You have medical insurance, say, with Blue Cross.

You find yourself in a medical emergency like a heart attack. You go to a hospital that is covered by Blue Cross and undergo cardiac surgery, assuming your health plan will cover most of the costs.

Except it doesn’t.

That’s the nightmare that as many as 30% of Americans with private health insurance found themselves in last year, when they received a surprise medical bill from a doctor who had treated them but who is not in their insurance plan’s network. In some cases, the patient discovered even the hospital is not part of the network.

(1) 64-year-old Leigh Lehman of Hillsdale, NJ, needed a quintuple heart bypass. He made sure that both the Valley Hospital in Ridgewood and his surgeon accepted his Aetna Insurance, which Lehman gets through his employer, a small consulting company. A few weeks after the surgery, Lehman got a surprise bill in the mail for nearly $2,200 from a critical care doctor in the intensive care unit who did not accept Lehman’s insurance. The hospital and Aetna said there was nothing they could do, so Lehman dug into savings to pay it. He said, “It’s a little stressful. You’re trying to recover. It’s major surgery. I mean, I felt like I was hit by a truck.”

(2) Andrew Heymann, a New Jersey accountant, had health insurance through his employer from Anthem Blue Cross-Blue Shield. Two years ago, when he was helping a neighbor move, a large glass table shattered, and a shard of glass sliced deeply into Heymann’s left ankle. An ambulance took Heymann to the closest emergency room — at Hackensack University Medical Center – which he knew was in Anthem’s network. After a plastic surgeon sewed up Heymann’s leg, Heymann received a $6,000 “balance bill” from the surgeon who was not part of Anthem’s network. Blue Cross covered about $860, but Heymann was stuck owing $5,000. Happily for Heymann, after 6 months of fighting his bill and appealing with his Anthem, his employer paid it off.

Chuck Bell, Programs Director at Consumers Union, the advocacy arm of Consumer Reports, says “We’ve received, literally, thousands of stories from consumers all over the country that are having this problem.”

The reasons for these surprise medical bills include:

- Medical insurers increasingly are offering “narrow networks” — cheaper insurance plans that give patients fewer doctors to choose from. When patients go to a hospital or an emergency room, they inevitably run into physicians and providers that are out-of-network.

- Physicians increasingly are opting out of insurance plans that they believe pay them too little, as insurance companies reduce payment, year after year, to the point that many insurance plans pay below what Medicare pays. A physician who is out of network is permitted to bill at a higher rate to the insurance company and patient.

- Even hospitals charge insurance plans with out-of-network higher rates. Kevin Conlin, Chief Operating Officer of Horizon Blue Cross Blue Shield, New Jersey’s largest health insurer, estimates New Jersey’s insurers pay around $2 billion a year to cover out-of-network care.

The problem requires redress from state laws.

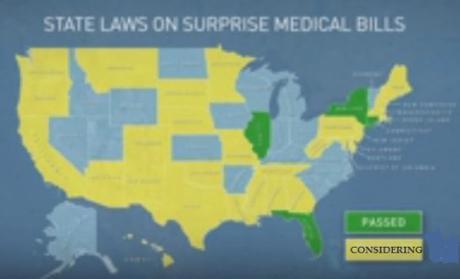

Four states — Illinois, Florida, New York and Connecticut — have already passed laws to protect patients against surprise medical bills. 28 states, including New Jersey, are considering such a bill.

- Mandate most doctors to participate in same networks as the hospital.

- Require doctors and hospitals to notify patients if they are not in network.

- Ban doctors from balance billing.

- Set up an arbitration system to press providers to defend their bills, and insurers to defend their rates.

But after years of negotiation, Vitale’s bill has gone nowhere because of competing interest groups.

Here’s the PBS Newshour video:

I suggest that, before we find ourselves in a medical emergency, we contact our medical insurance plans, doctors, and hospitals and find out their out-of-network providers.

Caveat emptor (buyer beware)!

~Eowyn