Three days ago, on Saturday, March 16, 2013, the people of Cyprus were told by the grand poobahs of the eurozone that as much as 10% of the deposits in their personal bank accounts would be “levied” confiscated, in exchange for a $13 billion (€10 billion) bail-out of their heavily indebted country to avoid default and a banking collapse.

Cyprus is a small island country in the Eastern Mediterranean Sea to the east of Greece, and a member of the European Union (EU). The eurozone is an economic and monetary union of 17 EU member states that have adopted the euro (€) as their common currency and sole legal tender.

The 10% levy figure is now undergoing furious negotiations. Most likely, Cyprus and the eurozone will settle on a “progressive” levy, wherein small savers will be spared or “levied” a small percentage, while those with 6-figures or more bank deposits will have a larger percentage of their money confiscated. Whatever the confiscation formula, what the eurozone wants is that Cyprus raise €5.8 billion to secure its bailout.

Although the Cypriot parliament must vote to approve the eurozone’s levy — and the latest news is that Cyprus President Nicos Anastasiades thinks parliament will reject the bill — that the levy was proposed at all is stunning. As the Financial Times‘ Wolfgang Münchau puts it: “the eurozone has effectively defaulted on a deposit insurance guarantee for bank deposits” given in 2008 after the collapse of Lehman Brothers to assure depositers “that all savings are safe.”

Analysts including Münchau, Phoenix Capital Research, and ZeroHedge’s Tyler Durden all expect that there will be bank runs, not just in Cyprus but elsewhere in Europe, especially in financially-troubled heavily-indebted countries like Italy and Spain. (Interestingly, Greece isn’t mentioned, perhaps because Greeks have no more money to even do a bank run.)

As Durden puts it: “the bottom line is that the Rubicon has been crossed, and deposits have now been forcefully confiscated in what Europe promises to be a standalone case. What is certain, is that nobody will wait to find out how long it takes before Europe’s class of increasingly more desperate and ill-meaning despots is found to have lied once more (as it has about everything else since the start of the European crisis).”

To prevent bank runs, Cypriot banks will remain closed till this Thursday. Customers can still use their banks’ ATMs but, as we know here, they are limited as to how much money they can withdraw from the machines. And as of yesterday, there have been no reports of bank runs in Spain or Italy.

How might the Great Cyprus Bank Robbery of 2013 affect Americans?

1. If you have a bank account in Cyprus, your deposits may be “levied” at a percentage depending on how much you have in your account(s).

2. If the levy is approved by Cyprus’ parliament, Americans will contribute toward the $13 billion bailout of Cyprus, thereby adding to our already gargatuan $16+ trillion national debt. Why? Because International Monetary Fund (IMF) Managing Director Christine Lagarde already said she would ask the IMF board in Washington to contribute to the bailout.

With 16.2% of the IMF shares, the United States is the largest shareholder or contributor among the 187 nations who belong to the fund—even though its managing director has always been a European. In addition to America’s 16.2% “share” (i.e., “contribution”) in the IMF, in 2009, Obama proposed and Congress approved a $100 billion U.S. loan to the IMF.

Even before Cyprus, the IMF has joined with the European Union to sculpt bailout packages for Greece, Ireland, and Portugal. Coupled with loans from the EU, the price tags on the bailout packages came to $157 billion for Greece, $122 billion for Ireland, and most recently, $116 billion for Portugal. Alarmed about this, Congresswoman Cathy McMorris Rodgers (R.-Wash.), the premier congressional foe of spending U.S. tax dollars on IMF bailouts, points out that “The Portugal bailout is half that country’s GDP—$116 billion out of $233 billion. The IMF has refused to provide a reliable number but, given America’s contribution to the bailout, we estimate that our support of the package is equal to writing a check worth $600 for every man, woman, and child in Portugal.” She added that this ratio “was nearly identical for Greece and Ireland bailouts. (See John Gizzi, “Why Is the U.S. Bankrolling IMF’s Bailouts in Europe?,” Human Events, May 2, 2011.)

3. If bank runs occur in Europe, leading to a systemic collapse of European banks and the euro currency, that in turn will trigger a worldwide financial-economic crisis of an unimaginable scale.

4. Can it happen here? Will we wake up one day to be told that our bank deposits are also confiscated? Tyler Durden of ZeroHedge writes that the key thing about what happened to Cyprus is that “the Rubicon has been crossed,” that is, the until-now taboo subject of the forceful “levy” of citizens’ private bank accounts has been broached. As Durden puts it: “the topic of ‘wealth taxation’ is now front and center, and it stars not only Europe, but the US as well. The question then becomes … is there any possibility of Cyprus ‘wealth tax’ recurring on the other side of the Atlantic.”

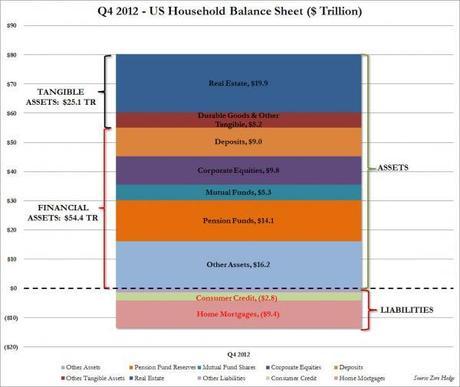

Durden points out that in the US, other financial assets, namely the stock market, account for a far greater proportion of household net worth than bank deposits. It is therefore quite possible that instead of confiscating our bank deposits, thereby voiding the FDIC guarantee, the government may instead choose to tax 30% of all of your stock holdings, and achieve the same “wealth transfer” result.

Will Congress do this?

Obviously, nobody can answer that question now. However, it was “absolutely certain” as recently as three days ago that the safety of Cypriots’ bank deposits was protected.

Then things changed rapidly.

What is the lesson we should take away from the Great Cyprus Bank Robbery?

Answer: There are no longer any rules, and any assets, any “wealth” saved, stored, and hidden is now fair game.

~Eowyn