BUT WHYYYYY?!

In the first three “Parts” of this article (#1 More Debt, #2 Ponzi Schemes, & #3 Fractional Reserve Banking), I explored and advanced an hypothesis concerning America’s National Debt. I argued that our National Debt isn’t growing due to accident or governmental incompetence. Instead, I argued that that our seemingly uncontrollable National Debt (it nearly doubled under the Obama administration) grows out of a mathematical necessity that’s somehow caused by our Debt-Based Monetary System (DBMS).

In essence, I believe that our DBMS forces our National Debt to grow as a necessity and requirement. The the DBMS will die if it’s not constantly fed an growing stream of debt. If the DBMS dies, it will kill our debt-based economy.

More, I suspect that the debt must not only grow, but must grow “geometrically” or, at least, it must grow faster than the economy. If that’s true, it’s the the kiss of death for the DBMS and our debt-based economy.

Our DBMS (Debt-Based Monetary System) doesn’t simply make more debt possible, it makes more debt necessary. If we fail or refuse to go deeper into debt, our DBMS and economy will collapse into chaos.

If my hypothesis is roughly correct, it means that any promise by the Republican Party or President Trump to eliminate deficit spending and/or reduce the National Debt from $20 trillion to, say, $19 trillion—is not only false, but potentially dangerous. If they succeed in significantly reducing the National Debt, I believe that reduction could cause our debt-based economy to collapse.

Part IV: Why? Debt to GDP ratios

In the last three “Parts,” I promised to explain why the DBMS requires that we go ever deeper into debt. Unfortunately, (once again) I can’t really keep that promise. In truth, I still don’t know exactly “why”.

What I can say is that my hypothesis “walks like a duck”. It quacks like a duck. It goes good with orange sauce. I therefore conclude that my hypothesis is a “duck”. In other words, I infer from indirect evidence that my hypothesis (that the DBMS forces America to increase the National Debt) is true.

But, in order to actually prove my hypothesis, I feel that I need some supporting mathematical formula. But I’m not a mathematician. I can’t create such formula on my own. The fact that my hypothesis “looks like a duck” may be amusing or even persuasive, but it’s not proof that the hypothesis is valid.

On the bright side, I can point to other sources that I (at least) view as a kind of mathematical evidence that supports my hypothesis. There’s apparently some sort of observable correlation between growing debt and an increasing GDP. But, why that correlation exists is still a mystery (at least to me).

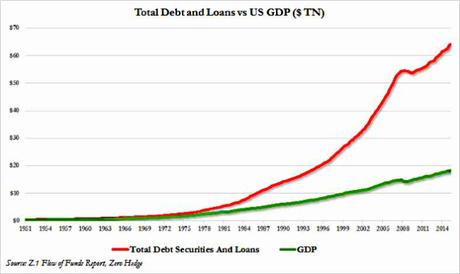

• Here’s a graph from an edition of ZeroHedge.com that illustrates the terrible problem faced by the government and central banks: There is a correlation between debt and GDP, but it’s not a fixed ratio. That is, over time, it takes more and more debt to cause the GDP to grow as much as it grew previously with less debt.

The graph’s red line represents the growth of U.S. total debt. The graph’s green line represents the growth of the U.S. GDP.

It could well be that the growth of debt and the growth in the GDP are only coincidental. Maybe there’s no causal relationship between debt and GDP. However, I’m arguing that the relationship is not coincidental–that it is causal.

This argument is hardly a stretch. Everyone knows that during the Great Recession President Obama and the Federal Reserve borrowed and spent an extra $9 trillion (and doubled the National Debt) in order to “stimulate” the economy (increase the GDP). Clearly, Obama and the Fed believe that more debt would cause the GDP to grow. But I suspect they were shocked to see how much additional debt was required just to sustain the economy. You can see the cause for their shock in the graph. The red line/total-debt is growing much faster than the green line/U.S. GDP.

I.e., according to the graph, back around A.D. 1970, a $1 billion increase in debt might cause a $1 billion increase in the GDP. If that 1:1 ratio was fixed, the DBMS could continue to support and stimulate the economy as far into the future as anyone could see. So long as the debt to GDP ratio remained fixed at around 1:1, all the Federal Reserve and/or government would have to do was: 1) decide how big they wanted the GDP to become; 2) create the right (fixed) ratio of debt instruments; and, 3) presto-changeo!, the economy could grow however much our fearless leaders decreed.

Unfortunately, judging from the ZeroHedge graph, the ratio of debt to GDP is not only changing, it’s accelerating. The debt is growing faster than the GDP. Today, it no longer takes an extra $1 billion in debt to stimulate the GDP into growing another $1 billion. Instead, it now takes an additional $10 billion in debt to create and extra $1 billion in GDP.

Forty-five years ago, the ratio of debt to GDP growth was 1:1. Now, it’s 10:1. We’re not getting the same GDP “bang” for the same debt “buck”.

I don’t know why the ratio of debt to GDP growth is changing. I sense that it’s changing. I infer from the ZeroHedge graph that the ratio is changing and accelerating. Perhaps the public is becoming dulled to the impact of fiat dollars. As with other drugs, maybe the world’s fiat-dollar addicts are becoming more and more desensitized. Maybe they need an ever-greater “fix” of fiat dollar debts to achieve the desired “high” (increased GDP). Perhaps that desensitization explains why the economy needs more and more debt to match or achieve previous levels of GDP stimulation.

Maybe it has something to do with inflation. The dollar has lost over 95% of its purchasing power since A.D. 1971. Today’s dollar is only worth about about a nickle as compared to a 1971 dollar. Maybe the world somehow senses that loss of purchasing power and therefore demands ten (twenty?) of today’s dollars to achieve the same economic stimulatation as might’ve been achieved by one dollar in A.D. 1971.

Whatever the explanation, the graph illustrates why I suspect that the debt must not only grow, but must grow “geometrically”. It appears that, in order to sustain our DBMS, the National Debt must grow faster—much faster—than the GDP.

• That’s why I believe Obama was forced to double the National Debt during his eight years in office. Did the economy double during the same period? No. In fact, it barely grew at all. Obama doubled the debt and all he did was prevent (or perhaps only forestall) an economic collapse.

Imagine that your income increased by 10% each year but your credit card debt doubled every year. How long would it be before you’d be bankrupt? Not long.

Similarly, suppose the U.S. GDP increased by 4% each year (as Trump hopes), but the National Debt doubles every eight years (an average of 12.5% per year). At the end of eight years, the GDP might be up by 32% but the National Debt might be up by (at least) 100%. How long before the government must declare bankruptcy? Not long.

More, based on the ZeroHedge graph, we can project that by A.D. 2030, it might take $100 billion in annual new debt to cause the GDP to rise by just $1 billion. Of course, an extra $100 billion in annual debt is impossible (unless we entered into an era of inflation that cut the dollar’s current value by another 90%). Therefore, if the trend seen on the graph continues, we’re at, or fast approaching, a moment when it’ll be obvious to all that it’s impossible to create enough new debt to sustain, let alone increase, our GDP.

At that moment, the public’s “full faith and credit” in the DBMS will vanish, hyperinflation will follow, and the DBMS and all debt-based national and global economies will implode. All those who stored their wealth in paper debt-instruments will be impoverished. The demand for real, physical assets (like gold and silver) will cause the value of tangible assets to skyrocket.

The Proof is in the Shooting

My hypothesis may be mistaken. It might even seem absurd. However, as supporting evidence, tell me how many years the Republican Party has run for office based on their promise to cut government’s deficit spending and reduce the National Debt? Now, tell me how many years since the onset of the DBMS in A.D. 1971 have the Republicans won control of government and kept their promise to cut deficit spending and the National Debt?

A: Virtually, none.

Sadly, there’s always some pesky war going on someplace that expands and thereby “forces” the Republicans to increase, rather than reduce, the National Debt. They don’t want to do it, of course—but whatcha gonna do?

Well, who can blame them? What’s a government “sposed”to do? Clearly, we must “back the boys” on our various military adventures by spending more currency on tanks, helicopters, bombs and bullets purchased with more and more borrowed funds (debt). Of course, we can’t raise taxes to support our wars. If we did, the taxpayers would scream for an end to the war. Therefore, modern warfare must depend on more borrowing with results in more debt.

If modern war is “hell,” it’s also cause for more debt. (I don’t know if the relationship between war and debt a unintended coincidence or a cause. I do know that modern warfare is virtually impossible without a strong credit rating.)

However, it’s not just the Republicans who cause more wars and thereby increase the debt. The Democrats are just as guilty. For example, consider the record of President Obama who, in his first year in office, won the Nobel Peace Prize. You’d think he might have some aversion to war, right?

Well, he doesn’t. He kept the U.S. military ensnared in Iraq, Afghanistan, and now Syria.

But, how can it be that the almighty U.S. military wound up trapped in Iraq for nearly nine years? Couldn’t we have just kicked the Iraqis’ butts in a year or two and brought the troops homes?

Likewise, couldn’t we have destroyed the ragtag rebels in Afghanistan in a few months or years? Why are we still in Afghanistan thirteen years after our initial invasion? Are these goat-herders just too tough for the U.S. military?

Clearly, we must have some ulterior motive to remain in Afghanistan besides bringing freedom and democracy to the Muslims. Could that ulterior motive be the creation of more debt?

What about the F.N.P.W. (Famous Nobel Prize Winner) Barack Obama? Why didn’t he, as President, unilaterally “pull the plug,” order the American military to clear out of Iraq, Afghanistan or Syria and give us another dose of “peace with honor”? Do our wars drag on interminably because our rag-tag adversaries are incredibly tough? Because our nobel government is determined to fight on for some principle like “democracy”? Or do our wars last “forever” in order to create more debt?

In other words, is our new debt merely an unintended consequence of war? Or, could debt-creation be the fundamental reason for war? Could it be that once Americans accepted the DBMS, international war (actually, “police actions”) become necessary, not to destroy the bad guys, but to justify the creation of more domestic debt?

• Y’know, some argue that the American government created and secretly funded the Islamic State and Al Caida as credible villains and terrorists for the purpose of justifying our Middle East wars. Some think terrorism is at least partially a scam to justify more and more wars or at least more military spending. Some think that modern warfare is caused by “the world bankers”.

Each of these three conspiracy theories shares a common denominator: modern warfare is intimately tied to debt. In fact, modern warfare and the “military-industrial complex” are primary creators of nearly unbridled debt. The public might grumble about growing government, more welfare or the cost of Obamacare. But what real American would begrudge going a little deeper into debt to support the “boys” in Afghanistan?

Think of all the bullets and bombs that’ve been fired or detonated (often harmlessly) in the Middle East over the past 20 years. According to one source, the U.S. fired 250,000 bullets in Iraq for each “insurgent” killed. For the cost of the bullets alone, we could probably have sent all of those insurgents to college. How could we have fired so many bullets and yet not have destroyed our adversaries? Clearly, we must’ve been firing most of our bullets into places where the enemies were not present

Can’t our “boys” shoot straight? Are we fighting enemies that are so elusive we can’t even find them? Do these elusive enemies even actually exist?

Is our modern, high-tech military really that impotent?

Or could it be that the primary object of modern warfare is not to subdue and destroy foreign enemies but instead to create more debt the American people?

• Lots of people refer to our political parties as the “demopublicans” and “republicrats”. Some claim there’s not a nickel’s worth of difference between the two parties. Could it be that the common denominator for both parties is their secret addiction to same drug: debt?

Whatever the answers to these questions may be, one thing seems clear. Regardless of what they say, regardless of what they promise, both the Democrat and Republican parties seemed determined to contiue with deficit spending (borrowing) and increase the National Debt by means of more war debt (fight now, pay later). Similarly, regardless of rhetoric to the contrary, both parties seem equally determined to increase the size of the government bureaucracy and the welfare state—both of which institutions grow by means of increasing the National Debt. Is the real objective behind the growth of big government to better serve the taxpayers, acquire more power for the government or to create more debt to support for the DBMS?

Inquiring minds wanna know.

But, There’s a Problem

There’s limits. There’s a real “debt ceiling” that can’t be exceeded even by Congressional legislation.

Perhaps the growth of the National Debt is simply an inadvertent, unintentional consequence of modern war and big government. Or, perhaps (as I hypothesize), the debt must grow to feed the DBMS. Either way, there’ll come a time when government’s source of credit dries up or the American people adamantly refuse to go deeper into debt. (Trump’s election might be viewed as early evidence of a growing populist refusal to go deeper into debt.)

One way or another, we’re going to reach a “debt ceiling” that can’t be exceeded by even an act of Congress. Why? Because sooner or later the world’s creditors will refuse to lend any more currency to the world’s biggest debtor. It’s got to happen—and probably not so long from now.

Q: Can the DBMS survive if we stop (or are stopped from) going deeper into debt?

A: I don’t think so.

Once our capacity to create more debt fails, the Debt-Based Monetary System and Debt-Based Economy should also collapse.

We’re addicted to the DBMS and fractional reserve banking. We’re dependent on the DBMS and fractional reserve banking. Debt is no longer a luxury. In the DBMS, debt is a necessity. If we stop diving deeper into debt, the Debt-Based Monetary System and Economy will cave in on our heads.

I’m convinced that we’re riding a debt-tiger. I don’t think we can’t hang on much longer and I know we can’t safely dismount. We can’t pay the debt. We can’t cancel the debt. And, in my opinion, our DBMS demands that we create more debt.

Time’s running out. The debt’s growing. The real debt limit (end of credit) is approaching.

I hope you’re keeping your wealth in some media other than paper or digital debt instruments. If you’re not doing so, you’re going to lose your assets.

Advertisements