Evening one and all,

I have a chart of EURUSD for today.

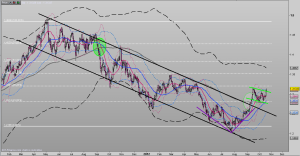

In September, EURUSD broke up convincingly from a long-term downward parallel channel. At the same time, most other risky-on assets surged up. EURUSD covered 400 pips in less two weeks. Resistance came in at the 1.3150 region, and the EUR/USD pair dropped back to the 200-day MA. Taking a high in 2011 to the low in July of this year, the fibonacci retracement levels 23.6% and 38.2% are in play. 1.2800 is a strong support zone for now because the 23.6% retracment level and the 200-day MA are there.

Looking at how EURUSD is well out of the long-term downtrend channel, I am leaning on the bullish side in the months ahead. The V-shaped price action (in purple lines) looks like a bottoming pattern for now. In hindsight, we can safely say the huge run-up in risky assets in September had to result in a retracement - which we are seeing now. Looking at the last two sentences, it should sound like a bullish pattern that we know – a cup and handle pattern. I am strict in defining those sort of patterns, and I do not see the EURUSD as having one. But, I see a possible breakout set-up on EURUSD’s chart. EURUSD has been rangebound between 1.2800 and 1.3200. Bollinger bands I have on the chart have been pierced by price. I will prefer to wait for slightly more upside before considering a long position. The current resistance gives me a good place to cut potential losses, while no clear resistance overhead means a good risk:reward tradeoff.

One important event to notice is the golden cross on EURUSD’s chart. While my experience tells me that there is a high chance of downside right after a golden cross, this is a basic – and strong – bullish technical signal. Take note also of the EURUSD finding good support at the 200-day MA. The last time EURUSD stayed above the 200-day MA was back in the former half of 2011.

Time to build up a mid-term trend trade?

All analyses, recommendations, discussions and other information herein are published for general information. Readers should not rely solely on the information published on this blog and should seek independent financial advice prior to making any investment decision. The publisher accepts no liability for any loss whatsoever arising from any use of the information published herein.