pic credit: Investment U

Every major cryptocurrency has dropped 30% to 50% in the previous 30 days, and it appears that there is no end in sight. The sentiment is fading, and I can sense a resurgence of negativity. But, given the current state of the market, I needed to get something out immediately.

As a result, let's take a brief look at why the markets are down, whether you should be concerned in the long run, and some immediate steps you can take to boost your earnings.

We need to look at other asset classes also

I want to start by saying although crypto is down, we need to look at other asset classes first. Zooming out will help us set the stage for what's going on in the world and zooming out, we can see everything is down right now. The Nasdaq is down significantly.

pic credit: Google Images

Anything high growth, anything tech is not doing well. Even what's generally considered the safe bet in investing, the S&P 500 is down 10% in the last month. That's a massive amount. This is largely the result of uncertainty.

Investors are anticipating earnings calls this week as well as policy announcements from the Federal Reserve, which might tighten monetary policy somewhat. Essentially, investors are concerned that the Federal Open Market Committee, which sets interest rates, will raise rates quickly in order to combat inflation.

If interest rates rise dramatically, borrowing money will become more expensive. This is important in stocks, particularly high-growth stocks, because they borrow money to develop quickly. As a result, it's understandable that if borrowing rates rise, growth would drop.

Now, it's improbable that the FOMC will decide to raise rates drastically all of a sudden, knowing that this would produce complete market chaos. Instead, it's more probable that they'll designate a target date for when rates will begin to rise gradually.

What does this have to do with cryptocurrency?

In times of fear, investors, particularly large institutional investors, will shift funds to safer asset classes in anticipation of further market declines. As a result of the rebalancing, more money is being withdrawn out of crypto, speculative assets, and even non-speculative stocks, and invested in more secure assets.

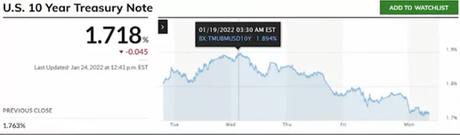

One way to track if money is being moved to safer assets is by looking at the ten-year treasury yield. The yield of this government-backed bond will typically decrease in times of uncertainty. And if we look at the charts, the ten-year note has actually decreased 8.5% since last week.

Again, these are big money-making moves in anticipation of monetary policy changes. Then what we see is the fear from one market creeping into other markets, which is what we're seeing in crypto. People tend to assume that if it's time to be scared in one asset class, well, we better be fearful in this other asset class as well.

And the funny thing is that this kind of ends up being a self-fulfilling prophecy. And the funny thing is that this kind of ends up being a self-fulfilling prophecy. People pull money out, markets dip, fear increases, more money gets pulled out, markets dip even further. It's this vicious downward spiral.

Then we have the added impact of Russia. The Central Bank of Russia recently came out with a report titled "Cryptocurrencies: Trends, Risks, Measures". In this report, cryptocurrencies are compared to Ponzi schemes. And there's a call for this outright ban throughout Russia by the bank of Russia.

And this caused a little bit of an uproar throughout the world of crypto and hurt markets as investors who were already on the edge of their seats worried about crypto, they received this confirmation that you know, this may be a good time to go ahead and exit the market for a little while. However, it turned out that the opinions of the report were not a consensus.

The ban is not universally accepted in Russia. Others have said that a ban of this magnitude would be virtually impossible, which I have to agree with you. I mean, someone could just use a VPN in Russia and still use crypto if they wanted to if it did get banned. To me, this is something to keep an eye on, but it doesn't feel like something that should keep you out of the markets entirely.

Of course, none of this is financial advice. In crypto, another way to judge fear in the market, besides the obvious of just looking at price charts and seeing bloody red price decreases, you can gain some insights by looking at the market caps of stable coins.

This is because, in times of uncertainty, people will move some of their crypto positions to assets pegged to the dollar- stablecoins. In fact, this is a moneymaking strategy that I'm going to talk about in just a minute. But if we look at the market caps of UST, USDT, MIM, USDC, we can see that they have all had dramatic increases in market cap in the last month.

So this leads us to the question, is this the end? Is this the long, dark, cold, bear market that we've been worried about?

In order to better understand, I think we should look at adoption instead of prices, pretend that CoinMarketCap doesn't exist, and ask the question, is blockchain technology actually being used more today than six months ago? More today than a year ago? Is it trending upwards? This is important because, in the long run, the value of crypto projects will be determined by the value that they provide.

Is this technology actually being used? Where are the trends headed?

So let's start off with NFTs. Trading volume for NFTs hit $10.6 billion in the third quarter of 2021, up 704% from the previous quarter. Facebook and Instagram are finishing a feature that will allow users to display NFTs on their social media profiles.

pic credit: crypto briefing

Coinbase will soon accept credit card payments for NFTs. This means you don't even have to deal with crypto in order to buy an NFT. Some say this is a double-edged store. They don't really like it, but others think this is awesome news for the average investor, the average person to get into NFTs. Now, play-to-earn games.

In Axie Infinity alone, there was $5.5 billion locked in virtual assets in November in a single game. Crypto games are gaining traction, they're getting more fun, they're getting more users, and they're even gaining popularity on Twitch.

And this is despite the fact that crypto gaming has only an $18 billion industry market cap. That's 1/6th the size of DeFi and more than 100 times smaller than the regular video game industry.

What about DeFi?

According to DeFiLlama, the current total value locked in DeFi exceeds $290 billion. Now, DeFi 2.0 was a fantastic innovation. However, it just simply was not user-friendly enough for the average investor.

Now, with DeFi 3.0 things like DeFi as a service, or just more usability in the space means projects can appeal to your regular investor who doesn't have the time to learn the ins and outs of yield farming, or just anything having to do with DeFi.

Increasing the usability means an increased scope of people who can use these products, thus increasing the market cap for DeFi and crypto as a whole. Then more broadly, we're seeing more and more institutional investors embracing cryptocurrencies, we're seeing large corporations adding crypto to their balance sheets, and countries beginning to accept Bitcoin as legal tender.

This has largely all happened in the last year, so it's safe to say that the industry is moving in the direction of adoption despite prices declining in recent months. I think we would be having a completely different conversation if we couldn't see those darn price charts.

Now, this isn't me saying that you should dump your entire life savings into crypto, or that it's some kind of risk-free bet. That's not what I'm saying at all. I'm just saying actual use metrics seem to be increasing, and that's what will matter in the long term.

How you can actually make huge profits during the bear market

There are two strategies that I'd like to discuss here that I personally use and have seen a lot of success with. The first is simply buying the dip. Now, this is a bit obvious, but you need to be a little bit more tactful than just hucking your money into projects and crossing your fingers that the market turns.

Now, in times like the current market, buying the dip can feel like you're straight up throwing cash into a bonfire. I've been buying, and it feels like that. And this is a bonfire that is slowly consuming your home.

But the reality is if you believe blockchain technology is here to stay and it's here for the long term, then there's no reason you should believe that prices won't eventually go up in the long run.

Now, I have no idea where prices are going to be in the next month, but I do know that buying Bitcoin today at $35,000 is actually less risky than buying it at $60,000 in November. That is if you think crypto has long-term staying potential.

My strategy is to buy the dip and not focus on the ultra speculative small-cap cryptos for now. Instead, I'll focus on the largest cryptos, the largest layer-1s that I believe have the most staying potential. The simple reason for this is diversification.

Buying a layer-1 is like buying a farm with 50 cows instead of buying a single cow. A single cow can die, or maybe it gets mastitis. I used to work on a farm if you can't tell. But the point is, chances are if you own the farm, you're not going to lose all 50 cows. If a layer-1 has 50 projects built on it, then you're going to be okay.

If one of those projects goes under, and when money begins flowing back into the crypto space, you will be the first one to see gains. Money flowing into the space typically seems to go in disorder.

Bitcoin first sees some gains, then Ethereum, then other large layer-1 blockchains, and then smaller cap projects with potential, and then you see the speculative crazy type projects gaining steam. It seems to go in that order most times.

In terms of how much I'm buying, I've already purchased quite a bit, but I always leave money on the sidelines ready to seize any massive dip opportunity. So let's say I had $1,000 to buy the dip. I may use $300 today and then buy $100 every five or so days until that money runs out.

Unless I see a big dip in the market even further, in which I may double the by that day to $200, dollar cost averaging will help flatten out the volatility. If you've gone all-in on the first dip in November, you wouldn't be so happy right now.

Now the good part is you can still make money with the money that you have on the sidelines. This is good either to put that cash reserve to work or if you're thinking, buying the dip, that's too risky for me right now. I simply lend out my stablecoins, always. With this, you can earn some nice passive income and you don't have to worry about any 30% corrections in price because it's pegged to the dollar.

Bottomline

All in all, we need to remember that this is an entirely new market. It's easy to forget that the price we pay for massive gains is a massive downside risk and we're going to see this and this is going to happen again in the future.

This is why any purchase I make is made with the intention to hold long term. Because I can't guess where the market is going to head next week or next month. No one can. But I can look at the sentiment. I can do my best to understand how the technology will be adopted and I can invest based on five and ten-year potential.

Now if tracking all of this is too overwhelming for you, that is totally fine. You are not alone. You don't need to overcomplicate things. Your investment strategy could be as simple as buying $50 a week in Bitcoin and never looking at the news. There's literally nothing wrong with that.