Has Beijing finally realized it will need to step in aggressively if it wants to avoid an economic collapse?

Moments ago, and just days after the release of China's dismal woeful new credit data, the National Bureau of Statistics reported the July data dump which was just awful. Among the latest monthly data:

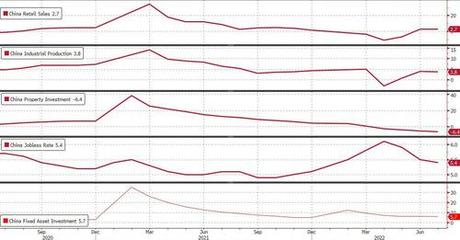

- Industrial production rose 3.8% from a year ago, lower than June's 3.9% and missing economists' forecast of a 4.3% increase

- Retail sales grew at a 2.7% annual pace, also lower than June's 3.1%, and badly missing the consensus estimate of 5.0%

- Fixed-asset investment gained 5.7% in the first seven months of the year, which however was also below the June YTD number of 6.1%, and also missed the 6.2% projected by economists

- The silver lining is that just as in the US, the worse the economy founders, the lower the jobless rate which in July fell to 5.4% from 5.5%

"July's economic data is very alarming," said Raymond Yeung, Greater China economist at Australia & New Zealand Banking Group Ltd. "The Covid Zero policy continues to hit the service sector and dampen household consumption."

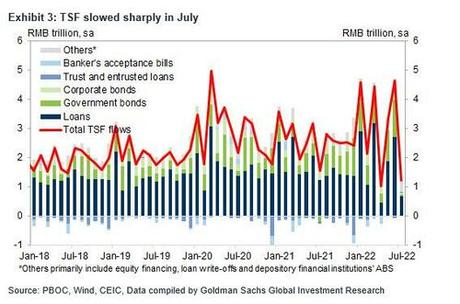

It's not just Covid Zero: the "alarming" collapse in China's economy was strongly hinted last Friday when Beijing reported that July credit growth, in the form of total social financing and RMB loans, came in well below the already-low market expectations.

According to Goldman, the detailed breakdown of the July loan data pointed to weaker credit demand: household and corporate loans both slowed in July from June, and interbank rates declined to very low levels in recent weeks. Smaller government bond net issuance also contributed to the lower TSF. That said, local government officials are working on preparing the pipeline for additional infrastructure investment projects, and the July Politburo meeting pointed to likely additional local government special bond issuance beyond this year's budget in the next few months.

However, Beijing appears to finally realize that at a time when China's housing is crashing (with residential property sales plunging 28.6% in July, it's no surprise the WSJ last week wrote that " The Bursting Chinese Housing Bubble Compounds Beijing's Economic Woes"), it will have to do something at the national level, as the latest credit figures clearly raise the risks of a liquidity trap where monetary easing is failing to spur lending in the economy.

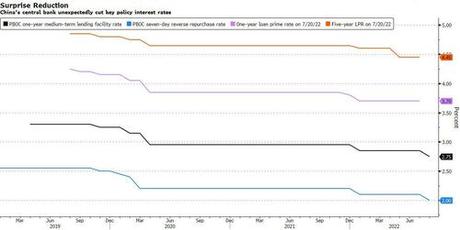

As such, moments before the latest horrific data dump, China's central bank unexpectedly cut its key interest rates in a feeble attempt to prop up the failing economy weighed by Covid lockdowns and a deepening property downturn.

The PBOC cut the rate on its one-year policy loans by 10 basis points to 2.75% and the seven-day reverse repo rate to 2% from 2.1%, surprising China watchers with all 20 economists polled forecasting the rate on the one-year medium-term lending facility would be left unchanged. Expect all other key reference rates to follow a similar 10bps rate cut in the coming days.

While the rate cut was small, "it's more of a signaling effect" showing authorities are prepared to act, said Zhang Zhiwei, chief economist at Pinpoint Asset Management Ltd. " In terms of the size of this action, it's quite limited. In order to turn around the market expectation and break the downward spiral, they need to do a lot more. "

And they will... eventually.

And with China once again dovishly diverging aggressively from the rest of the Developed world which is hiking at every opportunity, it's no surprise that as the PBOC confirms the economy is rapidly slowing, that Chinese bond yields slumped after the rate cuts: China's 10-year government bond yield slid five basis points to 2.675%, the lowest level since May 2020, while the offshore yuan extended losses, falling 0.3% to 6.7607 per dollar. Stocks were also volatile in the morning session, with the benchmark CSI 300 Index was little changed after rising as much as 0.7% following the PBOC's rate cuts.

Beijing's commitment to Covid Zero - which has emerged as a convenient smokescreen for Xi Jinping who can blame all of China's ills on his own failed response to the Wu Flu - has made it impossible to sustain any hard-won economic progress, as the threat of repeated restrictions and re-openings continues to loom. As Bloomberg notes, August saw a surge in cases in the resort island of Hainan, where authorities have locked down holidaymakers, suspended flights and shut businesses to contain infections.

Yet even today, the PBOC decided to confound China watchers, as the central bank withdrew liquidity from the banking system (by issuing 400 billion yuan of MLF funds, only partially rolling over the 600 billion yuan of loans maturing this week) at the same time as it cut rates.

"The dominating downside risk for growth and weak credit data prompted the PBOC to lower the policy rates," said Ken Cheung, chief Asian FX strategist at Mizuho Bank. The cut widens the divergence between the PBOC's easing stance and other major central banks that are tightening monetary policy to curb soaring inflation. That's raising risks for the yuan as capital outflow pressures increase. It also comes a surprise as the PBOC recently warned against the risk of rising inflation, even though domestic demand still remains soft, keeping overall price pressures in check for now.

The rate reduction underscores the severity of growth challenges. China's top leaders vowed last month to achieve "the best outcome" possible for economic growth this year while sticking to a strict Covid Zero policy, and downplayedthe official target of around 5.5% growth. Economists polled by Bloomberg forecast the economy to expand only 3.8% this year.