Our health is the most essential aspect of our lives, as it is the window to our happiness and the world. Our lives are connected to our dear ones, and we can't ever afford to affect their lives for the bad, isn't it?

In today's world, one of the best ways to secure and assure lives of not only oneself but also of our near and dear ones is by choosing the best of Insurance Plans. But, every health and insurance plan has their pros and cons, which differ from company to company. While we talk about Life Insurance or Wealth Plans, one of the best till date is the Edelweiss Tokyo Wealth Plus Plan which covers a whole lot of aspects making it #unyakeenable for us. How?

Well, to begin with, it is a unit linked insurance plan (ULIP) that has- Over 20-year premium paying term, 80% of one-year premium is invested viaadditional allocation.- No Premium Allocation & Policy Administration Charges

- Additional allocation (as a % of Annualized Premium) on every premium paid and increases every 5 years -

- - Extra Allocations - added with every premium in the first 5 policy years - 1% Premium Booster - added at the end of each year starting from the 6th policy year till the end of the premium paying term - the premium booster start at 3% for year 6 to 10, 5% for year 11 - 15 and 7% for year 16 to 20.

Lumpsum amount (based on age of policyholder) becomes payable immediately+Sum of all the future premiums shall be credited to the Fund Value instantly +Under this strategy, fund value is distributed between the below 2 funds: All future premiums will be waived off+5 fund options are available under the plan, which are as follows- This strategy thus provides the flexibility to: Additional allocation will be added to the Fund Value as and when due+ Maturity Benefit becomes payable on maturity

Maturity Benefit becomes payable on maturity What do they expect from the policyholder? Two simple things -

The Additional Allocation feature is the newest in the market and encourages investment. That's not all! Let's dive further into details of the next feature or aspect which comprises of the Child Proposition also called as the Rising Star Benefit.

With the Rising Star Benefit feature, your child's dreams would be fulfilled. On the death of the parent (policyholder), he/she will be entitled to receive the following benefits under this feature:

The above feature of the Edelweiss Wealth Plus Plan ensures optimum + excess returns and covers all the aspects that may be experienced by the child. Thus, no plan could be as great as this, which thus makes it #unyakeenable for me. Don't you agree as well?

Next is the Investment Strategy.

Life Stage and Duration based Strategy - in this model and it divides the investment into proper divisions as per age and duration to the end of the term. As age of the life insured starts to increase and the remaining policy term reduces, this strategy ensures money is moved automatically from a riskier fund to a safer fund progressively.

For example, if the attained age (at inception) is 40 years and the remaining policy term is 20 years, then 80% is allocated in the Equity Large Cap Fund and 15% is allocated in Bond Fund. Whereas, if the attained age (after 20 years) is 60 years and the remaining policy term is 0 year, then 0% is allocated in the Equity Large Cap Fund and 100% is allocated in Bond Fund. This policy, thus, ensures optimum utilization of the investments and makes proper use of the same.

Self-managed Strategy- in this model, policyholder can invest the premium in any of the available funds and in the proportion of his/her choice based on the risk appetite.

- Switch the invested amount amongst the available funds using the switching option.

- Redirect the future premiums to the newly chosen fund using the redirection option.

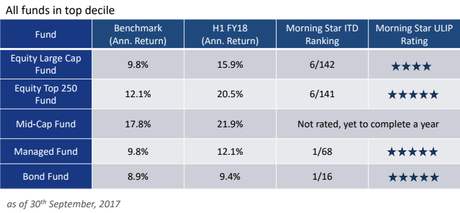

The chart for Superior Investment Funds: ULIP, wherein all funds in top decile are stated in a tabular format below:

For example, if the age of the insured male is 30 years where the annualized premium is 1,00,000 INR as the mode of payment is annual and the investment strategy chosen is self-managed with the policy term being 20 years and the premium paying term is 20 years with no Rising Star Benefit, then the Sum assured would be 10,00,000 INR. The Extra Allocation and Premium Booster will be added to the fund and will grow along with the fund. Thus, the maturity benefit would be 41,41,053 INR. Whereas in Mutual Funds, the same fund would grow to 39,39,813 INR. Also, investing in mutual funds won't provide life insurance benefit at any point in time. Hence Wealth Plus seems to be a hero as an investment product.

Isn't this one of the best investment wealth plans ever? Don't the benefits and ideas make you feel #unyakeenable about this entire plan? Share your ideas and thoughts in the comment section.