What’s this? Would someone please put out the fire? Our economy is overheating!

We're in the red hot, somebody call the fire engine!

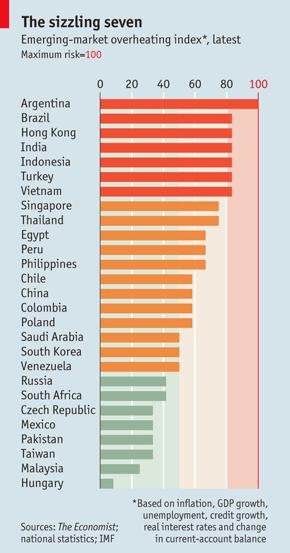

Yes, the economy is growing, yes, the rate of inflation is under control. Did I forget to mention that those are only things that has already happened or is expected to happen this year? What about next year? Five years from now? Or ten years from now? Some indicators are often disregarded by policymakers until the danger of collision is right in front of their noses and there’s nothing else that can be done save for putting their hands where their noses are. Nope, it doesn’t help at all, we’ll still get a bloody nose, at the very least.

Of course, the fact that most policymakers in Indonesia aren’t raising concern over this development is because they’re high on this country’s recent economic performance. Either that or they are ignorant. It is indeed human nature to assume that the good times will last a long time, to not take caution against dangers beyond the horizon. But I won’t go into too much details on the psychology of humans and how their vested interests can cloud observation and judgment. That’s for another article to evaluate.

What needs to be told, because not enough people is telling, is that we’ll be running into a wall in the next 5 years if the current policies, particularly the expansionary monetary policies, are not reversed. I am particularly concerned about the growth of credit in Indonesia and how this is contributing greatly to overheating of the economy. Bank Indonesia (Indonesia’s central bank) has slashed the benchmark interest rates late last year to 6.5% as a response to fears regarding the possibility of shortfall to economic growth due to the fallout from the crisis in the West. I have lauded this decision in a previous article looking at the falling CPI (indicator of inflation). I admit, I was wrong regarding that (the part about lauding the decision).

While the inflation is indeed under control, the slashing of the benchmark rate is poorly made because it is done amid rapid growth in bank credit. In 2011, bank credit saw a growth rate of 26% from 2010. It is projected that in 2012, it will grow by a further 24-27%. This, with a projection by Bank Indonesia of economic growth (GDP) of 6.3% in 2012. What this means is that consumption and investment will grow by 380% to 420% of the growth in the national economy. It doesn’t take a genius to point out that this trajectory is definitely unsustainable.

Unless some action is taken, whether through monetary policy or tighter lending standards (or both), the real economy will be affected. Sectors dealing with fixed assets such as the property market will see serious bubble as prices and rents rise beyond what the market can really accept. The inflation is very likely to spill over into other sectors, particularly consumer products and food, which will affect large portions of the Indonesian population. This is particularly bad because food forms a significant share of the consumer-price basket for at least half of the population. The end result of such an inflation would be social chaos not unlike those we have seen in 1997-1998. This can prove detrimental to the country’s ongoing process of democratization and national reformation. As such, it is imperative that solutions are executed to prevent this “doom-scenario” from being realized.