The Great Cyprus Bank Robbery earlier this year was our first wake-up call.

If you recall, indebted up to its eyeballs, Cyprus’ government made a deal with their Eurozone financial masters to confiscate steal 80% of “large” bank deposits.

At the time, I warned that Americans should be on the alert to copycat moves by our feral government and bankers, all the more because the American Left actually applauded the theft of Cypriots’ bank savings.

Tyler Durden of ZeroHedge warned us that when bankrupt insolvent governments “run out of fingers to plug the dikes,” history shows that they fall back on a very limited playbook. Simon Black of Sovereign Man blog enumerated 8 steps in the playbook of bankrupt governments:

- Direct confiscation (the Cyprus model)

- Taxes

- Inflation

- Capital controls

- Wage and price controls

- Wage and price controls on steroids

- Increased regulation

- War and national emergency

Step #4 is here. (For the other 7 steps, go to my post of April 3, 2013: “How bankrupt govt steals your money in 8 steps”.)

Chase, one of the Big Four banks in the United States just instituted capital controls by:

- banning international wire transfers; and

- Limiting banking transactions, including cash withdrawals, to no more than $50,000 “per statement cycle,” which effectively means per month.

The above capital controls will go into effect in about a month, on November 17, 2013.

Chase bank is a national bank that constitutes the consumer and commercial banking subsidiary of the multinational banking corporation JPMorgan Chase. The bank was known as Chase Manhattan Bank until it merged with J.P. Morgan & Co. in 2000. (See also “Red Star over JPMorgan’s One Chase Manhattan“)

InfoWars.com first sounded the alarm about Chase’s capital controls.

Mike Adams of Natural News then followed up and verified the extraordinary news. In his words:

I called my own accounting team to ask if we had received a similar letter from Chase, announcing that no international wire transfers would be allowed after Nov. 17th. Sure enough, we were sent the same letter! [...]

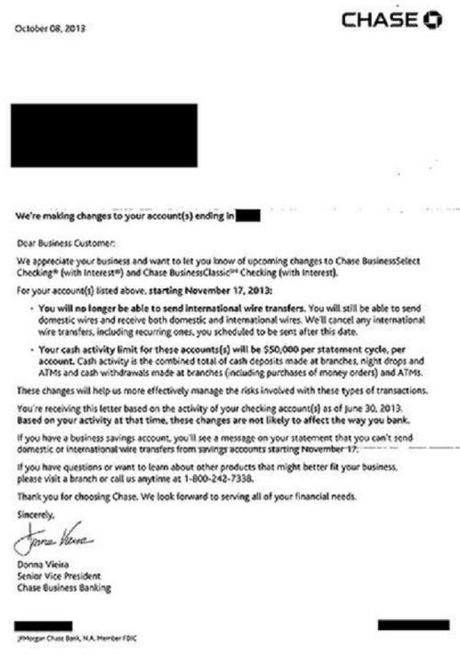

The letter clearly states that beginning November 17:

• All international wire transfers will be disallowed.

• All cash activity, including cash withdrawals and deposits, will be halted at “$50,000 per statement cycle.” How are businesses who deal with a lot of cash (such as restaurants) supposed to function under such restrictions?

This is the letter that Adams received from Chase bank (you can also click here to see the hi-res scan of this letter):

Adams then called Chase bank to ask why these capital controls were being implemented on November 17th. Their response was that these changes were being implemented “to better serve our customers.” They did not explain how blocking all international wire transfers would “better serve” their customers. Chase bank specifically denied any knowledge of problems with cash on hand, or government debt or any such issue. They downplayed the entire issue and had no answers for why capital controls are suddenly being put into place.

Adams concludes:

This is the beginning of the capital controls we’ve been warning about for years. Throughout history, when governments are on the brink of financial default, they begin limiting capital controls in exactly the way we are seeing here. Following that, governments typically seize government pension funds, meaning the outright theft of pensions for cops, government workers, etc., is probably just around the corner.

Finally, the last act of desperation by governments facing financial default is to seize private funds from banks, Cyprus-style. The precedent for this has already been set in Cyprus, and when that happened, I was among many who openly predicted it would spread to the United States.

This is happening, folks! The capital controls begin on November 17th. The bank runs may follow soon thereafter. Chase Bank is now admitting that you cannot use your own money that you’ve deposited there.

This is clearly stemming from a government policy that is requiring banks to prevent cash from leaving the United States. Such policies are only put into place when a huge financial default event is expected.

H/t FOTM’s Miss May

See also these related FOTM posts:

- “Does Obama’s 2014 Budget nationalize retirement accounts?,” Oct. 3, 2013.

- “EU puts the screws to “insured” bank deposits,” Aug. 12, 2013.

- “Federal Reserve governor: If large financial institution fails, there’ll be no bailout of depositors,” May 2, 2013.

- “Who had insider knowledge of the impending Cyprus bank confiscation,” April 11, 2013.

- “State of Illinois wants a record of your gold & silver purchases,” April 8, 2013.

- “Obama takes first shot at retirement IRAs,” April 8, 2013.

- “Eurozone chair says personal bank accounts of other countries can also be raided,” Mar. 26, 2013.

- “Govt confiscates 30% of all large bank deposits in Cyprus,” Mar. 25, 2013.

- “Cyprus copycats: NZ and Spain talk wealth tax on bank deposits,” March 20, 2013.

- “Confiscation of bank deposits: Can it happen in America?,” March 19, 2013.

~Eowyn