Sometimes taking loans may be a tough task because of poor credit scores, it is not a mystery that people with low credit scores have a hard time finding a lender who is ready to accept their loan application. Even though there are short term loans available for people with poor credit, like payday loans, £500 loans and many more, these are just small loans.

Lenders run soft or hard eligibility checks on their applicant's credit history when he applies for a loan with them.

As people are aware that there are ways to check your credit score without having it affected, that is by using a loan eligibility checker, it will help you determine your eligibility for a loan. Even for you to use the loan eligibility checker, there are certain requirements you have to meet.

If you want to know how to improve credit score UK, then read on further to know more.

What is a Credit Score?

It is a calculated numerical result of statistics that helps a lender determine if you're eligible for a loan. It is used by lenders to determine if you will pay the borrowed sum or not. Credit scores usually range from 300 to 850. Higher scores point out the punctuality of payments and the trustworthiness of the borrower. The Fair Isaac Corporation (FICO) created the credit model and now is widely used by financial institutions and corporations alike. FICO credit scoring system is by far one of the most popularly used systems.

Here below is the average FICO score range

- 300 - 579: Poor

- 580 - 669: Fair

- 670 - 739: Good

- 740 - 799: Very Good

- 800 - 850 Excellent

Factors That Affect Credit Scores

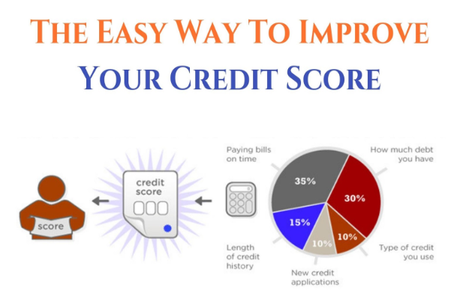

Here are some of the common factors that affect your credit scores:

- Newly taken credit

- The type of credit

- Credit history length

- The total amount that you owe

- Payment history

Credit Checks

When a financial institution searches for information regarding your credit history, it is called a credit check or credit search. This is done in order to determine your financial behavior, like making payments on time and many more. This is crucial for a lender as it is up to him to decide if you're eligible for the loan or not. There are two types of searches that lenders usually do: