Evening all,

I must apologise to regular readers starved of technical analysis here for the draught of posts in the last few weeks. I have been suddenly more active in a time-consuming hobby – golf – so time for the markets and charts have been shortened. Anyways, I should be back to churning out at least 2 posts every week soon.

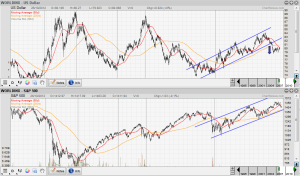

Ever since the drop in equities because of the US Debt downgrade last year, the market – as it should be doing so in a multi-year bull-run – defied bears by going on a good-sized 25%+ rally. At the same time, the US Dollar has been strengthening as well. On the fundamental side, with all the dire predictions aimed at the Fed for setting off the printing machines, the US Dollar has still strengthened. There are reasons out there, but I shall not discuss here.

As of now, while equities are still trudging higher, the Dollar has lost some strength in the last few months. Chart-wise, the Dollar has already started to look bearish. The death cross a few weeks ago plus the breaking of a mid-term uptrend channel are obvious bearish takeaways. Equities may turn down in the weeks ahead. With growth forecasts cut around the world, mundane-to-disappointing earnings from corporations, and a subdued-to-gloomy outlook for major economies (including China), the case for falling equities has been making some headlines in financial media. Chart-wise, I still have to keep my head up as mid-term and long-term trends are still strong. Bearing in mind that the Dollar and equities share a negative correlation in general, is it time the Dollar depreciates against other currencies and equities fly off to even greater heights? When comparing two instruments that supposedly share some kind of correlation, the basic theory is that when there is a contrary movement, what should happen after a while is that the two instruments will go back to the correlation that they are supposed to share. In this case, I will watch and see if the greenback continues to fall while equities hold up strong.

All analyses, recommendations, discussions and other information herein are published for general information. Readers should not rely solely on the information published on this blog and should seek independent financial advice prior to making any investment decision. The publisher accepts no liability for any loss whatsoever arising from any use of the information published herein.