![Cashless Society? [courtesy Google Images]](http://m5.paperblog.com/i/147/1476857/cashless-society-L-D7nmy6.png)

[courtesy Google Images]

Visual CapitalisttrendWhy?

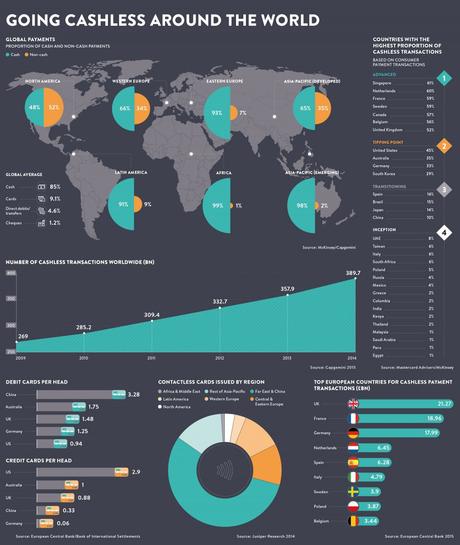

If you take a close look at the upper left-hand corner of the graphic, you’ll see that the U.S. (actually, “North America”) is the world’s most “cashless” society. A majority (about 52%) of North American monetary transactions already take place by means of some media other than cash. That would certainly include credit and debit cards and probably includes checks and money orders.

For the rest of the world, the majority (even the vast majority) of monetary transactions take place by means of cash.

Even for the U.S., 48% of all of our transactions still take place with cash.

48%.

I’m only guessing, but I’ll bet there are at least 1 billion monetary transactions in the U.S. each day. If 48% of those transactions are conducted in cash, that’s 480 million cash transactions per day.

How long do you think it will take the U.S. government to somehow convert 480 million daily cash transactions (many by people who don’t have bank accounts or even Social Security numbers) to some “cashless” media like debit or credit cards?

In the context of some “national emergency,” it might be that such conversion could take place in, say, 90 days. But I can’t see how. I can’t see how government could have any more success as creating a 100% “cashless” society than it’s had at establishing ObamaCare.

State of the Union vs. territorial state?

Plus, I doubt that the U.S. government really wants a cashless society. I could be wrong, but I subscribe to the notion that government is running a second plane or venue that supplants the States of the Union (where government has limited powers) and subjects us to the unlimited powers of Congress under the pretext that we’re in some “territory” (rather than a State of the Union).

I further suspect that one of the key indicators government relies on to presume we’re in a “territory” is our voluntary use of Federal Reserve Notes. If these theories are roughly correct, your voluntary use of FRNs is deemed to be evidence that you have voluntarily entered into the jurisdiction of a fictional territory and voluntarily left the jurisdiction of your State of the Union.

Yes, yes–I know how crazy that theory sounds. But there’s some evidence to suggest maybe the theory might be valid.

But, if the theory is valid, it’s essential that the use of FRNs be voluntary. To be voluntary there must be some sort of choice. If the government were to impose a true, cashless society wherein everyone was forced to transact only by means of plastic or thumbprints or some such, we’d have no choice as to whatever currency we used. No choice means involuntary. Involuntary use of FRNs may provide a basis to defeat the presumption that the “voluntary” use of FRNs can be deemed evidence that we’ve “voluntarily” entered into the “territory,” voluntarily left the State of the Union, and thereby voluntarily subjected ourselves to the jurisdiction and unlimited powers of “this state” (a territory).

If the government imposed a cashless society, it might lose the presumption that the use of FRNs signaled our voluntary submission to the law and authority of a territory rather than a State of the Union.

If government really needs and relies on that presumption, it should not want to impose a cashless society.

Trust the Math

Regardless of whether the previous theory concerning States of the Union vs. fictional territories is valid or irrational, the fact remains that hundreds of millions of cash transactions take place every day in the U.S.. There’s no way that the existing banking system can absorb another several hundred million non-cash transactions each day any time soon. There’s no way that we can wire every vending machine in the country to take only digital purchases anytime soon.

Therefore, I see no reason to fear that cash will disappear from our economy suddenly or in the near future.

Will we have a cashless society one day? Probably.

Will we have a cashless society in the next five years? Probably not.

Our fears of an imminent cashless society are almost certainly exaggerated and unfounded.

Here’s the graphic: