by a fake company (11:34), the stock began climbing from $6.50, all the way up to $8 by 11:45 before the 23% gain triggered a halt in the system.

That 7-minute break gave AVP time to deny that they had received an offer and the stock re-opened at 11:52 and dropped 10% that same minute, triggering another halt. Another 7-minute break and another 7-minute break and another drop of just under 10% let the stock sell off for the rest of the day. All in all it was total idiocy, but idiocy with a $3Bn company on a major exchange – not a penny stock!

"The SEC has so many forms being filed, I don't think it can check every one," former SEC lawyer, Robert Heim said. "But I think they could do a better job acting as a gatekeeper."

The filing contained many red flags raising questions about its authenticity, including numerous typographical errors and two different spellings of the company's own name. That would be highly unusual in an authentic regulatory filing, which would receive close scrutiny from companies before being posted. But robot traders and the sheeple that follow them don't read the reports, they just look for the keyword "buyout" and the frenzy begins!

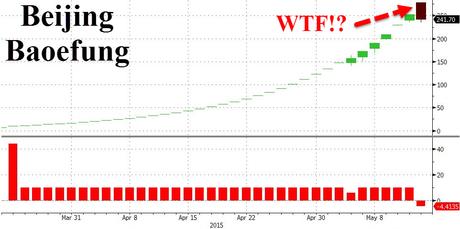

That's the kind of market we're in now – it's a madhouse and it's fine if you want to play along but try to be aware: IT'S A MADHOUSE – and should not be taken seriously. At this point, we're no different than the Chinese markets, where companies like Beijing Baoefeng can IPO at $9.43 and then, on identical daily volume for 35 consecutive sessions, makes identical 10% gains each day until finally, after going up 3,285%, it drops 4% in a day and everyone FREAKS OUT (it lost another 6.5% this morning).

That's the kind of market we're in now – it's a madhouse and it's fine if you want to play along but try to be aware: IT'S A MADHOUSE – and should not be taken seriously. At this point, we're no different than the Chinese markets, where companies like Beijing Baoefeng can IPO at $9.43 and then, on identical daily volume for 35 consecutive sessions, makes identical 10% gains each day until finally, after going up 3,285%, it drops 4% in a day and everyone FREAKS OUT (it lost another 6.5% this morning).

Beijing Baofeng offers a virtual reality headset for gamers and sells on-line videos and has a media player. Yesterday it was accused of copyright infringement on some movies and TV shows – just an accusation, no official filings, but it knocked 10% of the company's "value" off in 2 days. That drop from $250 to $225, by they way, was a bigger loss for recent investors than all the gains in the month of April.

Beijing Baofeng offers a virtual reality headset for gamers and sells on-line videos and has a media player. Yesterday it was accused of copyright infringement on some movies and TV shows – just an accusation, no official filings, but it knocked 10% of the company's "value" off in 2 days. That drop from $250 to $225, by they way, was a bigger loss for recent investors than all the gains in the month of April.

$3Bn was erased in two days but how much of that value was ever real. The funny thing is that investors (and I'm talking to all of your momentum chasers!) don't understand how this scam works. This stock was driven from $9.43 to $278.15 so the people who put in between $9.43 and $50 in the first month (20 sessions) at 6M daily shares spent $243M to drive the "value" of the company from $1.13Bn to $6Bn.

Unfortunately, the people who bought the stock over $225M in the last 4 sessions spent an average of $1.5Bn a day to add the last $6Bn in value, all of which was wiped out in 24 hours. As I often point out, the people who chase the stock are the real losers while the people who bought at $50 or less are long gone by now or, if not, are running for the exits while the people who bought at 4x their price are left holding the bag.

Unfortunately, the people who bought the stock over $225M in the last 4 sessions spent an average of $1.5Bn a day to add the last $6Bn in value, all of which was wiped out in 24 hours. As I often point out, the people who chase the stock are the real losers while the people who bought at $50 or less are long gone by now or, if not, are running for the exits while the people who bought at 4x their price are left holding the bag.

All I am saying is that, if you are in a stock that has run up a lot – don't get sucked into the hype. It's not a real profit until you cash it out so how about adding some CASH!!! to your portfolio – just in case there's a correction. Yesterday morning we found 10 cheap stocks to add to our Watch List and pulled the trigger on two of them for our Member Portfolios. I'll have another 10 over the weekend so it's not like we don't have any places to put our cash – it's just that we feel safer having some at the moment.

So far, so wrong as we've been expecting a correction but, instead, we're back at the all-time highs but we stuck to our guns and added more SDS positions to our Short-Term Portfolio and we'll be looking to get back in some Japan (EWJ) puts as /NKD (Nikkei Futures) popped back to 19,900 this morning, giving us a nice re-entry for a short position.

Maybe the markets can go up forever but, fortunately, I got some good market advice when I was very young:

There are plenty of painted ponies out there – no need to chase the rainbows!

Have a great weekend,

- Phil

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!