During the study of the various components of the Balance Sheet, a thought sneaked into my mind. I smiled on the thought. The thought was, 'We humans are so clever. We listen to the things which we want to listen and ignore the rest!' For an example, consider this fact. You never start your day till you have read the horoscope for the day. You have a strong intuition that your day would go just great! You read the horoscope in a daily newspaper. The difference is that the horoscope has written just the opposite. Now, pause for a second and think. What would you do?

I am sure that most of you would check out other newspapers and websites till you get to read what was actually in your mind, what your intuition was telling you. Only then you would get relaxed. Did you notice something? I know all of you have noticed but choose to ignore it. This is something which we have been hard wired with. The best example about this concept is a kid's behavior. Parents would definitely agree to this one. If you have kids at home, you can't deny this, too.

If a kid wants a chocolate, the kid would get hold of you. He/she will not leave you till you get irritated and give it to them. What happens to us when we grow old? As we grow older, our minds get conditioned to the fact that there is difference in wanting and needing a thing. As a consequence of the fact that we as humans are highly adaptable to all the conditioning we get, we tend to believe the facts. The result? We leave most of the things we wanted to achieve in life.

This is a proven by research as well. The biggest regret for most of us who are on the death bed is:

"I wish I'd had the courage to live a life true to myself, not the life others expected of me."

This has been published in Times of India as well. This left me to ponder upon the thought that if a Balance Sheet is the snapshot of the company, what is the snapshot of our life? Seriously, I don't want to die with the above said regret. I am willing to do anything needed to stay away from the weird feeling. I am sure that you all would also not like the idea, either. I contemplated a little about it, jotting down the pointers which would help me to prepare a Balance Sheet which would act as a snapshot of life.

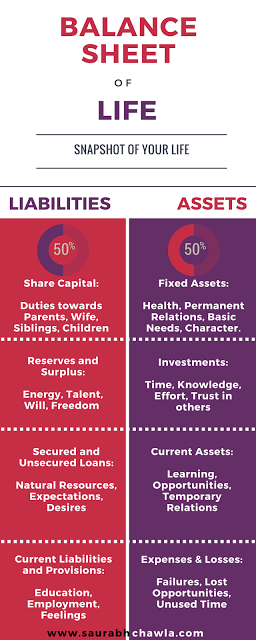

I would like to introduce you to the components that make a Balance Sheet. They are the Assets and Liabilities. The terms are more or less self explanatory. Assets are the things which you have earned or built up. In financial terms, they are narrowed down to two more categories: Current Assets and Fixed Assets. Current Assets tend to liquidate themselves in a short span of time, usually within one year. Fixed Assets, on the other hand tend to be more of stay with you long kind of assets.

Similar classification is of the Liabilities. Fixed and Current Liabilities. Liabilities can be understood in layman terms as the price you have to pay for earning those assets. I would like that you all hold on for few moments here. Take a walk, ponder upon it, come back again. What you all deduce? It's a cycle. A vicious cycle in which we all are circling around. What's most important to most of the people is money, right? Some of you won't agree, but I would like to share a quote here which I read in a recent self help book by Napoleon Hill:

"Whatever may be said in praise of poverty, the fact remains that it is not possible to live a really complete or successful life unless one is rich."

Liabilities can be best understood by the example of home loan. Suppose you want to buy a house. You would approach bank for a loan. The house is your asset. Loan will be your liability. What you are doing? Paying a price (interest on loan) to earn that asset (house). Right? Similarly, is that not evident from all this that a Balance Sheet can be created for your life in a similar fashion? It is.

Below is an ideal Balance Sheet which can be considered as a snapshot of your life. I call it as ideal because it shows a fifty-fifty balance between Assets and Liabilities which normally is rare in reality ( I am talking about life here :-)).

The more successful you are in balancing them, more you would be able to lead a good life. More it gets imbalanced, it could lead to disturbances in life.

So are you able to balance the Assets and Liabilities? Do share your thoughts.